Bridging the Value Gap: Powering Value Investing through Active Engagement

A Proactive Strategy that Reimagines the Traditional Tools of Activist Investing

Staying ahead of the performance curve while traversing today’s cookie-cutter investment landscape requires more than passive investing and intermittent engagement. Doing better than the market necessarily calls for doing something different. However, our industry’s over-reliance on the same sets of broadly available, electronically accessible data and analytics, means the notion of investors gaining a meaningful information advantage is becoming a rarity, especially among widely held funds or securities.

Against this backdrop, value investing is becoming an increasingly attractive proposition for investors who aren’t content to simply go along with the rise (and fall) of the broad market. With a focus on identifying lesser known, mispriced, or misunderstood companies that are trading for a fraction of appraised value, and then closing that gap, value investing is a strategy that tends to sell itself very well in concept. However, in practice, successful value investing requires an uncommon mix of deep study and well-developed skills to execute.

For these reasons, value investing is not only difficult for investors to do on their own, but it also presents a conundrum for many established firms and advisors. There are very few that possess the specialized expertise, and those that do aren’t prepared to make the commitment of time and resources needed to effectively make and manage these investments on an ongoing basis. The net-net of this is that investors looking to build wealth through a value investing strategy will likely need to seek help from a specialized firm that has the skill, market sense, and temperament to consistently execute an effective value strategy.

Building Blocks of a Business

Within our firm, we view every business as having three primary value drivers: People, Strategy, and Capital. People manage businesses based on a Strategy which is executed utilizing Capital.

The first level of “people” is the board of directors. Directors are elected by stockholders as their representatives. A board has two principal functions: hire management to develop and execute a business strategy, and provide oversight to ensure the strategy is successfully executed. Directors are accountable to stockholders and are obligated to replace management if it fails to deliver performance in accordance with the strategy.

A strategy is a detailed plan designed to achieve specific goals. It is subject to ongoing review, and may need to be adjusted over time, with board approval, to adapt to changing industry and economic dynamics.

Effecting a business strategy requires capital. Stockholders provide equity capital with an expectation of receiving a rate of return on their capital. Stockholders judge the success of a business by the dollar value of their stock holdings – as portfolios and share prices are easy to track in near-real time from any computer or smart phone.

When our firm evaluates a company for investment, it does so with an intensive focus on these three value drivers. We commit capital with an expectation of achieving an acceptable return over time. However, once we have identified the unrealized potential of a business and made an investment, our work has just started. We believe we have an obligation, on behalf of our clients, to then hold the company’s management and directors accountable for executing a well-conceived and articulated strategy to deliver to our investors the level of return identified in our team’s investment thesis. With this in mind. I’d like to tell you a little more about our firm and what we do differently.

Doing Value Investing Right

Global Value Investment Corporation (GVIC) was formed in 2007 to offer a unique discipline for wealth creation. Our focus on value investing grew out of our experience witnessing the success achieved using this approach through many market conditions and businesses cycles, while at the same time seeing the more commonplace methods of other practitioners generate mediocre long-term results. Today, GVIC operates globally based on the same Midwest values we started with in our early days in Milwaukee. From then until now, we have remained focused on deploying patient capital to build generational wealth.

Our work begins with identifying undervalued businesses and zeroing in on their appraised value, while attempting to accurately assess their future potential. Being able to find an actionable “information advantage” in this context, requires an expert level of “roll-up-your-sleeves” due diligence that is, with few exceptions, no longer practiced within our industry. However, as many other firms have turned toward low-cost, widely available “desk research,” we continue to invest in developing, maintaining, and refining a culture of relentless due diligence.

As we have demonstrated repeatedly over time, the breadth and depth of GVIC’s process for analysis enables us to develop a highly differentiated and insightful investment thesis that is expected to develop over a long-term horizon. Our clients note and value our comprehensive analysis of market and industry factors and third-party data, while also digging into the meaning behind the numbers and words contained in financial reports and filings. Although we are patient in our time frames for expected returns, we are proactive in guiding, accelerating, and amplifying each investment’s ability to deliver results.

