Outlook:

The economy continues to sputter along at a 1.5% to 2.0% annual rate of growth. Despite massive monetary stimulus provided by the Fed over the past nine years, the economy can’t seem to accelerate to a pace that would characterize a post-recession recovery.

Employment and income levels have improved to pre-recession levels, but we see tepid wage growth, suggesting people may be back to work, but labor has little pricing power, which is surprising given the reported low level of unemployment. We suspect a systemic change has occurred within the US labor force whereby businesses have replaced labor with equipment – a normal evolution within markets from an historic perspective. When labor is scarce or overpriced, management will substitute it with capital. In other words, we are seeing a material replacement of labor with equipment, that is, industrial automation.

Longer-term, labor needs to match its skills with jobs that are not easily automated. This will require an increased level of skill and creative thinking. In the short-term, we suspect businesses will opt to employ more capital/automation and less labor. In the long-run, businesses will need additional skilled labor to monitor and repair the automation equipment. Business profits will rise for those businesses that are quick to adapt. As a function of the increase in automation, industries will consolidate, with the strongest and most innovative players acquiring lesser competitors, while weak and poorly managed business will eventually go into liquidation. Prices will ultimately be driven lower due to competition, and consumers will benefit through innovative products and lower prices. And so it goes.

Again, most of the macro-economic data points we monitor suggest a slowing, not strengthening, economy. We continue to see gridlock with our national fiscal policy makers. We remain skeptical that any constructive fiscal policy will emerge in the short-term, whether tax revision, infrastructure investment, or health care reform.

The good news is the anticipated interest rate spoke has paused. It now appears rates will remain low in the foreseeable future. If this is the case, then the dollar will more than likely weaken versus major trading partners, including Europe, Japan and China, creating a net positive for export-oriented US producers.

Additionally, energy prices remain range-bound, which is good for consumers in many ways – at the pump, the thermostat, and the retail counter – given the diverse uses of petroleum in everyday products. Presently there is a global supply/demand imbalance as supply exceeds demand. To be sure, this situation can change quickly; however, US land-based producers have made dramatic innovations over the past ten years, driving exploration and production costs lower, thus enabling economically viable production at today’s market price. As a result, US domestic oil production is at near-record levels, confounding OPEC and Russia, whose stranglehold on global oil production and pricing has been severely reduced.

The current environment continues to have many conflicting trends, creating heightened uncertainty – a circumstance we find conducive when seeking investments in mispriced securities.

Bond Investors:

We recently penned an article entitled “Fear the Fed – QE to QT” (quantitative easing to quantitative tightening) for our institutional clients. We had tremendous feedback. You can reference it on our website.

Our hypothesis suggests the Fed is stuck. Over the past nine years they bought bonds to manage interest rates to historically low levels. This was done through a process called quantitative easing in which the Fed entered the bond market and became the dominant buyer of US Government debt. To understand this, let me offer a simply illustration.

In the case of our seesaw, on the near side are interest rates, on the far side are bond prices. As interest rates rise, bond prices fall. Conversely, as interest rates fall, bond prices rise. The longer the maturity date of the bond (i.e. 30 years as opposed to 2 years) the greater the movement in price given the same movement in rates. Long-dated bonds are the most volatile in price – both up and down.

When the Fed began buying bonds, creating excess demand, they drove prices higher which resulted in lower interest rates (yield). The Fed’s stated policy goal was to drive rates down in an effort to encourage borrowing. This was a reasonable strategy given the dire economic circumstances at the time as well as the Fed’s limited available policy tools (at that point, the Fed had exhausted its interest rate policy tool by reducing overnight rates to nearly zero percent). The Fed then entered the market, buying intermediate and longer-dated bonds in an attempt to drive long-term interest rates lower. They succeeded.

The Fed expanded its balance sheet in this process from a total asset base of $800 billion in 2008 to over $4.5 trillion today, a 5x increase!

The dilemma the Fed now faces is how to unwind or right-size its balance sheet. Assume the appropriate asset level in 2017 is roughly between $1.75 and $2.25 trillion. This means the Fed needs to shed several trillion dollars of assets. In the same way the Fed drove prices higher (and interest rates lower) by being the dominant buyer, we suspect when they show up to sell bonds – and there will be no disguising itself when the Fed shows up in the marketplace to sell bonds – it will cause a decline in prices with a corresponding rise in interest rates.

Markets tend to decline and economies tend to slow when interest rates rise. For decades, the Fed has used the overnight funds rate (and US bank prime lending rates) to manage the economy. We now face a situation in which we have a slow growth economy (see page 1) and a Fed that is poised to reduce its bond holdings, which will predictably raise rates and slow an already tepid economy. We see a recession on the horizon. This is reason for bond investors to tread with caution.

Stock Investors:

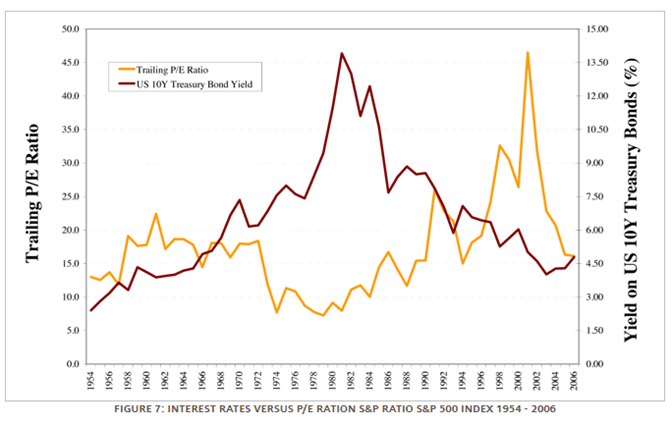

Thinking about stocks under this paradigm causes us to again reflect on historic precedent. Business valuations move inversely to interest rates. Low rates lead to higher valuations. High rates lead to lower valuations. This relationship is very clear. Part of this is intuitive. When rates decline, many traditional bond investors, seeking higher returns, will reallocate to stocks; not necessarily a good policy, but still a common phenomenon. As rates rise, many of these same investors will return to the bond market seeking greater certainty of cash-flow and maturity.

