2021 was an extremely challenging and financially complex year as the effects of COVID remained and even accelerated during the fall. The much-anticipated Fed interest rate tightening was communicated on the heels of a series of inflationary economic reports and continued labor shortages across virtually every major developed economy.

Despite these challenges, Global Value Investment Corp. (GVIC) had its best year in company history. All three of our strategies produced benchmark-beating returns – including our flagship Total Return Value Strategy, as well as our Concentrated Equity Strategy and Focused Fixed Income Strategy. The results prove there are opportunities in every market if one has the patience and discipline to know where and when to invest.

The markets were impacted by supply chain disruptions, stressing manufacturers and wholesalers alike to meet strong consumer demand that arose as citizens across the globe emerged from a variety of lockdowns with a healthy appetite for consumer goods. In addition, nearly all service businesses experienced their own labor shortages, and virtually every business that relies on semi-skilled and unskilled labor found itself increasing compensation to attract and retain labor. Without question, we are in the midst of a tectonic shift in which business will need to rethink their use of labor and how to provide productive engagement and competitive levels of compensation.

We wrote about labor issues in our October 2021 letter, commenting on the extreme and sudden increase in labor costs and the impact we believed this would have on profit margins and corporate earnings. We anticipate these headwinds will continue and potentially lead to future earnings disappointments and likely to an increased use of automation in lieu of human labor.

At this time the 10-Year US Treasury bond is trading to yield 1.85%, which is still relatively low when compared to long-term trends. Market expectations suggest this rate could rise to somewhere between 4% and 5%, which would undoubtedly cause an economic slowdown, as well as increased opportunities for investors in both the stock and bond markets.

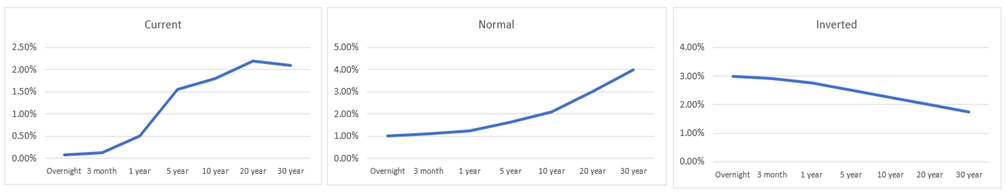

As we think about imminent Fed interest rate hikes, we are mindful the Fed only sets overnight interest rates while market forces dictate all other rates, which creates a yield-curve. A normal cycle yield-curve, as measured by the slope of rates from overnight through 30-years, has a spread of roughly 300 basis points, or 3%. We believe as the Fed proceeds with its tightening, and corresponding signs of slowing economic growth continue, the slope of the curve will actually flatten, and could invert (see graph on left for the current yield curve, middle for a normal curve, and right for an inverted curve). Inverted curves are typical of periods of slowdown and recession.

Portfolio Update

The research team at Global Value Investment Corp. constantly seeks new and attractive investments in both the stock and bond markets. They are committed to managing our current holdings, which includes an ongoing, rigorous analysis of each company’s financial reporting and other news and events.

We attempt to conduct one-on-one phone calls, or more recently video conferences, with senior management from every company in our core portfolio, distilling a great deal of qualitative information. Over time, as senior managers become familiar with our team members and investment process, they tend to be more candid and occasionally solicit our input on issues such as capital allocation, executive compensation, board structure, and business strategy.

In addition to managing client portfolios and analyzing current holdings and prospective new investments, the team meets weekly to discuss economic releases and visible trends emerging as a result of geopolitical events.

We identified the current global supply chain issue early on and invested in a number of shipping and logistics companies, including the stock of Hoëgh Autoliners, ASA (an overseas car carrier business), the stock of 2020 Bulkers, Ltd. (a shipping business that contracts for the overseas hauling of a variety of industrial commodities), the stock of Western Bulk Chartering, AS (a ship chartering intermediary overseeing the ongoing movement of 100 plus ships over a variety of international trade routes), the stock of Global Ship Lease, Inc. (a ship leasing and finance company to the containership sector), and the bonds of SFL Corp. (a ship finance and leasing company working across a broad range of shipping assets).

We also anticipated rising energy prices and the sustained period of limited capital investment in energy infrastructure, which led us to make several strategic investments including the bonds of Callon Petroleum, Murphy Oil, PBF Energy, and PBF Logistics, each priced to generate attractive cash flows over the next three to seven years. The investment process is designed to manage maturities to a less than five-year average maturity (duration). Like many bonds we have invested in previously, these holdings may be sold in advance of maturity if the price rises above our appraised value.

