Outlook:

The letter was penned during the early hours of January 2nd and edited for distribution at day’s end. Be sure to read our post-script below.

2018 ended with a thud. The broad market was down 10% in December, and 20% over the fourth quarter.

| December | 4th Quarter | Full Year | |

|---|---|---|---|

| Value Line | -11.43% | -18.48% | -16.82% |

| S&P 500 | -9.03% | -13.83% | -5.18% |

| NASDAQ | -9.40% | -17.20% | -4.28% |

| DJIA | -8.66% | -12.47% | -6.03% |

Few stocks were spared. Bonds fared only slightly better. Investors panicked and pulled their capital. Cash was the safe-haven.

Despite the sharp market correction, the strength of the economy and company fundamentals remained intact. As we exited the year, economic indicators continued to show positive trends:

| GDP Q3 | 3.4% | solid growth heading into 4th quarter |

| Inflation | 2.2% | low and relatively stable |

| Productivity | 2.3% | continued strength |

| Wage Growth | 3.1% | stable year-over-year improvement |

| Unemployment | 3.7% | very good and steady level |

| Oil ($/Barrel) | $45.30 | down 40% from October 1 level of $75.30 |

| Fed Funds Rate | 2.25% – 2.50% | increasing as expected |

Corporate earnings remain strong, with modest signs to indicate slowing growth rates; as expected, now that the 2017 corporate tax-rate reductions are fully incorporated.

Financial fundamentals of companies across our client portfolios, including earnings and balance sheet strength, are generally good and improving.

Looking at the market, the daily volatility of pricing is noteworthy. During the past week, intraday market price swings can only be described as extraordinary. Investor uncertainty reigned.

| Point Change | Low/High | Daily Point Swing | |

|---|---|---|---|

| Monday, December 24 | -653 | 21,792/22,445 | 653 |

| Tuesday, December 25 | – | Closed | – |

| Wednesday, December 26 | +1,086 | 21,712/22,787 | 1,166 |

| Thursday, December 27 | +260 | 22,267/23,139 | 872 |

| Friday, December 28 | -76 | 22,981/23,382 | 401 |

During the quarter, US oil price/barrel dropped by 40% – a huge plus for the economy. Retail gasoline was selling for under $2.00 per gallon in parts of the country. Lower gasoline prices function like an immediate tax stimulus – cash in consumers’ pockets instantly. Holiday retail store sales were exceptionally strong. Personal income continues to improve as does the personal savings rate, which was reported at 6.6%. Both spending and savings rates are solid, pointing to further economic growth.

The 2018 Q4 stock market decline was clearly a valuation correction. Prices for stocks had become absurdly overvalued, and the price-to-earnings multiple which investors are willing to pay decreased. Not all stocks were overvalued, but many of the largest companies that make up the market index were. We’ve written about this on numerous occasions, as we believed the elevated levels were concerning and unsustainable (see 2018 Q3 Letter). Market corrections are predictable, normal, and healthy. They occur with some frequency. What is unpredictable is the precise timing of these corrections. We are not at all surprised to see valuations returning to levels that are more in line with historic norms but were surprised by how quickly this correction occurred. As with most corrections, nearly all stocks suffered regardless of fundamentals.

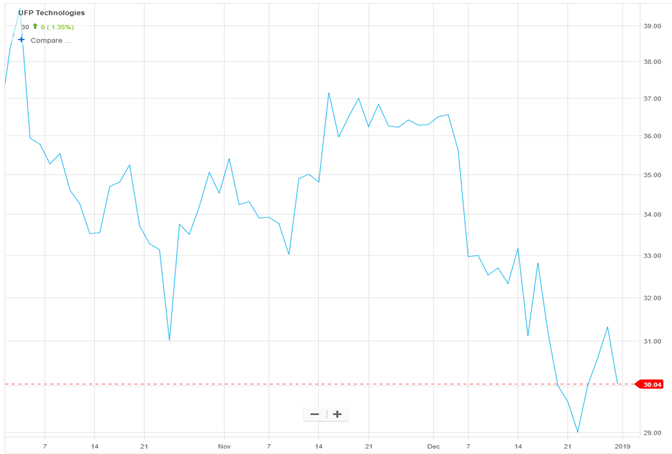

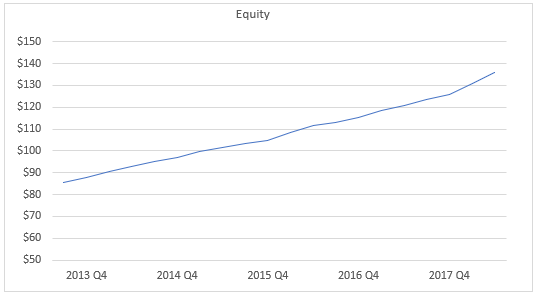

However, one notable long-term steady performer illustrates how share price can disconnect from business value in the short-run. See below – UFP Technologies, Inc. three-month price change in comparison to its long-term equity value change:

Over my 32 years of personal experience on Wall Street, I’ve seen a few markets like this one: excessive valuations followed by correction. The catalysts and timing of corrections are almost always unpredictable. Market participant behavior is far more predictable – buy with great enthusiasm during the run up; sell with increasing conviction as we get closer and closer to the bottom. Not surprisingly, once the chaos has settled, we tend to see prices move higher.

It is this experience that makes me feel positive about our outlook. We have believed for a long time that the Fed needed to raise rates and shrink its balance sheet; they are doing so now. This is a necessary pre-condition for a return to normal. We think we will achieve excellent returns over the coming years. We have remained true to our value approach despite the frustrating shorter-term results. We know our diligent process is the correct may to value businesses. We are now entering a market environment in which we believe investors will once again reward companies for earnings performance rather than popularity. We think passive index investing will decline as more investors recognize that it pays to ask why they are invested in a company – not simply invest because a company is a constituent of an index. This is our kind of market, where rigorous financial analysis is rewarded.

As always, we are thankful for our clients’ patience during periods of market uncertainty. We remain committed to dedicating our full time and effort to achieving long-term investment excellence.

Please let us know if you’ve had any change with your investment goals or circumstances that would prompt an adjustment to your portfolio.

Happy New Year wishes! We head into 2019 with high expectations that our portfolios will produce above average long-term returns.

Your Investment Research and Advisory Team

Global Value Investment Corp.

PS: At the close of trading on January 2nd, the first trading day of the year, our equity only account returned +3.98% for the day, while the Value Line Stock Index return +.54%. A solid start to the year.