Making Sense of the Data

2024 Q1

Economic and Market Overview

Overall, the US economy continues to enjoy a modest tailwind allowing a reasonable level of growth, fairly strong employment trends, easing inflationary pressures, and ongoing increases in equity market prices.

Fed policymakers find themselves in an awkward position, wanting to reduce rates to avoid an expected recession, yet unable to justify doing so, given the durability of the economic expansion, and with inflation hovering above its targeted level of 2.0%. They are now deferring anticipated rate cuts to the latter part of the year. Six months ago, market participants had expectations of between three and five cuts occurring in 2024, beginning as soon as January.

Energy prices have remained stubbornly high, with the US crude oil benchmark currently trading at $85.79 per barrel, up 18% during the first quarter alone. Oil is a ubiquitous commodity, reaching virtually every corner of the economy. Controlling its price is essential in the long-term management of inflation.

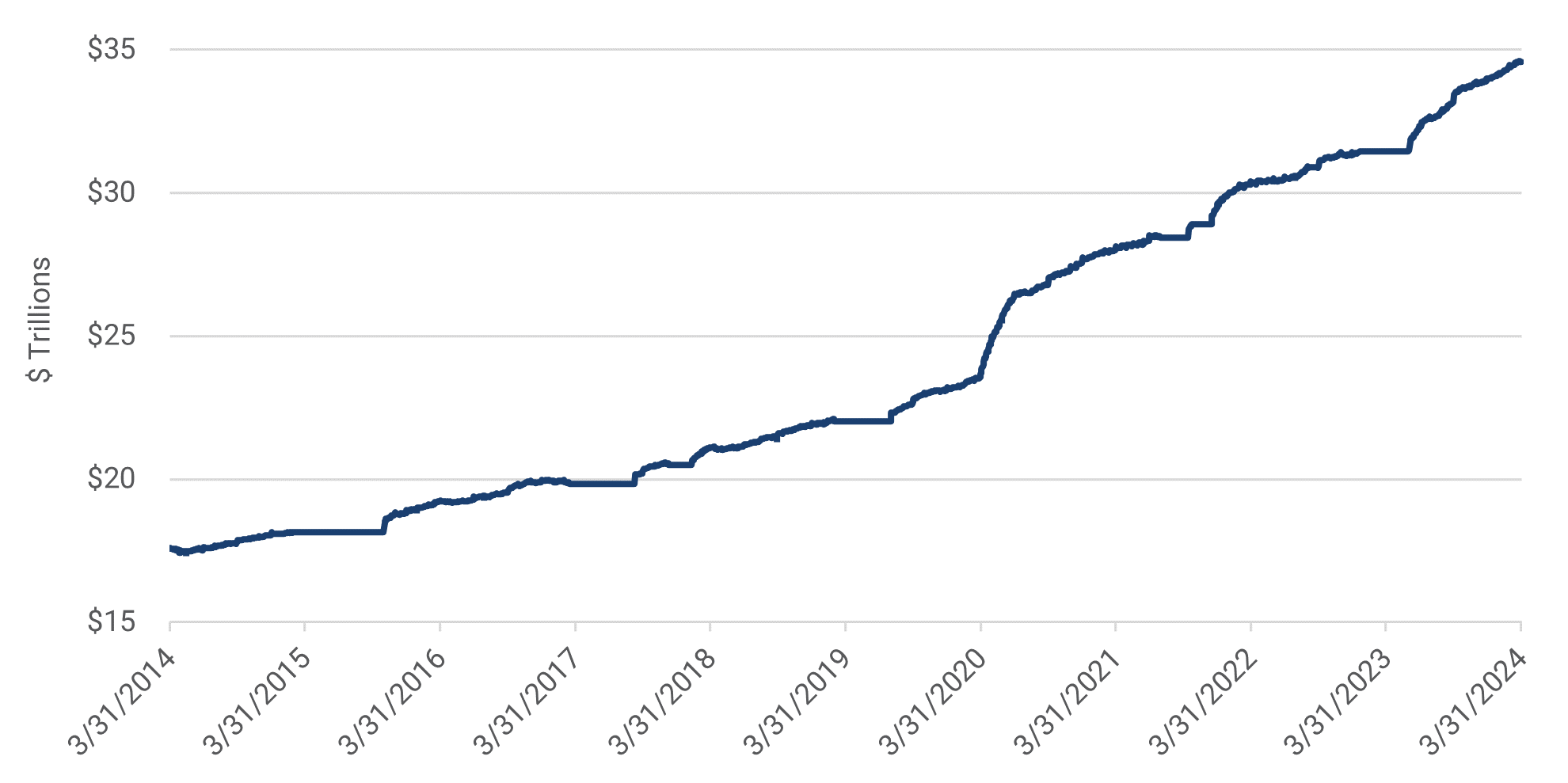

GVIC remains concerned with the elevated federal debt level, which is nearly $35 trillion today, versus $17.5 trillion just 10 years ago. We are also closely watching US household debt, which has reached a record level of nearly $18 trillion. In particular, credit card debt has risen rapidly over the past year (according to the NY Federal Reserve Quarterly Survey), which is a major concern with the potential for a long-lasting adverse economic impact. The firm believes these levels foretell some amount of future uncertainty and corresponding price variability, which may lead to more attractive valuations and investment opportunities. In anticipation, we have gradually increased cash holdings across all portfolios over the past few quarters.

Total US Government Public Debt Outstanding ($ Trillions)

Source: US Department of the Treasury (https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny)

The US Treasury market has moved sideways this year, and with the 10-year bond currently yielding 4.56%, we fully expect longer-dated rates to decline over time, putting a floor under any dramatic market correction. We also note the recent pickup in US and European M&A (mergers and acquisition) activity, with a nearly 60% increase in US and a nearly 65% increase in European activity in Q1 versus last year, a sign of business confidence and the willingness of sophisticated strategic and financial investors to acquire assets today with the expectation of improved valuations three to five years from now.

Given these factors, GVIC is acting with prudence in light of our historic perspective on long market cycles and the recognition of the rhythm of the market from peak to trough to peak. We opt to remain alert and opportunistic as we anticipate increased volatility ahead. Our posture remains cautious, with the view that we know what’s going to happen, we just don’t know when.

Our team, both in the US and overseas, continuously monitors incoming data and information of all types – financial, social, political, and demographic – to develop and maintain a timely, dynamic understanding of the changing world and how each change potentially impacts our investments.

Portfolio Update