The less intuitive reason for higher valuations in a low rate environment is cost of capital. Businesses and investors will borrow more aggressively as rates decline, justifying an investment based on a lower cost of capital – generally adding to the overall leverage (debt) which creates a higher return-on-equity (ROE). There are aspects of our banking system that drive loan demand, with corresponding valuation increases for businesses, including businesses traded on exchanges and in the private sector.

Consequently, we are faced with what to do if/when rates move higher and the economy potentially slows to a recessionary level. We will follow with two conclusions.

First: At the present time, many of the most popular stocks trade at very high valuations. Amazon, for instance, is trading at an unsustainably high valuation – its price-to-earnings (P/E) ratio is over 175x. An historically normal P/E ratio for the broad stock market is 14x. Below are a few P/E ratios of other popular stocks, all of which are trading above what we believe represents an appropriate or sustainable valuation:

| Company | P/E Multiple |

|---|---|

| Apple | 18x |

| Netflix | 223x |

| 33x | |

| Microsoft | 32x |

| S&P 500 | 24x |

As you know, we are in the business of investing in undervalued securities, which explains why we do not own any of the above. Valuations in general are very high, largely due to the current low interest rate environment.

Second: The “stock market” is a market of stocks. Not all stocks rise while the market goes up, and not all stocks decline while the market goes down. Astute investors attempt to own stocks that have the potential to rise regardless of overall market behavior.

Despite the enthusiasm for stock ownership today, we remain cautious when committing capital to new investments. There are some, but not many, undervalued securities available today. We think in time this will change, and we will position portfolios for future profit.

From Our Library:

Concentrated Investing, a new addition to our library, was co-authored by an old friend of ours, Allen Benello. The first chapter is dedicated to Lou Simpson, who worked for GEICO Corp. from 1979 – 2010 in various capacities. Simpson offered the following investment advice in a 1983 personal archive:

We try to be skeptical of conventional wisdom and to avoid the waves of irrational behavior and emotion that periodically engulf Wall Street. Such behavior often leads to excessive prices and, eventually, permanent loss of capital. We don’t ignore unpopular companies. On the contrary, such situations often present the greatest opportunities.

And,

An investor is not likely to obtain superior results by buying a broad cross-section of the market – the more diversification, the more performance is likely to be average, at best. We concentrate our holdings in a few companies that meet our investment criteria in the belief that we have a chance at superior results only of we take risk intelligently, when the risk-reward ratio is favorable to us. Good investment ideas, that is, companies that meet our criteria, are difficult to find. When we think we have found one, we make a large commitment.

We think Simpson offered sound guidance in 1983 that applies today.

Concluding Thoughts:

The firm will celebrate 10 years of business on August 13th, 2017. We’ve covered a lot of ground in ten years and been able to develop a focus unimaginable while employed by a large financial institution.

Over my nearly 30-year Wall Street career I’ve seen many changes in the world and within the securities industry. At Global Value Investment Corp. we have tremendous autonomy to invest in companies where we have absolutely no conflict-of-interest from an investment banking arm or otherwise. We speak directly with company senior management based solely on the merit and reputation of our firm. We are able to execute trades – both stock and bond – with current custodians or at a non-affiliated firm, giving us exceptional price discovery when trading. Our access to investment research resources is extraordinary. In addition to having a physical presence in India, we have developed many material relationships with other value-oriented investors around the world. To be sure, the firm has evolved over the past ten years, embracing change, investing in our business with increased technology, information resources, and most importantly, human resources.

We are fortunate to employ a very bright and extremely committed team of analysts and advisors. I want to acknowledge their consistent efforts and long hours focused on delivering excellent results.

We officially opened our India office this year. We now have two full time analysts employed there. They begin their work day shortly after we turn out the lights for bed in the US. This gives us a distinct advantage when we come to work at 7:00 am and our Indian counterparts immediately update us on world markets and events.

On May 1st we hired an associate who will work from our new office in Boston, MA. He will provide both research and advisory resources to the firm, drawing on experience gained during a five-year tenure with Wells Fargo.

Throughout these changes, we have remained focused on investment research and analysis, seeking undervalued equity and debt investments. I believe you will notice our expanded capacity. Regardless of when or where you call our offices, you can expect a knowledgeable Associate to answer in person and provide the client service on which we have prided ourselves over the years. Remember, our Associates own the same equity issues we recommend for purchase in client portfolios.

All of this only matters if we deliver an excellent experience to you. Please feel free to let us know if we can do better. If you’ve had a change in, or would like to update your investment objectives or portfolio restrictions, please let us know so we can make adjustments. We are ever mindful of the trust and confidence placed in us by our clients and continue to dedicate ourselves to investment excellence.

Very best wishes,

Your Investment Research and Advisory Team

Global Value Investment Corp.