Seventh Inning Stretch

2024 Q3

Economic and Market Overview

The third quarter was punctuated by the long-awaited reduction of the federal funds rate by the Federal Reserve’s Federal Open Market Committee (FOMC). On September 18, the FOMC reduced the federal funds rate by 0.50%, to a target range of 4.75% to 5.00% (in practice, the federal funds rate is managed within this range by the twelve Federal Reserve Banks). Of note was the magnitude of the rate reduction – 0.50% versus the more typical 0.25% adjustment. In our second quarter letter, we cautioned, “overly restrictive monetary policy could lead to recession if the FOMC fails to adjust rates to match economic activity in a timely manner.” We view the magnitude of the September 18 rate cut as a validation of our concern, and perhaps a suggestion that members of the FOMC are beginning to share those concerns.

The dovish rate cut should be understood against the backdrop of broader monetary policy, or the collective effect of the Federal Reserve’s actions to promote maximum employment and stable prices. In addition to setting the federal funds rate, the Federal Reserve also determines bank reserve requirements and engages in open market operations (buying and selling securities in open market transactions).

Open market operations have historically been employed to manage short-term policy objectives. However, since the 2008 financial crisis, the Federal Reserve has also used open market operations to stimulate or control economic activity and job creation. This is accomplished by using its balance sheet to inject cash into the economy (loose monetary policy) by buying certain securities, and remove cash from the economy (tight monetary policy) by selling certain securities.

