COVID-19 took the world by surprise in Q1. In this letter, we will look at how it has affected the markets, and why we are optimistic about the near future. Once this passes (and it will), we are poised to rebound in spectacular fashion.

The current market decline is the largest and most rapid in recent memory. The selloff has included both the stock and bond markets. In the course of less than a month, markets across the globe have become virtually correlated. We’re all in this together, as no amount of diversification seems to have mattered.

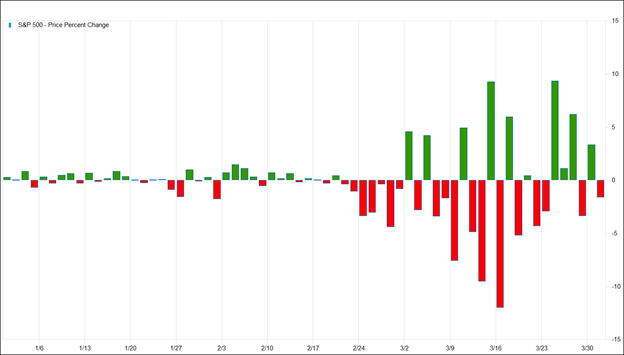

Gains achieved in the U.S. stock market over the past three years were wiped out in just six weeks. The S&P 500 index declined by 34% between Feb 14th and March 27th. The Dow fell nearly 3,000 points in a single day with moves of 1,000 points becoming common. Down one day, up the next: volatility reigned. The Dow dropped to a low of 18,213 from a recent high of 29,568. This index level was last seen in November 2016.

Market participants hate uncertainty. The higher the degree of uncertainty, the greater the level of fear and panic. Price volatility moves in sync with panic: higher panic = lower prices. At many points during the past several weeks, the overriding concern for investors and investment managers was liquidity – thus many scurried for the doors, seeking to exit at virtually any price.

I’ve been through situations like this in the past, beginning with October 1987. They are challenging and generally compounded by short periods of panic behavior. With great confidence, I can assure you that we will come out of this and likely rise to new record highs in time. The biggest challenge is to remain calm and focus on how the world will look when the chaos subsides.

In response to financial disruptions caused by the pandemic, monetary authorities around the world have been busy providing relief through interest rate cuts and quantitative easing (similar to 2009). The U.S. Fed’s balance sheet has spiked to nearly $5.5 trillion dollars, compared to just a year ago, when the balance was under $4 trillion and moving lower at a measured pace. Central banks have provided massive liquidity (cash) to ensure national and regional banks are able to meet the increased cash needs of their clients. The Fed alone committed $1.5 trillion dollars of additional liquidity by creating short-term loan facilities. This is a timely and necessary move to be sure.

In addition to monetary measures, fiscal policy makers on Capitol Hill quickly passed a $2 trillion stimulus package to immediately support businesses, workers, and families. The tax filing date was postponed until July 15th, forgivable business loans were offered, and direct payments to millions of households were initiated to mention just a few programs.

As all of this was happening, global oil prices dropped from $63 per barrel to a recent of low of $19 while the Saudis and Russians engaged in a price war that began on March 8th. What may otherwise have been the biggest geopolitical event of the year was dwarfed by the developments of the COVID-19 pandemic.

The monetary and fiscal responses, coupled with low oil prices, have created an extraordinarily positive and stimulative economic overlay which will impact us as we return to normal after the virus has run its course and the nation gets back to business.

The Silver Lining

We are naturally optimistic. Having watched prices move higher and higher over the past few years, we tended to sell into strength and hold increasing levels of cash. We observed many of our professional peers doing the same due to generally unattractive valuations of which we’ve written over the past few years. It’s tough to hold cash in a rising market but rewarding going into a market decline.

Recently we have been very busy deploying substantial cash balances in client accounts. As active investors, we tend to hold more cash in frothy markets, while holding less in depressed markets as we move to fully invested positions. Although we cannot know when things will return to normal, we do know a good value when we see one, and we are seeing many now.

We are confident in the stocks and bonds we held going into the downturn and those we have added recently. We feel we are very well positioned to enjoy large profits when the level of panic falls and we have greater economic certainty. We think the stimulus actions of the Fed and Congress along with sharply reduced oil and gasoline prices will be huge drivers of economic growth for many months when certainty returns.

Conclusion

In order to reach out quickly, we shortened our quarterly letter. We welcome your call to discuss the current situation in more detail. If your situation has changed and you would like to review your investment objectives, please let us know.

We recently filed our annual SEC Advisory update (ADV part II). If you would like a copy, let us know and we would be glad to send one. We have included our privacy policy with this letter as a reminder of our commitment to protect your personal information.

We hope this letter finds you in good health and spirits as all of us navigate a truly unusual period in history. We remain confident and thank you for your ongoing trust.

Your Investment Research and Advisory Team

Global Value Investment Corp.