November 2020

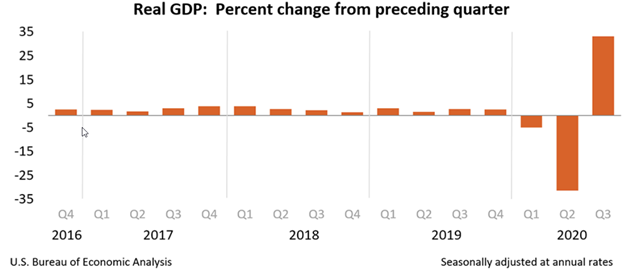

2020 has turned out to be an outstanding year in many ways. The extreme variability in market pricing has been among the many notable situations. Not in modern times have we had as sharp a fall in economic activity as we saw during the second quarter, with a drop in Gross Domestic Product (GDP) of 31.4%. Equally impressive is the recently reported jump in third quarter GDP of 33.1%. These are “off the chart” numbers. The current actual GDP of the United States in dollars is roughly $21.1 trillion.

The most impressive part of the current GDP number is the personal consumption expenditures component – or consumer spending – which was +40.7%. Pent-up demand is evident in many parts of the economy.

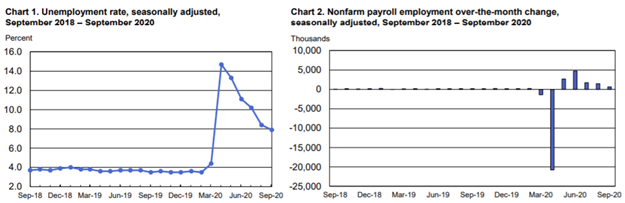

The other stunning number was the rate of unemployment, which crested at over 14% in May. At that point, more than 20 million workers in America were out of work. Over the ensuing months, employment levels have improved dramatically – today, just 12 million people are out of work, representing about 8% of the labor force.

Personal income and savings have been impacted as a result of the aforementioned. Recently reported employee compensation was $11.4 trillion (annualized), versus $10.6 trillion (annualized) in April. Clearly, income has been augmented by US Government programs implemented earlier this year. Government benefits paid to individuals increased from $515 billion in March to $3.38 trillion in April and $1.36 trillion in May, reflecting assistance to the millions of people dealing with unprecedented economic conditions.

The type of events that create these striking numbers typically have parallel activity in the stock and bond markets. True to form, the stock market dropped by about 45% between the domestic emergence of the COVID-19 pandemic in mid-February and its late-March low.

A heavy dose of fiscal and monetary stimulus caused an impressive rebound in the stock and bond markets, employment, and GDP. Although the economy has yet to recover to pre-pandemic levels, a robust recovery from the shocks of 2020 is clearly underway as Americans adjust to new ways of living and working.

We remain cautiously optimistic.

Portfolio Update

Seizing opportunity, we decisively invested in both stock and bond positions from February through June, becoming nearly fully invested by mid-summer. We held unusually high amounts of cash going into the downturn, anticipating market disruptions that would create opportunities to deploy capital (although no one at our firm predicted a pandemic). Our instincts were colored by the extreme valuations among a few notable and popular stocks that had created a euphoric atmosphere of “valuations be damned” among many investors. As a result, we maintained a defensive position going into the new year.

We remain cautious today and have recently exited select positions at fair value in order to achieve higher levels of cash. We anticipate an increased degree of uncertainty surrounding the US elections and consequent economic policy, potentially causing increased variability in pricing.

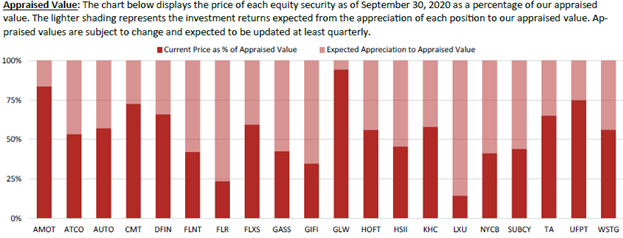

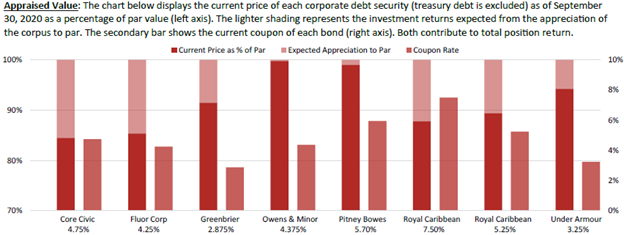

As illustrated on the following page, some of our holdings have approached our appraised value while others remain attractively priced (data as of September 30, 2020). We review and reprice issues on a recurring basis based on financial data provided by portfolio companies throughout the year. After the quarter ended, we exited our positions in Corning, Inc. (GLW) and Royal Caribbean Group 5.25% bonds due November 15, 2022.