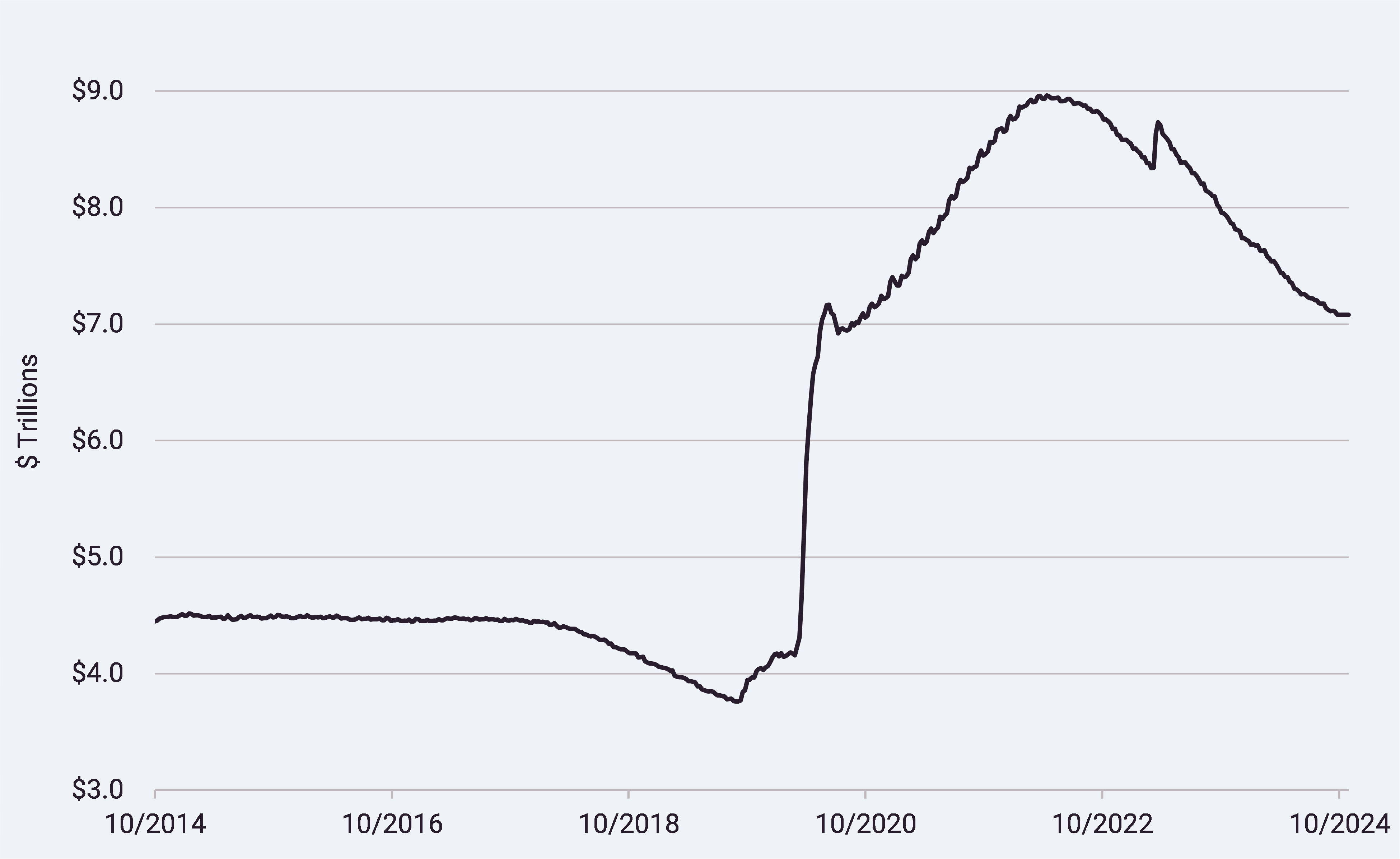

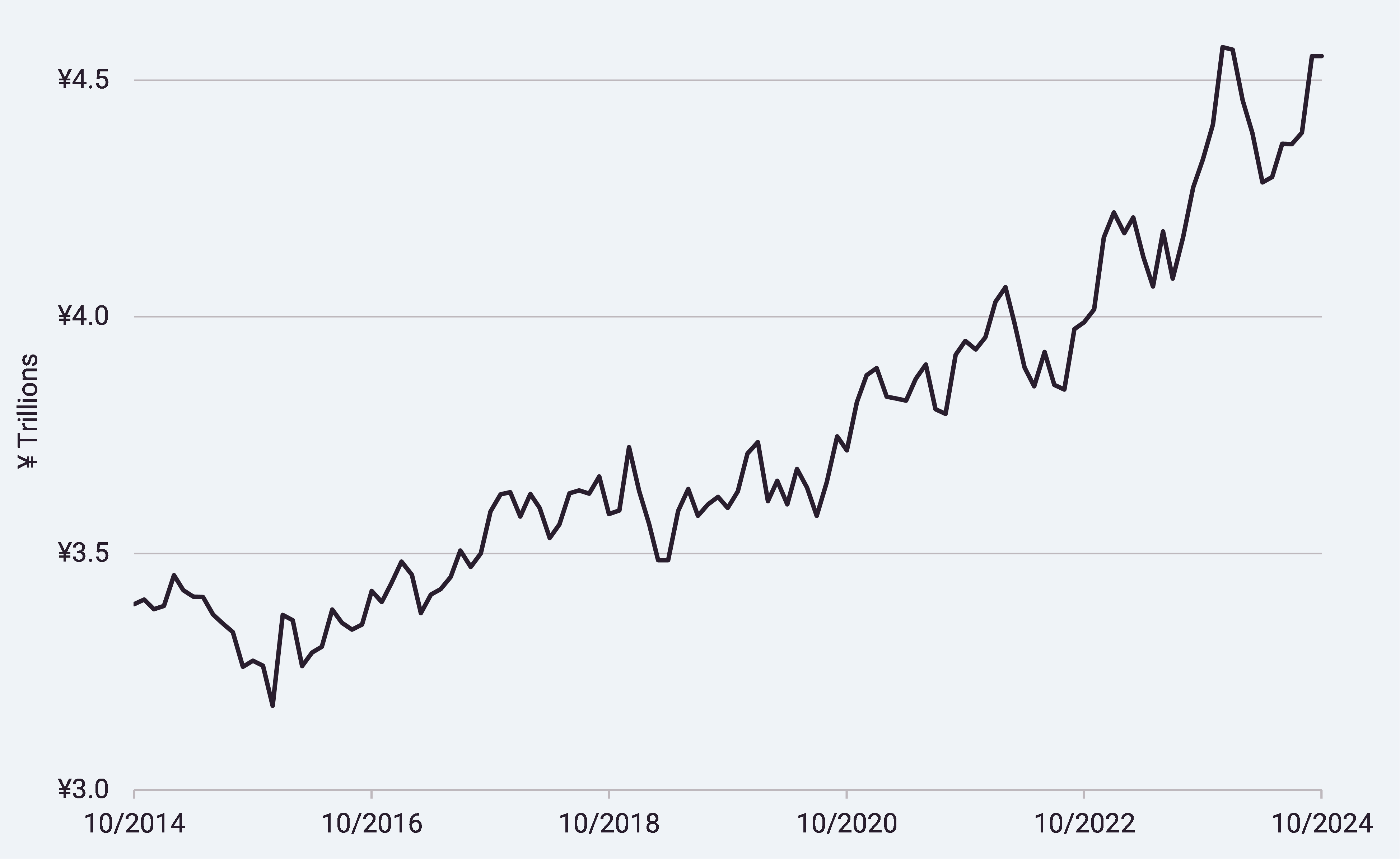

As of September 24, 2024, the Federal Reserve reported just over $7.0 trillion of assets on its balance sheet, including about $4.4 trillion of US Treasury securities and $2.3 trillion of mortgage-backed securities (guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae). This compares to a high of nearly $9.0 trillion of assets reported on the Federal Reserve’s balance sheet in April 2022, meaning that over the past two-and-a-half years, the Federal Reserve has shed nearly $2.0 trillion of assets. Put another way, the Federal Reserve has removed more than $2.0 trillion of liquidity from the economy (see Chart 1, below).

Chart 1. Federal Reserve balance sheet assets, October 1, 2014, to September 25, 2024. Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends_accessible.htm.1

In mid-2017, we theorized that the Federal Reserve’s balance sheet assets should “normalize” somewhere between $2.0 trillion and $2.5 trillion. That paradigm changed with the Covid-19 pandemic, when balance sheet assets grew from under $4.0 trillion to over $7.0 trillion in a single year (from October 2019 to October 2020). While an analysis of the appropriate size of the Federal Reserve’s balance sheet is beyond the scope of this letter, we are relatively confident that it will be smaller rather than larger in the future. Without a doubt, the FOMC continues to walk a fine line in managing monetary policy.

