Some Things Never Change: Share Price is a Function of Supply and Demand

2023 Q4

Economic and Market Overview

The economy continues to grow, albeit at an increasingly slower pace, and has not fallen into recession. Regardless, many economists are still calling for recession at some point in 2024.

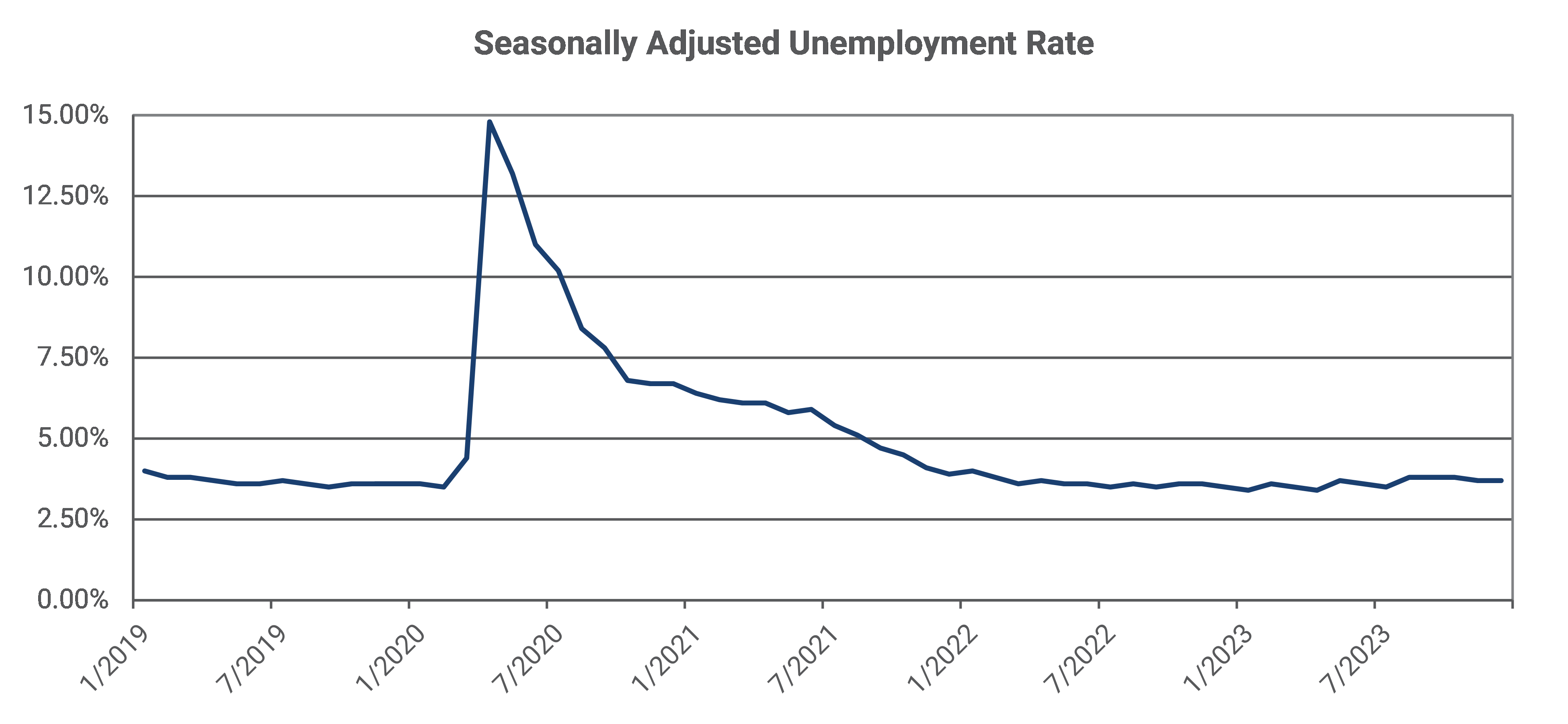

We continue to watch the employment data with fascination, believing the issue of labor shortage is real and likely understated. Tightness in the labor market could create a backdrop that in itself could prevent a recession, or at least partially offset economic contraction. As seen below, the rate of unemployment dropped after the pandemic and has stayed remarkably low.

