Outlook:

The current economic expansion is now the longest in US history. All indicators suggest the end is not in sight. Although signs of a slowdown have appeared, Fed Chairman Powell seems to be signaling he will do whatever it takes to avoid a recession. A recent survey of market participants showed a 72% expectation of a Fed rate cut when its July 31st meeting concludes. The same survey points to another two cuts before year end. Mortgage and lending rates are already declining. The 10-Year US Treasury is below 2.00% again.

The risk to continued growth lies in policy decisions, primarily trade. These dynamics change by the day, but as of this writing it still appears the US is working through trade issues with Canada, Mexico, Europe, Japan and China. It’s hard to handicap how this will play out, but we are mindful of the influence of the US election cycle, which kicked off recently with the first round of Democratic debates. No doubt there will be major posturing and policy negotiations, both inside and outside the US.

The primary economic growth drivers –employment, wage growth, productivity improvement, and inflation –are all in check. Wage growth remains contained at 3%. Employment levels are high with just 3.6% unemployed (96.4% employed). Consumer spending and debt levels are neither too low nor too high. Inflation, for a variety of reasons, remains at a moderate level of 2.0%.

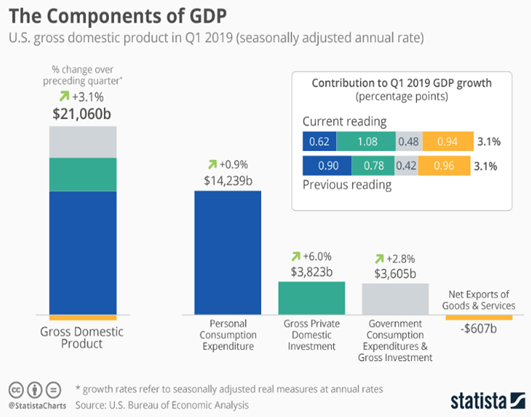

US economic growth registered a solid 3.1% for the quarter ending March 31st. Growth in the June quarter will likely be slower but still show growth. Note the following chart:

Gross Domestic Product (GDP, a measure of the growth of the US economy) is the sum of consumption, private investment, and government spending, less trade.

From this chart you can see why the consumer is such an important and disproportionately large contributor to our economy. Private and government investment are about equal. Net trade is then subtracted (this is reported as the US trade imbalance – a long-time deficit)

Oil and energy prices have experienced a sharp recovery through June 30th. West Texas Intermediate Crude (WTI), the US benchmark, gained more than 25%, while Brent Crude, the European Benchmark, was up over 20%. Ironically, OPEC +, which includes Russia, agreed this week to maintain reduced production levels through March of 2020 to support worldwide oil prices in the face of an apparent global oversupply. Simultaneously, US producers are pumping at records levels of over 12 million barrels/day. Continued uncertainty remains the only constant in the world of oil.

We remain alert to opportunity and mindful that every past economic expansion has come to an end. This one will be no exception.

Portfolio – Undervalued Stocks:

During my 33 years on Wall Street I don’t recall such an extended period when cheap stocks have stayed cheap for so long. Many of the companies we own remain sharply undervalued – 50% or more. They are ripe for acquisition by competitors who would gain market share and achieve greater profitability through scale. Alternatively, management or private equity investors could effectuate take-private transactions. Capital is both cheap and abundant today. The costs to merge or take a company private are very favorable. Yet, many companies remain independent and public. We continue to challenge company management to create long-term value for stockholders.

We recently had meetings with management from two of our portfolio companies. It is beneficial to visit company headquarters as it provides us with non-verbal cues as to how well the business is performing. Much can be gained in person versus over the telephone. We remind management of their duty to maximize stockholder value. This is typically an uncomfortable conversation for managers, but a discussion we feel compelled to have when needed.

In early June we attended a research conference in Boston where we met one-on-one with management of two of our portfolio companies; in addition, we had a chance to listen to half a dozen presentations from other companies that may one day earn a place in our portfolio.