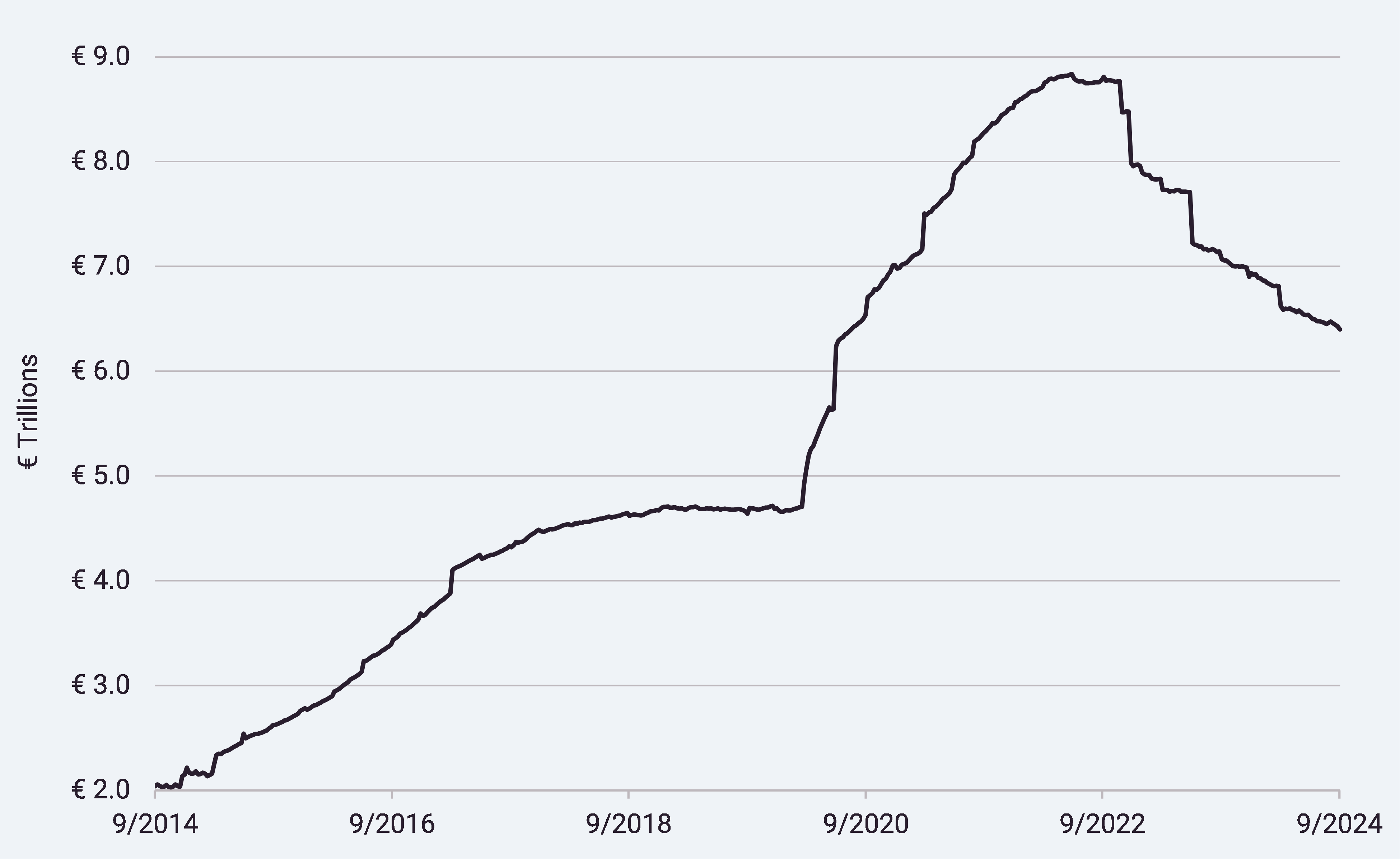

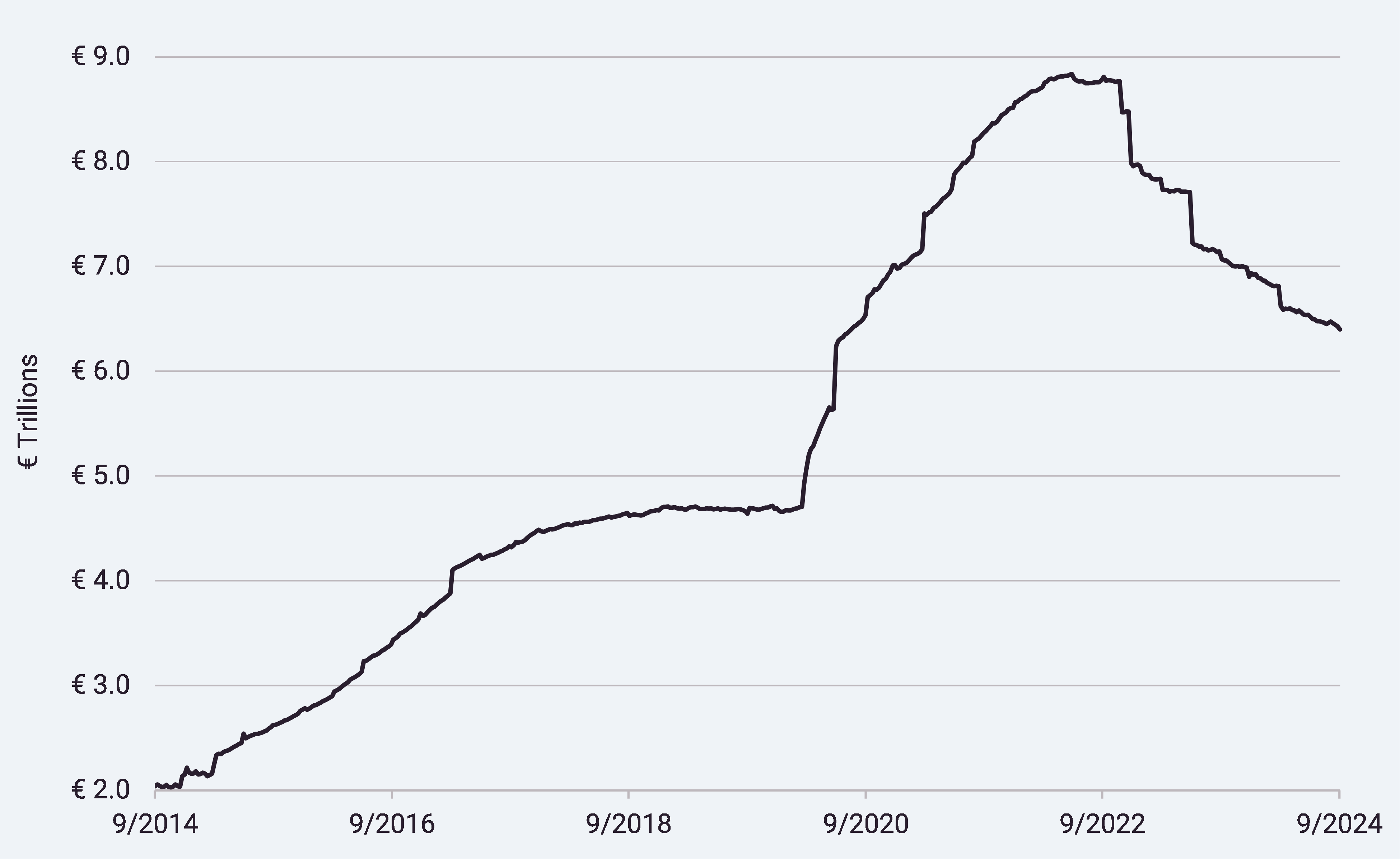

A curious juxtaposition arises when studying the balance sheets of the central banks of other major global economies. The Federal Reserve began tightening monetary policy by selling assets in early- to mid-2022. The European Central Bank soon followed, with a meaningful reduction in balance sheet assets beginning in mid- to late-2022 (the consolidated balance sheet of the euro area national central banks is shown in Chart 2, below). But, the Bank of China has reported an increase in balance sheet assets in recent years (albeit lumpy, as shown in Chart 3, below), as has the Bank of Japan (see Chart 4, below).

Chart 2. Eurosystem consolidated balance sheet assets, September 26, 2014 to September 27, 2024. Source: https://data.ecb.europa.eu/data/datasets/ILM/ILM.W.U2.C.T000000.Z5.Z01.2

Chart 3. Bank of Japan balance sheet assets, October 2014 to September 2024. Source: https://www.stat-search.boj.or.jp/ssi/cgi-bin/famecgi2?cgi=$nme_a000_en&lstSelection=BS01.3

Chart 4. People’s Bank of China balance sheet assets, October 2014 to September 2024. Source: http://www.pbc.gov.cn/en/3688247/3688975/index.html.4

We have yet to draw any actionable conclusions from this divergence in global monetary policy positioning, and note that a single comparable datapoint from institutions in countries influenced by a myriad of specific considerations could simply be aberrational or even meaningless. Nonetheless, we are acutely attuned to global economic activity and how that affects our portfolio holdings, given that many of the companies in which we invest on behalf of clients have truly global operations.

Finally, this is our last quarterly letter before the US presidential election on November 5. Internally, we’ve discussed and debated the implications of a win from each major party candidate, and while we expect some amount of market volatility around the election (and the announcement of results), we have yet to identify immediate risks to our portfolio holdings. That said, we will closely watch the economic and trade policies of whichever candidate prevails and make prudent adjustments as such.

Portfolio Update

Caution is the recurring theme from our recent calls with management teams of the companies held in client portfolios. Across a swath of industries and geographies, management teams have recently pared back or delayed capital investments and have been mindful of managing expenses due to a perception of uncertainty for the remainder of 2024 and into 2025. This uncertainty, however, has done little to temper enthusiasm around equity prices, as measured by broad market indices. During the third quarter, the Value Line Geometric Composite Index advanced 6.52% and the Russell 2000 Value index gained 10.15%.

Where appropriate, we have managed client portfolios in anticipation of volatility by trimming positions that are either approaching our appraised value or have become disproportionately large holdings in a portfolio. While risk management is always top of mind when making such decisions, we are pleased to have raised cash so we can act quickly should price volatility in the coming months present compelling investment opportunities at attractive prices. As always, our research team is steadfastly reviewing new investment opportunities in preparation for such a situation.

