A Peculiar Paradox: Moments of Opportunity Disguised as Misfortune

2025 Q1

Economic and Market Overview

Tepid economic optimism buoyed markets during the opening weeks of 2025, driven in part by expectations of pro-business policy actions from the new administration, engendering cautious confidence amongst business leaders. However, market resilience driven by these sentiments faltered as the likelihood of significant changes to US trade policy rose. As the first quarter drew to a close, volatility ticked up and investors braced for choppier waters ahead.

Despite the potential for policy changes, the US economy was largely stable throughout the first quarter. The labor market showed continued strength; unemployment stood at 4.1% in February before rising slightly to 4.2% in March, according to the Bureau of Labor Statistics (1). Inflation showed modest signs of cooling, with the Consumer Price Index for All Urban Consumers (CPI) rising 0.2% in February after a 0.5% increase in January, bringing the 12-month inflation rate to 2.8% (compared to the Federal Reserve’s target of 2.0%) (2). The shelter index (3), which rose 0.3% in February, accounted for nearly half of the monthly increase in headline inflation, while decreases in airline fares and gasoline prices helped moderate overall inflation. “Core CPI,” which excludes food and energy prices (which are typically volatile), increased 0.2% in February and 3.1% over the past 12 months.

Anticipated trade policy announcements materialized on April 2, when President Trump declared a national emergency and imposed sweeping tariffs that sent immediate shockwaves through global markets. The baseline 10% tariff on all imports with higher reciprocal tariffs ranging from 12% to 50% on countries with large trade deficits represents a fundamental shift in US trade policy likely to reshape the global economic order. As of the writing of this letter, most of these tariffs have been put on hold for 90 days to facilitate trade negotiations.

The immediate market reaction to these tariff announcements was severe: on April 3, the Dow Jones Industrial Average fell 4.0%, the S&P 500 dropped 4.8% and the Nasdaq Composite tumbled 6.0%, with each index recording its largest daily loss since 2020. Companies dependent on international supply chains were particularly affected, and investors quickly sought safety in traditional havens like gold and US Treasury securities.

Looking ahead, these trade policy developments introduce significant uncertainty to economic forecasts. The Federal Reserve Open Market Committee, which had been expected to begin lowering interest rates later this year, now faces a more complex environment with the potential for tariff-induced inflation occurring simultaneously with slowing economic growth.

We are closely monitoring several key data points: potential negotiations with trading partners, early data on how tariffs are affecting supply chains and consumer prices, and the Federal Reserve’s approach to monetary policy in this evolving landscape. We expect the administration’s ability to manage economic challenges will materially influence market performance in the coming quarters.

As always, we continue to have thoughtful conversations with senior management of portfolio companies about supply chain management and manufacturing cost discipline. Our investment discipline seeks to identify companies with strong balance sheets, capable management teams, and prudent capital allocation policies, all of which enable a company to adapt to difficult operating environments that inevitably occur.