We recently wrote about inefficiencies in market pricing – both debt and equity – which create circumstances for our firm to invest at opportune times, such as when we believe the last quoted market price is well below our appraised value of a business. We make these assertions based on more than 35 years of experience showing up in the marketplace and watching prices fluctuate in (often unpredictable) ways that open windows of opportunity for us to either buy or sell and take advantage of the irrational behaviors of others.

It is important to understand GVIC’s detailed appraisal process, and how it enables our team to move decisively when we transact. The cooking stock of our analysis is the fundamental research discipline we employ every time we evaluate a business. As previously described, we always begin by developing a thorough understanding of a business’s financial statements and condition, followed by discussions with senior management, and often in-person visits to a business’s offices and operating facilities.

As evidenced in the Economic and Market Overview section above, our team is continuously gathering and analyzing data and information, which becomes the foundation upon which we build our investment theses. Our individual research associates gather information by reading, listening, engaging in discussions, and observing the world at large through their own experienced lens to inform a distinct view of the investment landscape.

Our appraisal process is further differentiated by GVIC’s disaggregated operating model. Our associates live and work in disparate geographic locations, allowing each to take in a distinct set of local and regional data and experiences. After all, what’s happening in Milwaukee, San Francisco, Boston, or Charleston can be very different from each other, never mind in comparison to the experiences of members of GVIC’s research team who are based overseas. This additional geocultural dimension creates a tangible benefit to our research process and consequent investment conclusions.

We liken our process to that of creating a mosaic. Our team engages in the continuous collection of many small pieces of data and information, that alone may seem unimportant, but when consolidated and combined with hundreds of other pieces, it can bring into view a bigger picture that is more complete, clear, and makes a more compelling case for acting. Our work is dynamic, composed of pieces that are the subject of ongoing scrutiny, with new and changing information impressing our work and creating opportunities to improve its utility.

Ultimately, the value of our finished product can be measured through a return-on-investment calculation over our holding period, which is typically five years for stocks and slightly less for bonds. With each new investment, we have high expectations at the point of inception and continually seek to improve the outcome over our holding period. Through experience, we recognize not all investments will evolve into masterpieces, but some will. We continually challenge ourselves to identify as early as possible those with the greatest promise, and hold them until they are fully valued, while disposing of others with less promise to preserve the time value of money.

Regardless of our holding period, we are motivated every day to assess and reassess the world around us, ensuring we have not just the right data and information, but have correctly interpreted it, while understanding its full meaning, and remembering that the world is constantly changing.

“The important thing is not to stop questioning. Curiosity has its own reason for existence.”