During the early onset of COVID we were able to invest in several sharply depressed stocks and bonds, one of which was the bonds of Royal Caribbean Cruise Lines, Inc. This prompted more than a few calls from clients. We bought the bonds at a sharply depressed price and later sold them at a much higher price, realizing an extremely attractive total return. This is just one example of the way our research team remains alert to opportunities despite the apparent chaos of the moment.

When GVIC makes an investment, we expect to hold it for many years, but our investment holding period is ultimately driven by the relationship between price and value. All issues, be those stocks or bonds, are bought because the price is well below our appraisal of the business value and sold when the price reaches or exceeds appraised value. Occasionally we will sell a fraction of a holding in an effort to manage the weighting of the holding in portfolios.

GVIC’s research team concentrates nearly all of its time on establishing an accurate appraisal of the value of each investment, and then monitors it to determine how the value changes over time based on company-specific developments or changes in macro-economic or geo-political events, such as interest rate policy.

From Our Library

Over the past quarter we read several articles and letters, including the 1987 letter to shareholders from Berkshire Hathaway’s Chairman, Warren Buffett. As market participant behavior became increasingly irrational, we thought a trip back to the period when the S&P had its worst single daily decline might be a worthwhile review and reminder:

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him.

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren’t certain that you understand and can value your business far better than Mr. Market, you don’t belong in the game. As they say in poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.”

The market may ignore business success for a while, but eventually will confirm it. As Ben said: “In the short run, the market is a voting machine but in the long run it is a weighing machine.” The speed at which a business’s success is recognized, furthermore, is not that important as long as the company’s intrinsic value is increasing at a satisfactory rate.

Firm Update

Malcolm (Mac) MacLaren has joined our firm as a Research Associate. He spent the past three years practicing law after graduating from DePaul University College of Law in 2018. After thoughtful reflection, he realized his true passion was investing. We are pleased to welcome Mac. He will login daily from Champaign IL, where he and his wife recently relocated.

We’re also happy to have Maddie Wilke join the firm. She will work with our finance and operations team supporting the office of the CFO. Maddie joins us part time while she completes her undergraduate studies at the University of Wisconsin, where she is studying economics and finance.

As our business expands and we find greater opportunity in the marketplace, we require additional human resources to carry out our mission. We are very fortunate to have a group of bright and dedicated individuals on our team. Their joint efforts have resulted in the firm achieving success I never could have imagined when I formed the business in 2007.

Concluding Thoughts

2021 was an outstanding year for the firm and our clients as we realized exceptionally strong results across our three strategies. We continue to dedicate ourselves each day to achieving long-term investment excellence.

Please let us know if you have any changes in your investment objectives or financial situation that warrant adjustments to your portfolio.

Thank you for the continued confidence you have placed in us to be prudent stewards of your investment capital and financial well-being.

Your Investment Research and Advisory Team

Global Value Investment Corp.

This document is published by Milwaukee Institutional Asset Management (MIAM), a division of Global Value Investment Corp. (GVIC). MIAM is the institutional investment advisory division of Global Value Investment Corp., providing investment advisory services to institutional investors including Registered Investment Advisors and Broker-Dealers. All statements or opinions contained herein are solely the responsibility of Milwaukee Institutional Asset Management. The material, information and facts contained in this report were based on publicly available information about the featured company and were obtained from sources believed to be reliable but are in no way guaranteed to be complete or accurate. This report is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. Employees of GVIC may have positions in securities referenced in this report. ‘Intrinsic’ or ‘Appraised’ value refers to MIAM’s quantitative and qualitative assessment of the value of an enterprise. Market capitalization is a measure of the total dollar market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current quoted share price. MIAM’s investment strategies generally invest in a smaller number of securities than some other strategies. The performance of these holdings may increase the variability of a strategy’s return. There is no assurance that dividend-paying stocks will reduce price variability. Value investments are subject to the risk that their intrinsic value may not be reflected in market prices. For purposes of distribution in the United States, this report is prepared for persons who can be defined as “Institutional Investors” under U.S. securities regulations. Any U.S. person receiving this report and wishing to affect a transaction in any security discussed herein must do so through a U.S. registered Broker-Dealer. Neither Global Value Investment Corp. nor Milwaukee Institutional Asset Management is a registered Broker-Dealer.

An investor should consider a strategy’s investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Firm’s SEC form ADV Part II. To obtain a copy of GVIC’s ADV Part II, call 262-478-0640 or visit www.gvi-corp.com. Please read the ADV carefully before investing.

Additional information is available upon request.

No part of this document may be reproduced in any form without the express written consent of GVIC. Copyright 2023. All rights reserved.