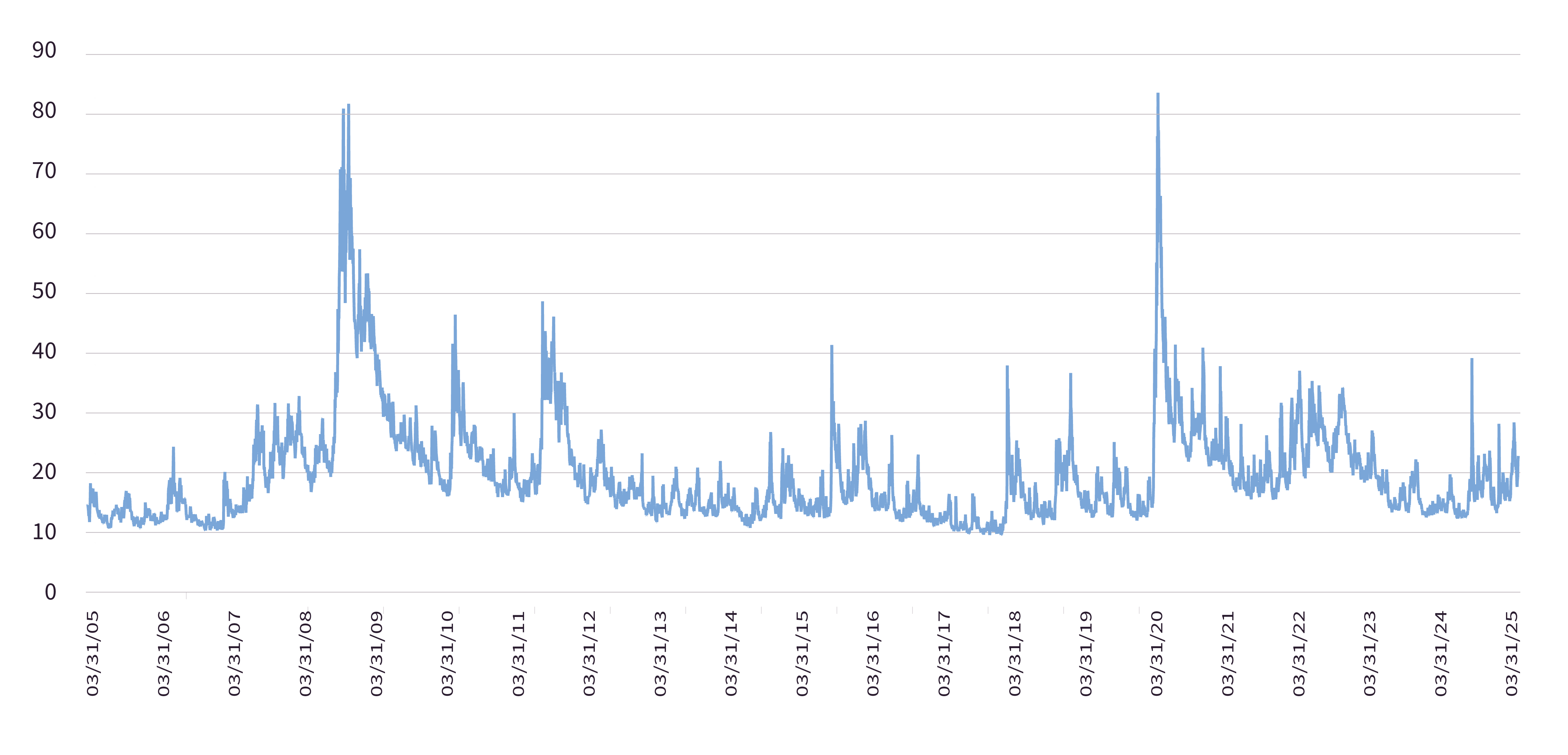

The thousands of companies that constitute market indices and underpin global financial activity will always be subject to change. Typically, change happens slowly, but is recognized by market participants (and traded upon) in a condensed period of time. When change happens suddenly, however, market participants often react irrationally: when such change is perceived as negative, many panic, clambering to sell; but when change is positive, frenzied buying follows. The Chicago Board of Options Exchange Market Volatility Index (the “VIX”), shown in Figure 1 below, is a measure of market participants’ expectations of price volatility as measured through S&P 500 Index futures. A higher VIX index value equates to higher expected volatility. Figure 1 exemplifies the concentration and short-lived nature of spikes in significant price volatility.

Figure 1: Chicago Board of Options Exchange Market Volatility Index (March 31, 2005, to March 31, 2025). Source: FactSet Research Systems

Portfolio Update

During the first quarter of 2025, a broad decline in US market prices reflected investors’ concerns around tariff-centric trade policy and its potentially adverse effects on the global economy. Uncertainty regarding trade policy caused trepidation amongst corporate managers and investors alike. For the quarter, the S&P 500 Index and declined 4.6%, and the Value Line Geometric Index, our preferred equity benchmark, declined 7.0%. Conversely, the EURO STOXX 50 Index increased 7.7%, reaching an all-time high for the first time since March 2000.

Market volatility creates a peculiar paradox — moments of opportunity disguised as misfortune. Our investment process embraces this contradiction through a straightforward approach: we acquire quality businesses when they trade at meaningful discounts to intrinsic value, and sell when valuations reach appropriate levels. While we don’t claim the elusive ability to perfectly time market bottoms or peaks, our rigorous valuation process consistently identifies when prices venture far enough from intrinsic value to warrant action. We operate largely in the middle ground between market extremes, occasionally finding ourselves in agreement with consensus but more frequently positioned between the extremes of fear and euphoria. It’s precisely this disciplined approach — adhering to valuation parameters rather than emotional narratives — that enables us to capitalize on market volatility rather than buckle under pressure. Current market conditions present our research team with an expanding landscape of potential investments, several of which may be added to client portfolios in coming months. We look forward to discussing these opportunities with you as they develop.

In March, our research team attended DNB’s 18th annual Energy & Shipping Conference in Oslo, Norway. For many years, we’ve identified compelling investment opportunities in seaborne trade and across the energy value chain, so this was a particularly pertinent event for us to attend. Additionally, interfacing with executives and investors alike from around the world broadens our collective perspective and improves our ability to draw astute analytical conclusions. While in Oslo, we met with the management teams of several companies that are held in client portfolios. Despite increasingly challenging business environments, we remain comfortable with these positions and their potential to generate future positive investment returns. True to our firm’s name, we remain alert to opportunities to invest globally.

During the first quarter, we invested in the equity of RedCloud Holdings plc (RCT). RCT develops and operates a cloud-based business-to-business ecommerce platform that facilitates the trading of fast-moving consumer goods in emerging markets. The platform connects brands, distributors, and retailers, enabling data-driven purchasing decisions and inventory management through technology-enabled insights. RCT is headquartered in the United Kingdom, and the company’s primary markets are Argentina, Brazil, Nigeria, and South Africa. We find these markets attractive due to high population growth, favorable consumer demographics, and antiquated retail infrastructures that would benefit from the efficiency provided by RCT’s platform. We believe RCT is well-positioned to grow in these developing economies, and is notably disconnected from US economic developments.

From Our Library

Firm Update

We continue to actively expand our client base through proactive outreach efforts and referrals from wonderful clients like you.

Your introductions have been invaluable in helping us connect with some truly remarkable people.

Concluding Thoughts

With this letter, we have included our annual summary of material changes to Form ADV, Part 2A, our Form CRS, and our privacy policy. We’re happy to answer any questions about these disclosures.

We remain committed to prudently deploying patient capital to build generational wealth, always mindful that the assets we manage often represent a lifetime of hard work. We are especially mindful that market volatility can create unease – please don’t hesitate to call or email if you have questions about your portfolio, how we manage your assets, or our views on investing or the economy. We are deeply grateful for your trust and confidence.

Your Investment Research and Advisory Team

Global Value Investment Corporation

- https://www.bls.gov/news.release/archives/empsit_03072025.htm; https://www.bls.gov/news.release/archives/empsit_04042025.htm

2. https://www.bls.gov/news.release/archives/cpi_03122025.htm

3. The shelter index is a major component of CPI, accounting for nearly 35% of the CPI calculation as of December 2024. https://www.bls.gov/cpi/factsheets/

owners-equivalent-rent-and-rent.htm