Figure 1. Seasonally Adjusted Unemployment Rate, January 2019 to December 2023. Source: U.S. Bureau of Labor Statistics.

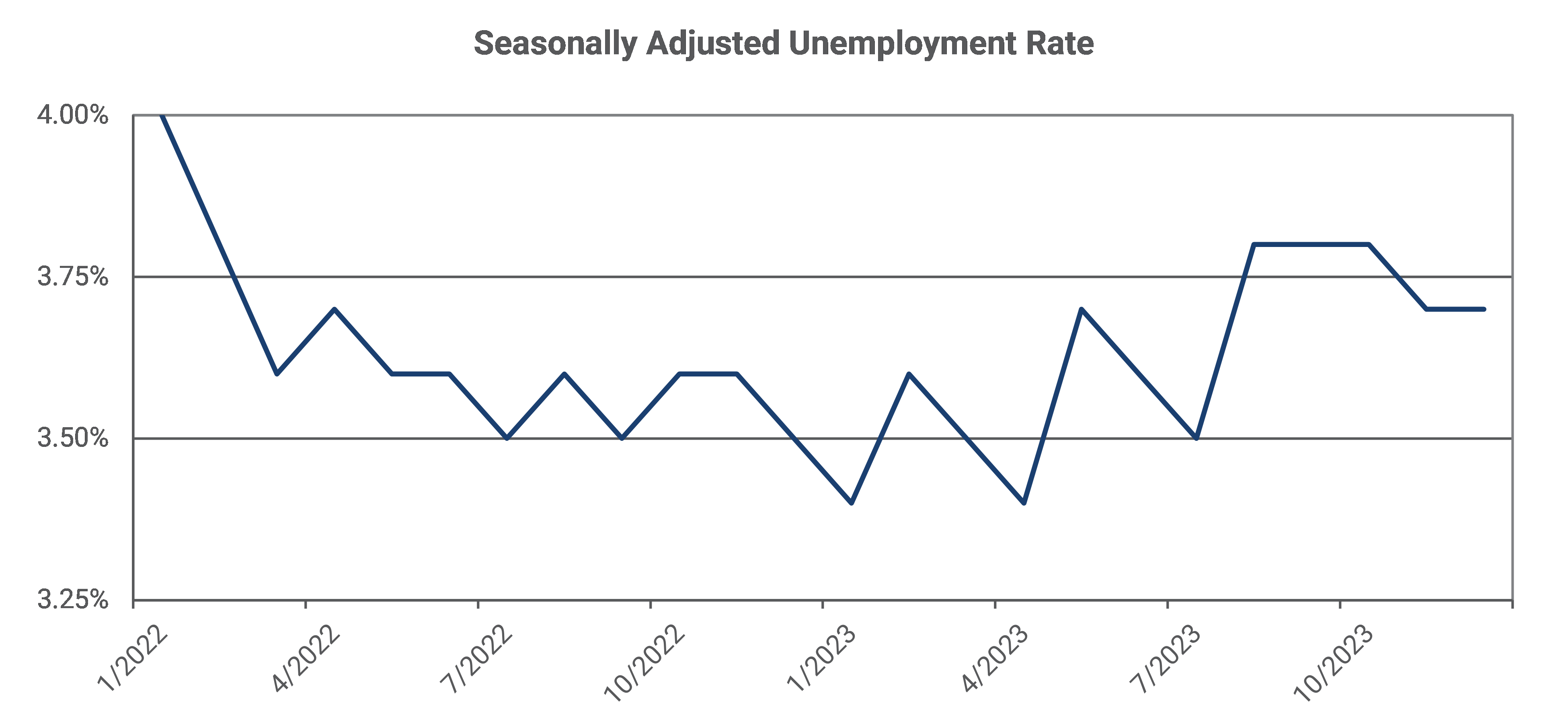

On a more granular level, over just the past 24 months, it is clear labor is in demand. We continue to hear anecdotal evidence from company executives regarding difficulties attracting and retaining labor, both skilled and unskilled. Even with higher wages, the amount of available labor remains sparse.