-Albert Einstein

Travel

In early March, several GVIC analysts traveled to Oslo, Norway for four days of meetings and industry analysis related to offshore energy and global shipping. This presented a significant and substantial opportunity to dig deeper on a wide variety of interrelated subjects. Our analysts met with the senior management from four of our current stock holdings, as well as a half-dozen management teams from companies in which we have a general interest, or that are competitors of one of our holdings.

This is a recent example of our commitment to immersing ourselves in environments where significant data points can be gathered, and where industry experts share information and insights previously unknown to us that add new context to our existing view of a topic. Not every data point matters, but taking in hundreds or thousands of new data points is a very constructive way to spend our time.

Whenever practical, we attempt to meet with company management on location, which enables us to see how CEOs and CFOs are treated by, and interact with, others within their company. We believe corporate culture is an often-overlooked critical ingredient in the success formula of a business. True cultural assessment can only be made through observation. Many companies have culture statements, but not all live by those. As we wrote in a prior letter:

Tip #4: Pay attention to corporate culture and watch for breeding grounds of bad behavior.

We have written on several occasions about company culture. Not much empirical data has been published on this topic because it is so difficult to measure. Nevertheless, we recognize that culture is real and extremely important to every organization, and even groups within larger organizations.

Our travel and onsite visits provide additional context for our investment mosaic, allowing us to update and insert new pieces into our design that can add to, and refine, our investment thesis, while also providing us with additional confidence to invest during times of market volatility.

From Our Library

We continued with Thinking Fast and Slow by Daniel Kahneman. Kahneman makes a statement that we completely disagree with, despite the fact it has been uttered by many Wall Street professionals for decades and is accepted doctrine at many elite academic institutions.

In its broad outlines, the standard theory of how the stock market works is accepted by all the participants in the industry. Malkiel’s (author of A Random Walk Down Wall Street) central idea is that a stock’s price incorporates all the available knowledge about the value of the company and the best predictions about the future of the stock. If some people believe that the price of a stock will be higher tomorrow, they will buy more of it today. This, in turn, will cause its price to rise. If all assets in a market are correctly priced, no one can expect either to gain or to lose by trading. Perfect prices leave no scope for cleverness, but they also protect fools from their own folly.

Most of the buyers and sellers know that they have the same information; they exchange the stocks primarily because they have different opinions. The buyers think the price is too low and likely to rise, while the sellers think the price is high and likely to drop. The puzzle is why buyers and sellers alike think that the current price is wrong. What makes them believe they know more about what the price should be than the market does?

Although it’s a widely accepted doctrine that an investor can’t outperform the broad market index over time, we have come to a different conclusion based on our own observations, conversations with other investment professionals, and personal experiences.

This doctrine is flawed in two important ways. First, the proponents believe market pricing is “efficient.” We on the other hand, based on actual experience and observation (see our 2023 Q4 letter for specific examples) believe the pricing efficiency postulate is misleading. Market pricing has great inefficiencies as anyone who participates in the market activity on a regular basis can attest. Those inefficiencies can be exploited to the financial advantage of alert investors.

Second, and of far greater importance, despite most of the buyers and sellers having the same information, it is the correct interpretation of the information that matters, not simply the possession of such information. Clearly, market participants arrive at different conclusions, explaining why there are both buyers and sellers at any given price. Investors have different opinions as to the meaning of the information.

Our research team collects vast and disparate amounts of data and information with the aim of arriving more times than not at superior conclusions. We acknowledge in advance not all of our analysis will be correct initially, but we continuously strive to update and refine our thinking by enriching ourselves with a deeper understanding and appreciation for what the data and information are implying both today and into the future. We have found it very rewarding to do our own thinking and working to exploit periodic mispricing and inefficiency in the markets.

Firm Update

Congratulations to our own Mac MacLaren and his wife Rebekah, proud new parents of Baker Holt MacLaren, who officially joined the GVIC family on March 27th. All are healthy and resting comfortably at home.

Concluding Thoughts

We recently penned an article which we refer to as GVIC’s ”ethos.” In it we take a moment to reflect on what led to the creation of our firm, its foundational elements, and how we’ve evolved over the first seventeen years of our existence. We hope our musings provide additional context as to what we do, how we do it, and why.

Although 2023 was a record year for GVIC, we look forward to furthering our team’s ability to make intelligent investments and deliver results through the remainder of 2024 and beyond. We do this always with the goal of providing a differentiated and excellent investment experience.

Please let us know if you’ve had any changes with your investment objectives or have other financial concerns. We are available to schedule a call or meeting to discuss your specific situation.

Finally, we would like to extend a sincere “thank you” to our clients and partners, who have provided invaluable support and encouragement over the years.

Your Investment Research and Advisory Team

Global Value Investment Corporation