Another of our portfolio companies recently hosted an investor day in New York City, where we saw firsthand recent product developments and heard management’s strategic plans. This was a very productive half-day of interaction with the company’s senior leaders from across all departments.

Our portfolios reflected improvement in pricing during the quarter, adding to earlier year-to-date gains. Although portfolios are up for the year, our average portfolio holding is priced below appraised value, leaving room for substantial future gains. We expect gains as the margin between the last quoted stock price and appraised value closes.

Valuation:

We’re in a Dot-Com/Nifty-Fifty-like market environment. It seems as if all one needs to do to achieve investment nirvana is own a few special companies (Amazon, Netflix, Facebook, Apple, Google). They are one-way trades – buy and hold forever, valuations be damned!

Valuation actually does matter when investing. Overpaying for a stock can lead to years, if not decades, of lost opportunity. Take Coca-Cola for example, once the darling of Wall Street. It peaked at $43.50/share in July of 1998. It was priced to perfection and traded for over 53x earnings. But of course, this was Coke – the global opportunities were enormous – there was no price too high to pay. Over the next fifteen years Coke traded below that level, as the graph below depicts, and investors who bought at the peak waited until 2014 just to break even. That’s a long time to sit in the overpayment penalty box. Today the stock trades modestly above its 1998 price, but at a more reasonable valuation.

We will not overpay. Valuation is critical. As the adage goes, “Bought right is half sold.” Our preference is to invest when we can make purchases at a fraction of book value (net worth) or at less than eight times pre-tax earnings – bargain levels. The current pervasiveness of overvaluations makes our work more challenging. Consequently, we are holding more cash than normal, keeping dry powder for the day when bargain prices appear.

We know company value (stock price) is tied to earnings power. Stock prices eventually follow earnings. In the short term, stock prices are driven by supply/demand dynamics. But over time a company’s earnings will determine its stock price. Fundamental to investment success is correctly assessing the appropriate price to pay when buying and then exercising patience to exit/sell at an elevated valuation.

From Our Library:

Each week, firm associates read a chapter from a selected book with industry relevance and then meet to discuss. We just finished reading Dear Chairman. The following passage on market pricing was a notable point of discussion during one of our meetings:

In an efficient market, divergent opinions balance each other out and guide stock prices to an optimal level. In the real world, misjudgments are much more likely to be biased in one direction, and mass hysteria is not uncommon. Even in periods when the stock market is stable, investors are capable of dramatically misvaluing a company.

Why does this matter? If markets are not efficient, participants have the opportunity to exploit dislocations for their own benefit. Companies can take advantage of shareholders, and shareholders can take advantage of companies.

If you believe in rational markets, a company buyout at a premium to its market price is a profit maximizing event for all shareholders. In the real world, buyouts are opportunistic, and people can, and do get screwed.

Firm Updates:

On July 1st we celebrated Tom’s 5th anniversary with the firm. He’s still having fun and learning each day.

Our Boston office will be relocating to a more central downtown location – if your travels bring you to town, please look us up and plan to drop by for coffee.

Our India-based research team also relocated to a larger office space in downtown Hyderabad (central-southern India) to accommodate our next associate. We are beginning the search process now and look forward to having an additional intellectual resource on our Indian team.

Concluding Thoughts:

As I stated earlier, I’ve been engaged in this work for 33 years. Each day brings new challenges and continued learning for all of our associates. I am in awe of the work we do today versus when I began with Shearson Lehman Hutton in 1987. Our level of due diligence and research along with access to company management and corporate directors is extraordinary. Our internal processes continue to improve as the firm ages and new associates are hired. I am grateful to all of our clients, both new and old, for your trust and confidence.

If you’ve had a change in, or would like to update, your investment objectives or portfolio restrictions, please let us know so we can make appropriate adjustments.

We remain committed to achieving long-term investment excellence by investing intelligently and opportunistically as situations arise. Our capital is invested in the companies we recommend. Please call anytime for a more detailed discussion of our strategy and market outlook. We are always happy to share our views and outlook.

Your Investment Research and Advisory Team

Global Value Investment Corp.