Figure 2. Seasonally Adjusted Unemployment Rate, January 2022 – December 2023. Source: U.S. Bureau of Labor Statistics.

Much attention is now focused on inflation data, which was reported on January 11. As measured by the Consumer Price Index for All Urban Consumers, inflation was 3.4% over the past twelve months – about as expected – with consumer prices a little higher, and producer prices a little lower than estimates. We believe that peak inflationary pressures are far behind us; in fact, we suspect if the Federal Reserve Bank continues with its “higher for longer” approach to short-term rate policy, we may be headed into a deflationary environment.

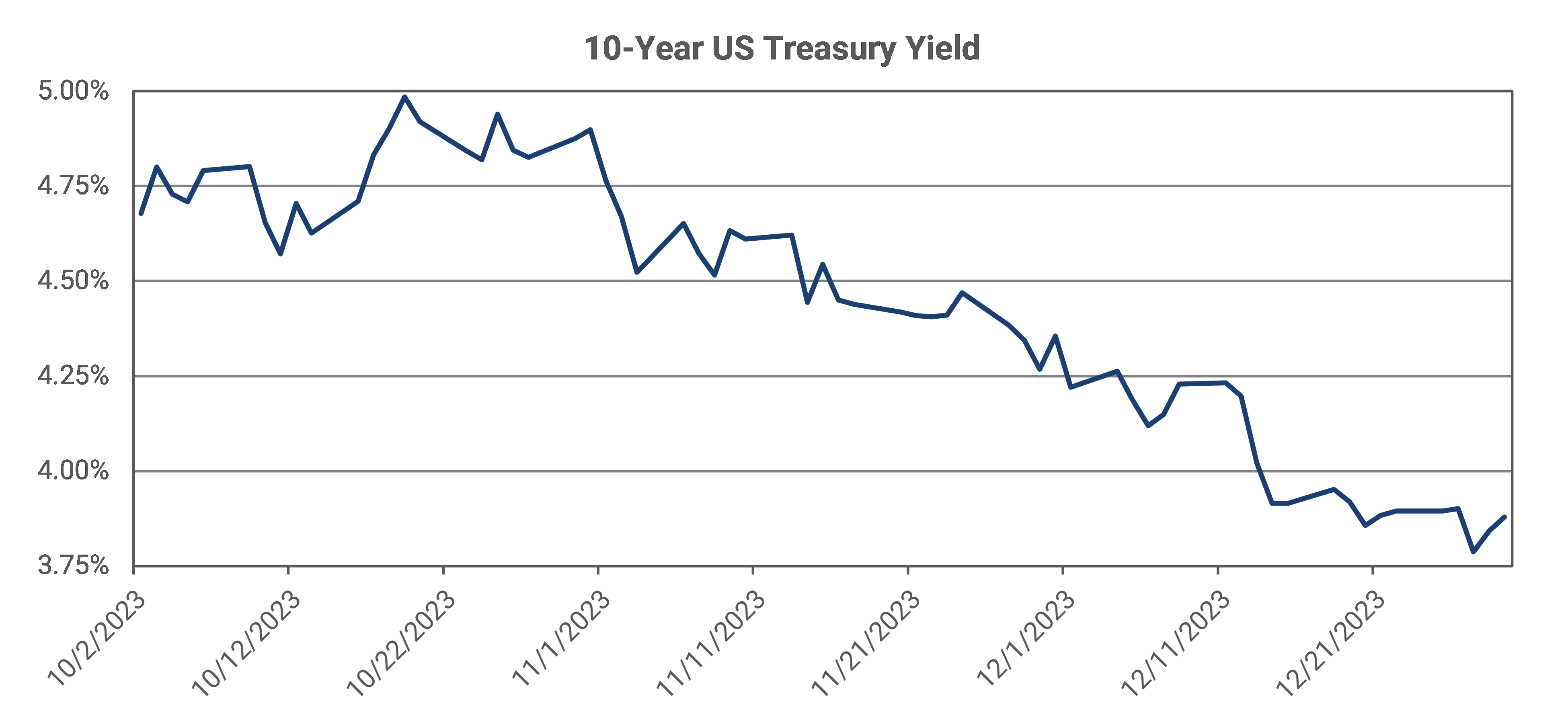

Over the past three months. the US 10-Year Treasury Note yield has declined sharply, as shown below. The move below 4% is material, particularly for the housing market, which has been stymied by high mortgage rates. Office vacancy rates remain at depressed levels, creating concerns for commercial banks and other lenders. We have limited our exposure to real estate due to our concerns around these continued uncertainties.

Figure 3. 10-Year US Treasury Yield, October 1, 2023 – December 31, 2023. Source: FactSet Research Systems.

