Process, Process, Process…Results

January 2023

We’d like to dedicate the first client letter in 2023 to “2022 in the rear-view mirror.” This letter highlights how GVIC’s rigorous, fundamental investment process delivered for the firm’s clients in both stock and bond portfolios last year.

What Happened in 2022?

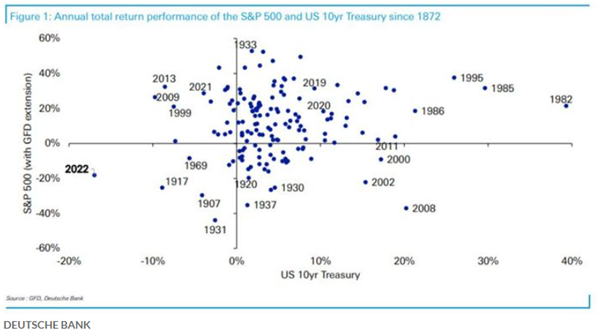

According to Deutsche Bank’s head of Thematic Research, Jim Reid, U.S. markets experienced a historic reckoning in 2022. He notes, “years where both stocks and bonds fall in tandem are few and far between, which is one reason why last year’s brutal losses marked ‘the biggest outlier year in history.’”

As the chart below shows, 2022 saw the worst combined total return for both stocks and bonds dating back to 1872. Reid explained that 2022 marked the first year where both the 10-year US Treasury note, and the S&P 500 index lost more than 10% on a total-return basis in a single calendar year.

We stated in our October client letter that there were both winners and losers in every economic cycle of the past. On any given day, if the broad stock market falls, there are stocks that rise; conversely, when markets rise, there are stocks that fall. The environment we experienced in 2022 created opportunity for investors who are adept in stock selection as opposed to simply buying large baskets of stocks in unmanaged index funds. 2022 was a year in which the results of our very patient and disciplined research process were on full display.

Disciplined Process Yields Results

Since we penned our first quarterly client letter in January 2008, we have continuously described our investment process as having an emphasis on fundamental investing through rigorous and thoughtful analysis and maintained conviction that our process produces satisfying performance over time. A typical market cycle extends roughly five years, so our research process incorporates a longer time frame when setting expectations and committing capital.

Over the years, we’ve touched on process related subjects as diverse as financial statement analysis, business valuation, corporate governance, board relations and management interactions, and investor psychology and how it impacts daily security price variations through simple supply and demand trends, to name just a few. Our research process incorporates both quantitative and qualitative aspects of business analysis, placing a high value on the people managing a business, with the recognition that a good management team can take a mediocre business and turn it into a great investment.

The past year provided a stellar example of how our process again resulted in significant outperformance even in a very uncertain market. After consistently sharing the tenets of our investment process, we are happy to report our 2022 performance. You will receive an updated portfolio review within a few days. GVIC’s managed client portfolios were by and large positive for the full year of 2022 in a world in which every major stock and bond market index was negative, some by large percentages. The table below includes the Value Line Geometric Composite Index, which is our preferred stock benchmark, and the Bloomberg US Aggregate Bond Total Return Index, our preferred bond benchmark. In addition, we’ve included several of the more popular market indices:

| Index (stock / bond) | 2022 Total Return |

| Value Line Geometric Composite Index (stock) | (20.2%) |

| Bloomberg US Aggregate Bond Total Return Index (Bond) | (13.0%) |

| Russell 2000 Value Total Return Index (stock) | (14.5%) |

| S&P 500 Index (stock) | (19.4%) |

| NASDAQ Composite Index (stock) | (33.1%) |

2022 was an exceptionally rewarding year for GVIC and its clients, with all of our strategies providing significant performance above their respective benchmarks. More important is the positive absolute return during a period when all major asset classes produced negative results.

A core business tenant at GVIC is this: all associates of the firm own the same securities we recommend for investment in client portfolios. We believe having capital at risk provides a sharp focus and an acute awareness. Over the years this has proved true and been to our benefit, as all associates have participated in the financial fruits of our labor.

