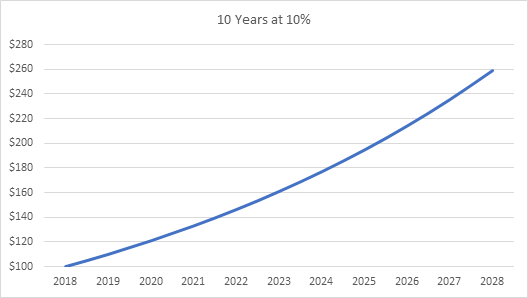

How much should you be concerned about the correlation of your stock’s price to some benchmark or index? Isn’t the goal of most investors to grow their capital at a high rate of return? Wouldn’t all investors like to see something as the graph below shows, a nice smooth 10% annual increase?

Yet that is not how share prices move in the real world.

If your goal is to achieve a high rate of return over time, meaning some investment horizon generally ten years or more, and if during the entire period the share price moved unpredictably during short measurement periods, but over time moved progressively higher, would that be a satisfactory outcome?

Yet how often do investors bail out of a perfectly good investment after a short time because the share price hasn’t moved progressively higher? That seems to be the norm in our short-term focused world.

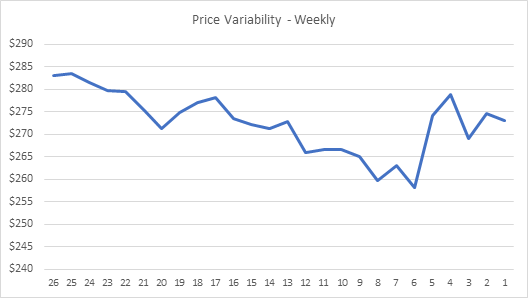

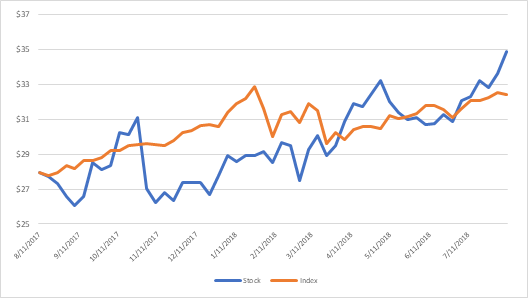

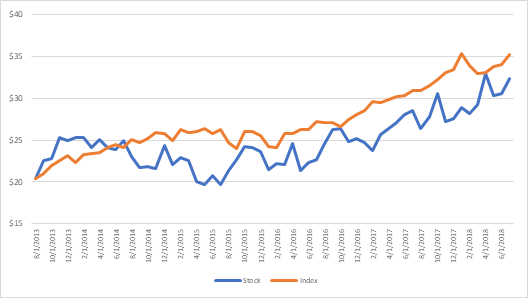

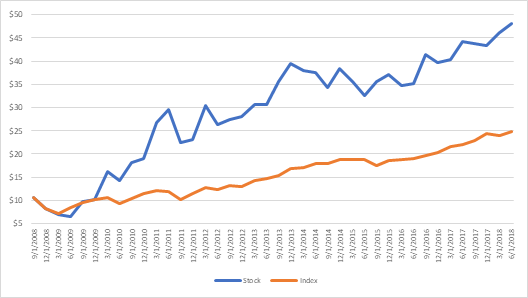

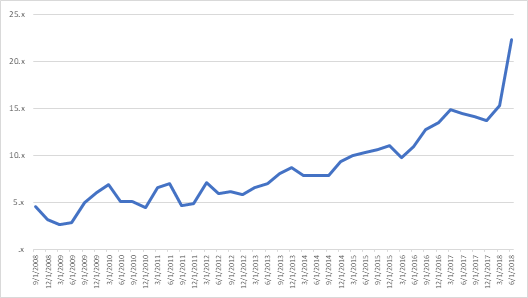

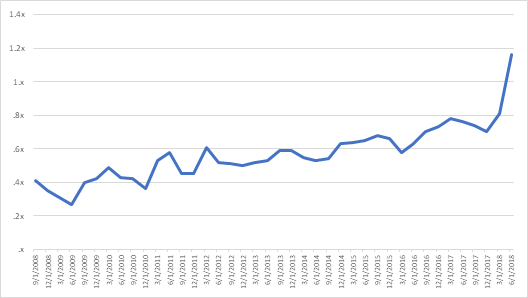

The challenge is to identify investments that make sense and buy only when the price is sufficiently undervalued. Once committed, keep track of the underlying business performance and sell only after the gap between the business value and the share price has been bridged. Over short periods this is challenging. Over longer periods it is much more likely, if one has patience. Note in the three charts below examples of a one, five and ten-year holding period for the same stock compared to a market index:

Note in all cases the correlation with the index was unpredictable, yet over the entire holding period the stock returned 215% versus the index at 118% – a near double annual rate of return. Did the lack of correlation matter?

All three charts are comparing the same stock and index. Over the long-term, despite the lack of correlation to the index, investor patience was well rewarded.

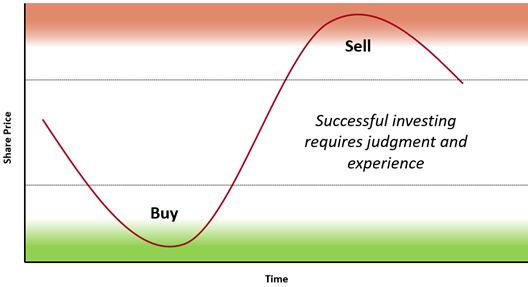

The most important task for an investor is to monitor the relationship between the business earnings and its price and invest only when the share price is adequately discounted from the share value derived from its earnings. A sell should occur when the share price is at a premium to the same earnings -derived value.

The stock traded at a low price in relation to its earnings for several years. Only more recently did the valuation become elevated, indicating to investors the shares were fully priced (see below).

When the share price is at a discount from its value, there is less risk and uncertainty of capital return. When the price is at a premium to value, there is greater risk and uncertainty of capital return.

On a relative basis, it is clear the shares now trade at a premium (above 1x), an indication the margin of safety has been eroded and the shares should be sold.

The intelligent investor evaluates a company’s appraised value and buys only when a large margin exists between the share price and its underlying value.

Simply illustrated:

Does it matter if the stock price mimics an index? No, we do not consider that a relevant indication of the merit of an investment.

Can an index itself be discounted or overvalued? Yes, we’ve seen the Dow Jones Industrial Index, the S&P 500 Index, and the NASDAQ Composite Index fall more than 50% on several occasions since the turn of the century. Index investors are susceptible to overpaying.

We see little value in tracking how a stock trades in relation to an index. Correlation is of little value to the enterprising investor.