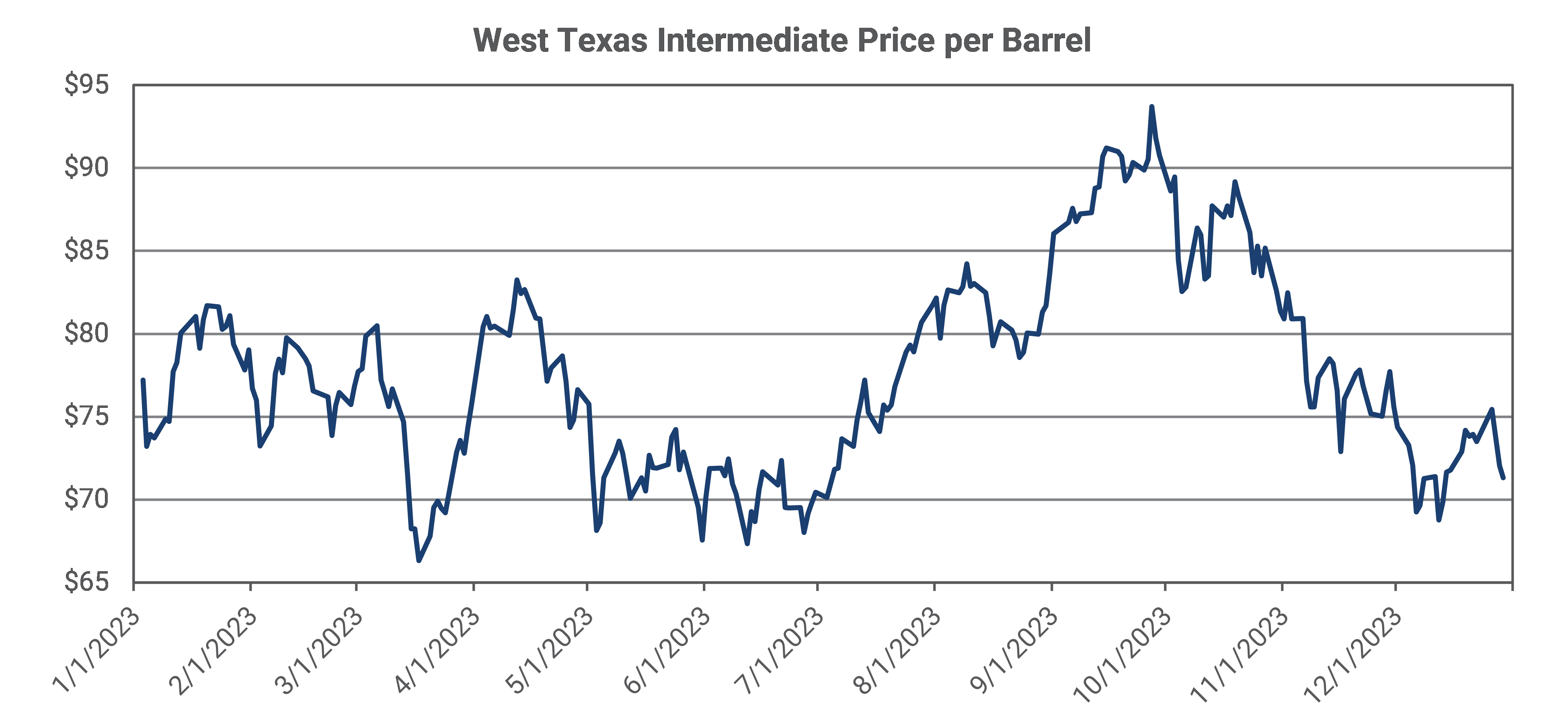

Of particular focus for us are energy prices, particularly the price of oil, as measured by the US benchmark, West Texas Intermediate crude (WTI). It strikes us that the impact of changes in oil prices have far-reaching effects on the prices of a wide variety of goods, including transportation, production, heating and cooling costs, and many consumable items. This in turn affects inflation. As the chart below depicts, the price of WTI has been volatile, and currently sits at roughly $72 per barrel. With the ongoing hostilities in the Middle East and surrounding areas, including the Red Sea, we think there is potential for oil to trade higher in the near term, which will most assuredly put pressure on global economic growth.

Figure 4. West Texas Intermediate Price per Barrel, January 1, 2023 – December 31, 2023. Source: FactSet Research Systems.

Until recently, more than 20% of the world’s container shipping traffic was routed through the Red Sea and Suez Canal. Some of this traffic is now being diverted around the Cape of Good Hope, causing delays in delivery and higher delivered prices, and contributing to increased inflationary pressures across many industries.

In considering these unpredictable situations and the consequent reactions within global politics and the financial marketplace, we remain extremely cautious. Where we have identified appropriate situations within our investment holdings, we have raised cash to be in a stronger position to take advantage of any pricing dislocation that could occur should global crises beget significant market volatility.

Portfolio Update