Economic Outlook

Our prior quarterly client letter was titled “Outlook: Looking Less Worse” which turned out to be the case as both stock and bond markets broadly increased since the date of that letter. It also appears that inflation, as measured by the Consumer Price Index (CPI) has begun to decelerate, having peaked in June at over 9% compared to the most current reading of 6.5%. Oil prices declined from peak levels of over $130 per barrel to just over $80 per barrel at last week’s closing prices, while natural gas prices declined from over $10 per MMBtu in late August to just under $3.20 per MMBtu last week (using the well-recognized US Henry Hub index).

We highlight the decline in energy prices, particularly oil, as those commodities are ubiquitous in the calculation of prices at all levels of production, very much impacting transportation which drives the global economy.

Source: FactSet Research Systems Inc.

The US Federal Reserve Open Market Committee (“the Fed”) continued its fight against inflation, twice raising the overnight lending rate by 75 basis points (3/4 of 1%) since we last wrote. The Fed has explicitly indicated it intends to combat rising prices by slowing the economy (aggregate demand) until inflation is on course to return to 2%, even if this means driving the economy into recession. The overnight rate is now 4.25% to 4.50%, levels last seen in 2007 as the housing crisis was just getting underway.

We observe that global commerce is slowing but we remain optimistic based on our review of available data. Employment levels are still very high, despite many workers having left the workforce over the past ten years. Wage inflation has slowed, moving beyond the statutory increase in wages 12 to 24 months ago from $7.00 per hour to somewhere in the mid-teens. The US Department of Labor reports the level of year-over-year wage increase has declined. We think a sharp economic slowdown is unlikely if labor remains employed.

We also observe companies managing inventory levels very rationally, as wholesale and consumer prices have been reduced to move excess inventory, and we’ve witnessed little evidence of massive ”fire sale” activity. Corporate balance sheets remain healthy, despite rising interest rates. Corporate executives were largely prudent with the use of debt coming out of the COVID-19 economic downturn.

Rising US interest rates accrue favorably to the value of the US dollar in relation to other currencies – a risk which companies selling products and sourcing raw materials, or intermediate goods overseas, must deal with on a continuous basis. The US Dollar Index hit multi-decade highs through 2022 as the Fed pressed ahead with its interest rate hike program. This created temporary pricing distortions that impacted earnings and valuations, but also opened windows of opportunity. 2022 witnessed a slowdown in merger and acquisition activity, but we expect that to pick up in the year ahead as companies doing business in US dollars have a distinct advantage with a stronger currency.

From Our Library

We recently began reading Dead Companies Walking by Scott Fearon. Fearon is a hedge fund manager who successfully and repeatedly identified poorly managed companies as potential prospects for bankruptcy. At GVIC, we believe it’s important to make good investments while avoiding getting involved in poorly managed companies that are likely to become bad investments. Fearon offers the following thoughts:

Geoff [Fearon’s boss at the time] believed human-to-human contact was the best way to gauge a company’s future performance. He valued numbers and raw data, but he knew that numbers were easy to fudge or misread. You had to study the people behind the numbers to get the full story. And reading secondhand profiles about a company’s executives didn’t count. Neither did pressing their flesh and swapping a few jokes with them at an investor conference. You had to go see them where they lived and worked—their own offices.

. . . people in management positions, even very senior management positions, are often completely wrong about the fortunes of their own companies. More important, in making these misjudgments, they almost always err on the side of excessive optimism. They think their businesses are in much better shape than they actually are.

And:

Bankruptcy is fundamentally about reorganizing a firm’s capital structure, as bondholders and other creditors often agree to ownership stakes in the new incarnation of the company. A lot of businesses

emerge from Chapter 11 in better financial shape. (I’ll talk later about former Continental Airlines CEO Frank Lorenzo, who actually used bankruptcy as a management tool.) But one thing never survives the process: the stock price. It goes to zero as a company’s former equity holders are wiped out and its creditors take control.

Firm Updates

We congratulate both Mac and Curtiss, who passed the Series 65 Uniform Investment Advisors Law Exam in December. This is a comprehensive industry exam for which they committed substantial time and effort in preparation.

Concluding Thoughts

If you’ve had any changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can update to better align with your current circumstances.

Your Investment Research and Advisory Team

Global Value Investment Corp.

[1] https://www.collaborativefund.com/blog/big-beliefs/