It is our firm belief that market participants are becoming increasingly aware of what they hold, triggered in part by a sharp drop in the value of investment portfolios, prompting a return to fundamentally focused valuation and analysis. We think it is best when investors are fully aware of what they own and why they own it. Many large institutions have perpetuated the idea that passive investing in index funds is the optimal way to allocate investment capital. We believe this is an irrational approach and investors are better off giving greater thought to the relationship between the price of a security and its intrinsic value, recognizing what they are paying for and what it is worth.

Extreme market price variability has continued to highlight pricing inefficiencies as emotional buying and selling has caused prices for many companies to fluctuate wildly. However, this has created wonderful opportunities for astute investors to deploy capital at unusually attractive prices and valuations. Uncertainty is the friend of the opportunistic investor and enemy of the passive investor.

From Our Library

Our firm is currently reading Against the Gods, The Remarkable Story of Risk by Peter Bernstein. He makes many interesting observations throughout his book – some more notable passages are listed below.

Wall Street folklore is full of such catch phrases as “Buy low and sell high,” “You never get poor taking a profit,” and “The bulls get something the bears get something but the hogs get nothing.” All are variations on a simple theme: if you bet that today’s normality will extend indefinitely into the future, you will get rich sooner and face a smaller risk of going broke than if you run with the crowd. Yet many investors violate this advice every day because they are emotionally incapable of buying low and selling high. Impelled by greed and fear, they run with the crowd instead if thinking for themselves.

Since we never know exactly what is going to happen tomorrow, it is easier to assume that the future will resemble the present than to admit that it may bring some unknown change.

The more realistic and stouthearted investors buy as others rush to sell and sell as others rush to buy.

It is what J.P. Morgan meant when he observed that “the market will fluctuate.” It is the credo to which so-called contrarian investors pay obeisance: when they say that a stock is “overvalued” or “undervalued,” they mean that fear or greed has encouraged the crowd to drive the stock’s price away from an intrinsic value to which it is certain to return.

Concluding Thoughts

We continue to work diligently as price volatility persists and attractive potential investment situations arise. Our patience was rewarded earlier this year as we invested throughout the market selloff, and we remain alert to similar opportunities.

If your investment objective or financial situation has changed, please let us know. We are aware of the non-financial impact the pandemic has caused for people around the world and stand ready to adjust to your changing needs.

Thank you for trusting us to be prudent stewards of your capital, particularly throughout these unprecedented times.

Your Investment Research and Advisory Team

Global Value Investment Corp.

This document is published by Milwaukee Institutional Asset Management (MIAM), a division of Global Value Investment Corp. (GVIC). MIAM is the institutional investment advisory division of Global Value Investment Corp., providing investment advisory services to institutional investors including Registered Investment Advisors and Broker-Dealers. All statements or opinions contained herein are solely the responsibility of Milwaukee Institutional Asset Management. The material, information and facts contained in this report were based on publicly available information about the featured company and were obtained from sources believed to be reliable but are in no way guaranteed to be complete or accurate. This report is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. Employees of GVIC may have positions in securities referenced in this report. ‘Intrinsic’ or ‘Appraised’ value refers to MIAM’s quantitative and qualitative assessment of the value of an enterprise. Market capitalization is a measure of the total dollar market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current quoted share price. MIAM’s investment strategies generally invest in a smaller number of securities than some other strategies. The performance of these holdings may increase the variability of a strategy’s return. There is no assurance that dividend-paying stocks will reduce price variability. Value investments are subject to the risk that their intrinsic value may not be reflected in market prices. For purposes of distribution in the United States, this report is prepared for persons who can be defined as “Institutional Investors” under U.S. securities regulations. Any U.S. person receiving this report and wishing to affect a transaction in any security discussed herein must do so through a U.S. registered Broker-Dealer. Neither Global Value Investment Corp. nor Milwaukee Institutional Asset Management is a registered Broker-Dealer.

An investor should consider a strategy’s investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Firm’s SEC form ADV Part II. To obtain a copy of GVIC’s ADV Part II, call 262-478-0640 or visit www.gvi-corp.com. Please read the ADV carefully before investing.

Additional information is available upon request.

No part of this document may be reproduced in any form without the express written consent of GVIC. Copyright 2023. All rights reserved.