Over the years, we have written repeatedly and emphatically about the inherent inefficiencies in market pricing. The spirited engagement, both positive and negative, amongst market participants is what determines asset prices (stock, bonds, and other assets traded in the open market) on a tick-by-tick basis every day.

Benjamin Graham, the father of security analysis, wrote the following in The Intelligent Investor, originally published in 1949 (and arguably the best book ever written for the investors):

A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price. The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap).

This remains as true today as it was in 1949. Investor demand is the factor that determines the share price of a company’s common stock. In the absence of demand, the share price will trend lower. With increased demand, share price will trend higher. Plain and simple, in the short run, a share price at any point in time is a function of investor demand in relation to the available supply.

Graham continued, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

We advise clients to ignore the day-to-day variability in prices and instead focus on the long-term underlying condition of businesses – a far more informative gauge of the quality of the businesses and likely future share prices.

A share of stock represents a fractional ownership in a company. As the company’s long-term fortunes go, so goes the share price. In the short run, however, share price can and does fluctuate widely based on investor sentiment, which can lead to a mismatch between supply (the number of shares that investors wish to sell) and demand (the number of shares that investors seek to buy). In the stock market, there is near-instantaneous price discovery when buyer and seller agree on price and transact shares of stock. Our market system allows for both rational and irrational behavior and can lead to extreme fluctuations in price.