Active Engagement - Creating the Catalyst

We’ve assembled an interdisciplinary team and developed distinct processes that go beyond the traditional definition and confines of due diligence. We work to cultivate effective one-on-one relationships and actively engage with members of the management teams of our portfolio companies. We also place boots on the ground, going on site, in person to offices and operating facilities to fully understand and unravel the intricacies of a company’s business.

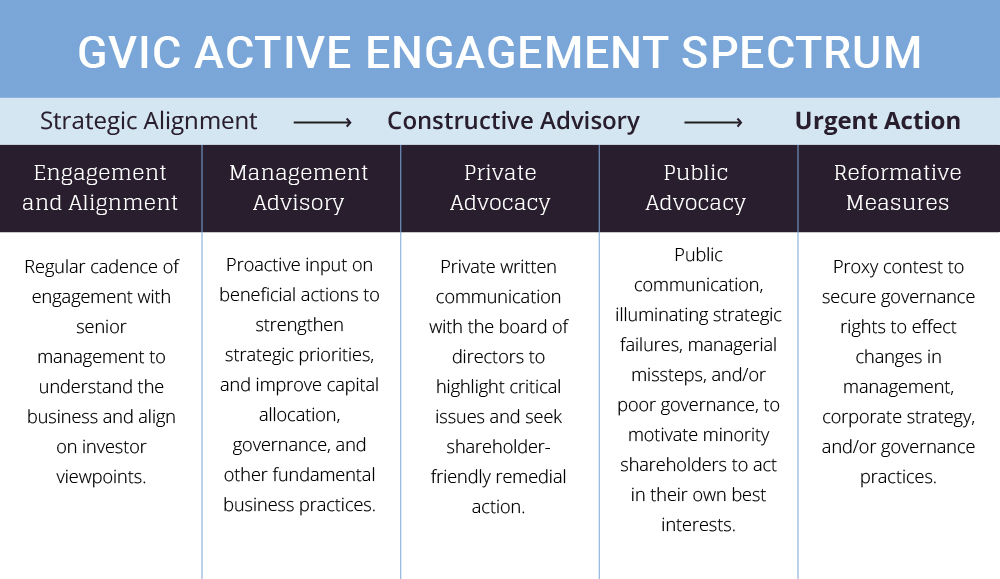

We broadly label this intensive approach to value creation as “active engagement.” It is a proactive strategy that reimagines traditional (and often aggressive) tools of “activist investing.” Emphasizing transparency, problem-solving, and long-term value creation, our approach leverages a broad spectrum of mechanisms in the areas of business strategy, capital allocation, corporate governance, and other relevant matters (see chart below) to positively impact investor perspectives. In this way, we work to accelerate the closing of the value gap, to elevate the market’s view and drive the share price to more closely reflect the true value of the business, as detailed in our investment thesis.

What it Means for Those Who Invest With Us

Investment advisors who retain GVIC as an investment manager can break through the sameness of financial service offerings by bringing their clients a differentiated value investment opportunity built on 1) exceptional due diligence to inform the strongest investment thesis, and 2) active engagement to optimize returns over the full lifecycle of the investment.

By fostering trust and openness in our interactions with companies, we work to garner access to deeper, more timely insights into corporate operations, financial performance, and strategic initiatives. This enhanced information advantage helps safeguard our investors’ capital, while also enabling more informed strategic investment decisions for other shareholders.

We believe GVIC offers a holistic, constructive, and actively engaged approach to value investing that catalyzes value creation for our investors and better positions the businesses we invest in for success. By integrating technology, streamlining workflows, improving cash flows, promoting sustainable practices, and adhering to ethical standards, companies can navigate the evolving landscape with confidence to deliver profitable growth well into the future.

When we are successful in closing the value gap, we create generational wealth for the firm’s clients. But we also benefit all stockholders, bond holders, company employees, customers, vendors, and ultimately the community the company works in and serves. Our success has a broad and virtuous ripple effect.

At GVIC, we’re committed to deploying patient capital, proactively engaging with our investments, and sharing our expertise to increase their competitive position and deliver higher results for our investors.

If you have questions or would like to chat, please let us know and we’ll be glad to set up a call or meeting. For information on our firm, please visit us at www.gvi-corp.com.