We recently added a position in Allient Inc, (ALNT) to client portfolios. ALNT designs, manufactures, and sells precision motion, control, power, and structural components. Our research team is familiar with ALNT and its management team through prior investment (this is the fourth time we have invested in the company; each of the three previous investments produced healthy gains). Recently, the price of ALNT’s common stock declined after recent earnings numbers fell short of market expectations. We revisited the company’s financial condition and future earnings potential, and determined that the price of the common stock was unduly discounted relative to our appraisal of the value of the enterprise. We expect financial results to improve in coming years, causing the stock price to more appropriately align with intrinsic value.

Recent sales in the portfolio include Global Ship Lease, Inc. (GSL), an owner and operator of small and mid-sized containerships. We exited the position entirely as the price of the common stock approached our appraised value. We also saw emerging risks: the expected increase in the global supply of containerships has grown in recent years, which will likely lower the cost of chartering containerships for years to come (and consequently cause the revenues of ship owners to decline). Additionally, containership charter rates had been buoyed by recent geopolitical factors that caused sailing routes to lengthen; because the resolution of such situations remains uncertain, we were increasingly uncomfortable with the sustainability of the economic tailwind this presented to GSL. We realized both capital appreciation and dividend income from this position, and are pleased with our investment result.

Our research during the quarter has not been exclusively academic. In September, members of our research team visited Durango, Colorado to attend Rocky Mountain Chocolate Factory, Inc.’s (RMCF) investor day. This investor day included a presentation from management, a tour of the factory floor, and discussions with other shareholders as well as members of the board of directors. What was immediately apparent from the visit was a renewed sense of purpose within the team at RMCF and a clear strategic plan. We remain enthusiastic about our investment in RMCF.

As always, our research team welcomes questions and conversations about portfolios and specific investments should you have them. We pride ourselves on being accessible to all investors and clients and look forward to our continued conversations about deploying patient capital to build generational wealth.

From Our Library

We are currently reading Competition Demystified by Bruce Greenwald, the Robert Heilbrunn Professor Emeritus of Finance and Asset Management at Columbia Business School and the academic Director of the Heilbrunn Center for Graham & Dodd Investing. Dr. Greenwald is highly regarded in the value investing community, and his work has informed much of our firm’s thinking on competition and competitive advantages. In Competition Demystified, Dr. Greenwald explores historical examples of business strategies to identify strong competitive advantages capable of providing a moat to protect a company’s earnings and market position over time. However, we are reminded of the ever-shifting investment landscape and caution that must be observed when forecasting the future when Greenwald writes the following:

It is hard to see what competitive advantage Apple might enjoy … Apple could concentrate in one of two niches, like graphics and multimedia software in which it might capitalize on its existing superior technology. Even here it might be confronted by the Microsoft-Intel steamroller, once better software and more powerful chips became available … Jobs did manage to return Apple to profitability, centering it once again in the personal computer business, where its elegant designs and easier-to-use operating system kept it the favorite of hard-core Apple devotees … Apple survived; it had hardly prospered. Its future does not look bright.

Apple went on to cement its position as one of the great companies of the past several decades. This serves as an important reminder for our team that while we may judge a specific outcome more likely than another based on historical data, a company’s fortunes can change quickly.

Firm Update

The firm celebrated its 17th anniversary on August 12, 2024. We extend a sincere “thank you” to all of our clients for your continuing trust in Global Value Investment Corporation. As we have shared in the past, we have developed a 100-year business plan, and we look forward to continuing to work with our current clients and future generations alike for years to come.

Kathy Geygan and Tom Molosky celebrated their 16th and 10th anniversaries, respectively, with the firm this quarter. Each has played an integral role in helping drive the continuous improvement of our public relations and advisory processes. Please join us in congratulating Kathy and Tom!

We also congratulate Satendar Singh on the birth of his son, Vyom! Both mother and child are happy and healthy, if a little tired.

Finally, we are excited to continue expanding our client base through a combination of referrals from existing clients and outreach efforts. We recently onboarded a new institutional client in Smithtown, NY, and we look forward to growing with them for many years to come.

Concluding Thoughts

If you’ve had changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can adjust your portfolio to more appropriately align with your current circumstances.

Thank you for your ongoing confidence.

Your Investment Research and Advisory Team

Global Value Investment Corporation