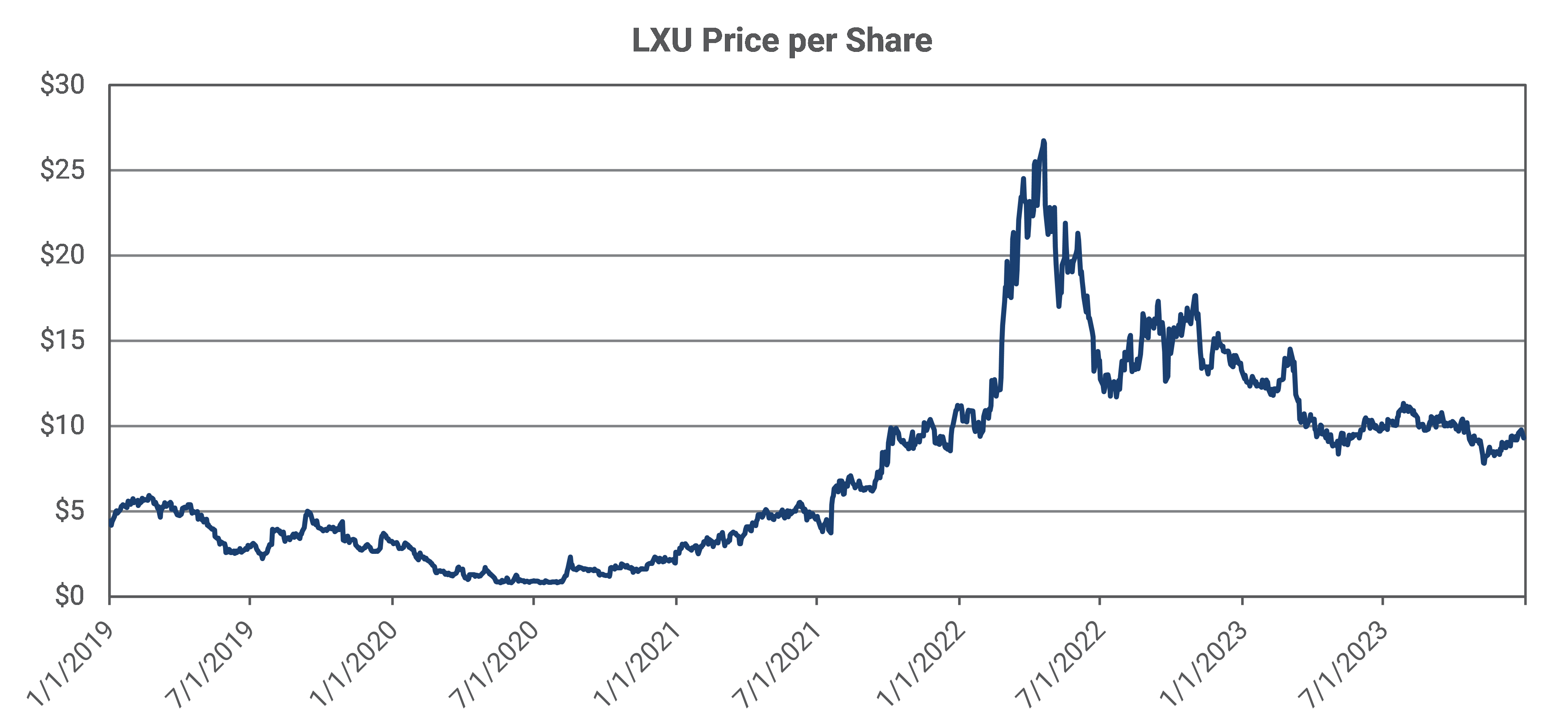

By way of illustration, consider two price charts for companies in which we have invested. During our holding periods the share price of each company experienced dramatic fluctuations that, in our opinion, were wildly disconnected from the sound fundamental financial characteristics of each business.

The first such example is LSB Industries, Inc. (NYSE: LXU), a company that produces ammonia-based chemicals, including fertilizer for agricultural purposes and a variety of products for industrial and mining applications. Between early 2019 and mid-2020 the share price declined by about 80%. Then, from mid-2020 to mid-2022, shortly after the onset of the Covid-19 pandemic, the share price increased from around $1.00 to over $25.00. We are nearly certain that the intrinsic value of this business did not increase by a factor of 25x during that period. Instead, we believe the share price of $1.00 was an irrationally pessimistic response to the outlook based on uncertainties surrounding the Covid-19 pandemic and other company-specific challenges, and the irrational optimism that followed created an extreme overvaluation caused by the sharp price runup. As of today, the stock trades around $8.00 per share.

Figure 5. LSB Industries, Inc. (NYSE: LXU) Price per Share, January 1, 2019 – December 31, 2023. Source: FactSet Research Systems.

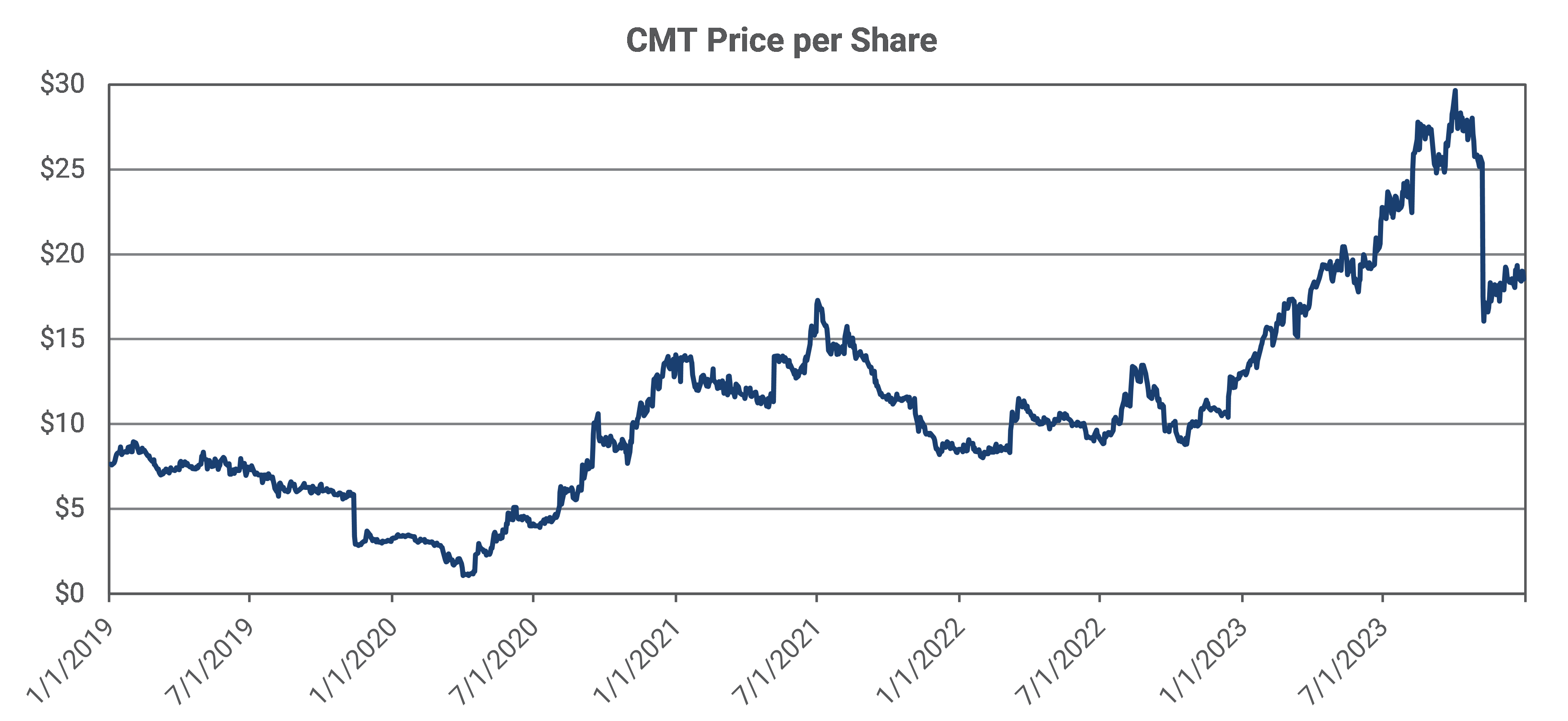

A second illustration of extreme price volatility is taken from Core Molding Technologies, Inc. (NYSE: CMT), a plastic-engineered solutions business that specializes in molding large and structural products using thermoplastics and thermosets.

Figure 6. Core Molding Technologies, Inc. (NYSE: CMT) Price per Share, January 1, 2019 – December 31, 2023. Source: FactSet Research Systems.

Again, from early 2019 through mid-2020, the share price declined by nearly 90% to just above $1.00. Then, beginning in April 2020, over a fifteen-month period, the share price increased from $1.20 to over $16.00, (and over the next two years, to nearly $30.00). Could the intrinsic value of this industrial business actually have increased by 30x over three-and-a-half years? We don’t think so.

These types of price swings can turn investors into multi-millionaires. We attribute these extraordinary moves to the effect of pricing discrepancies created by uninformed investors taking part in an inherently inefficient market, in which buying and selling frenzies create extreme disconnections between intrinsic value and share price.

Both examples provide excellent illustrations of what happens when a gross imbalance between supply and demand emerges. At GVIC, we seek to exploit these types of pricing inefficiencies. We believe we possess a competitive advantage over most market participants based on our deep understanding of individual businesses and their financial statements, an advantage developed through our rigorous investment research and analytical processes. By studying a company’s financial statements, both current and historic, and then engaging in frequent, detailed discussions with senior management, we believe we develop an “information advantage” over most other investors who own stock in the same companies. The average US stock mutual fund holds well over 100 positions. We typically hold between 18 and 22 stocks at any given time, meaning we have substantially more time and resources to devote to studying and understanding each of our holdings – we believe this is a material difference and a significant competitive advantage.

When those inevitable periods of heightened uncertainty and corresponding price volatility occur, we are able to act with a high degree of conviction due to our deep understanding of the intrinsic value of each of the businesses we own. We often face a panicked seller or overly exuberant buyer on the other side of our trades.

We believe that the dramatic declines in the stock prices of LSB Industries, Inc. and Core Molding Technologies, Inc. were largely the result of many investors selling their positions, driving the share price down. As more reasonable (and accurate) analysis prevailed, the share prices recovered to levels that more appropriately reflected intrinsic value of the businesses, in each case a correction of more than 10x.

This is the business we are in – buying while others are desperately selling and selling while others are desperately buying. To quote Graham again:

The intelligent investor is a realist who sells to optimists and buys from pessimists.

Travel

In early October, we attended the 15th Annual Capital Link New York Maritime Forum. Portfolio Manager JP Geygan was invited to participate in the “Shipping – Investor’s Perspective” panel. A recording of the panel discussion is available on our website.

At the same conference, our research team was able to meet with, or attend presentations of, several executive management teams from a wide range of shipping and transportation companies.

In early December, we held several meetings with the CEO, CFO, and chairman of the board of directors of Flexsteel Industries, Inc. (NASDAQ: FLXS). These meetings provided an opportunity for us to share our views related to business strategy and corporate governance. We continue to think highly of the management team and appreciated the robust discussion around these important topics.

From Our Library

We are currently reading Thinking Fast and Slow by Daniel Kahneman. This book was selected in response to the prior book we read, Financial Shenanigans, which concluded with a list of tips for alert investors. Tip #4: Pay attention to corporate culture and watch for breeding grounds of bad behavior.

We have written on several occasions about company culture. Not much empirical data has been published on this topic because it is so difficult to measure. Nevertheless, we recognize that culture is real and extremely important to every organization, and even groups within larger organizations.

Thinking Fast and Slow examines human nature and how the mind works to process information. Much of the discussion in the book is about biases of intuition, something we think about frequently as we challenge one another to arrive at thoughtful and well-reasoned investment conclusions. The author also spends a great deal of time on decision making processes and how those are subject to human emotions – particularly fear, affection, hatred, and greed – emotions that can cause a person to depart from rationality.

Kahneman goes on to describe:

a puzzling limitation of our mind: our excessive confidence in what we believe we know, and our apparent inability to acknowledge the full extent of our ignorance and the uncertainty of the world we live in. We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.

Our ongoing readings have provided great insights to our individual and collective perspectives and limitations, which translate into actionable discipline that governs our investment processes and, eventually, investment outcomes.

Concluding Thoughts

2023 was a record year for GVIC as the firm continues to grow and improve. With the new year, we will simplify our branding and begin solely using Global Value Investment Corporation (GVIC) across all of the firm’s operations, retiring our Milwaukee Private Wealth Management (MPWM) and Milwaukee Institutional Asset Management (MIAM) names.

We want to thank all of our clients and partners who have provided invaluable support and encouragement over the years. Your support allows us to continuously improve and hone our investment skills, always with the goal of providing a differentiated and excellent investment experience.

Your Investment Research and Advisory Team

Global Value Investment Corporation