Complex Factors Call for Awareness and Agility

2024 Q2

Economic and Market Overview

The second quarter of 2024 saw shifting dynamics in inflation, monetary policy, and geopolitical tensions lead to bouts of optimism punctuated by stretches of caution. As such, the well-worn adage, “Sell in May and go away,” may be as felicitous as ever as market participants remain on their toes in this unusual investing environment.

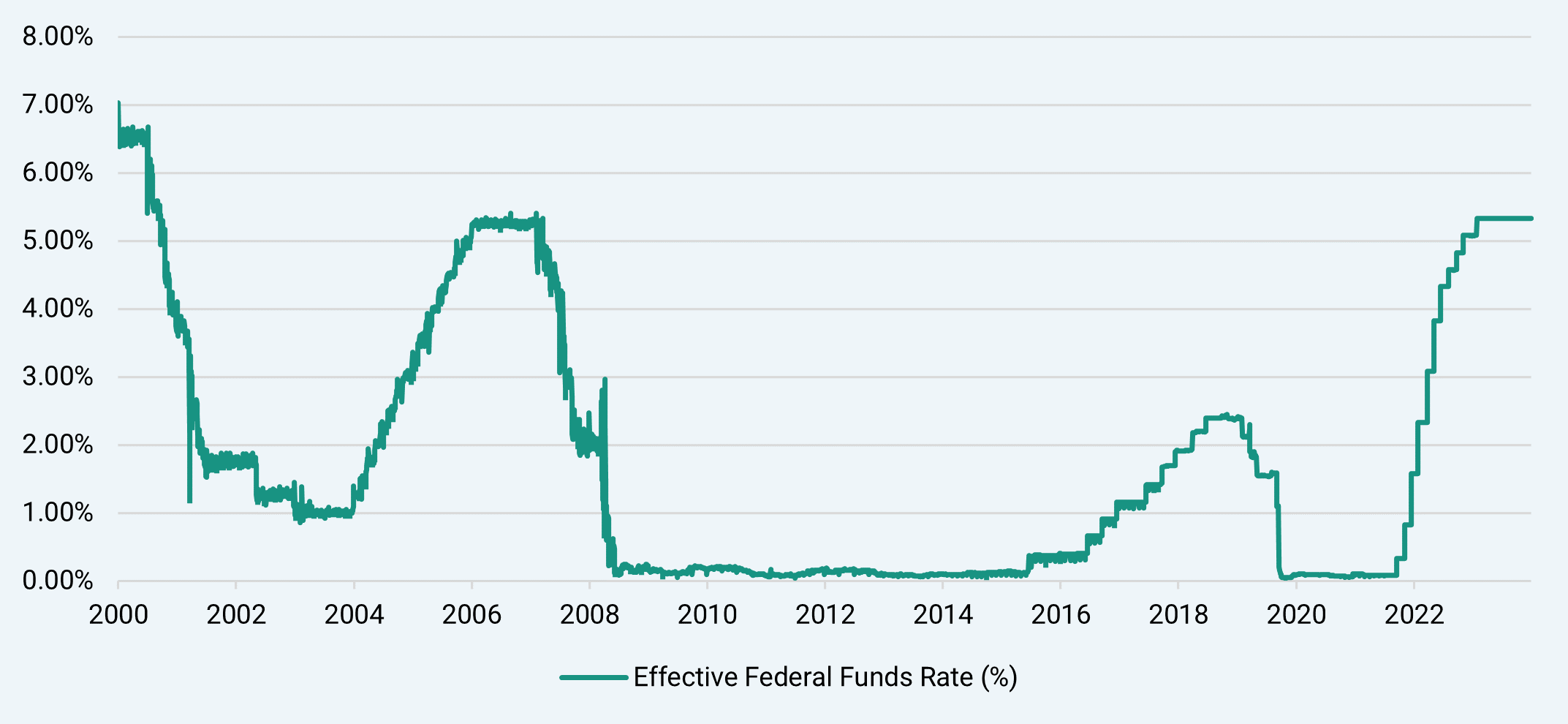

Since the Federal Reserve’s Federal Open Market Committee (FOMC) began increasing the federal funds rate in 2022, we have written about the topic frequently. The federal funds rate is the interest rate at which banks and other depository institutions trade federal funds with each other overnight. It serves as one of the few (yet effective) mechanisms that the Federal Reserve has at its disposal to execute its dual mandate of promoting maximum employment and price stability. The FOMC currently maintains the federal funds rate in its target range of 5.25% to 5.50% (the effective federal funds rate as of June 28, 2024, was 5.33%). As is shown in Chart 1, below, the federal funds rate is near its highest levels since the beginning of 2000.

Chart 1. Effective Federal Funds Rate, June 30, 2000, to June 30, 2024. Source: https://www.newyorkfed.org/markets/reference-rates/effr.

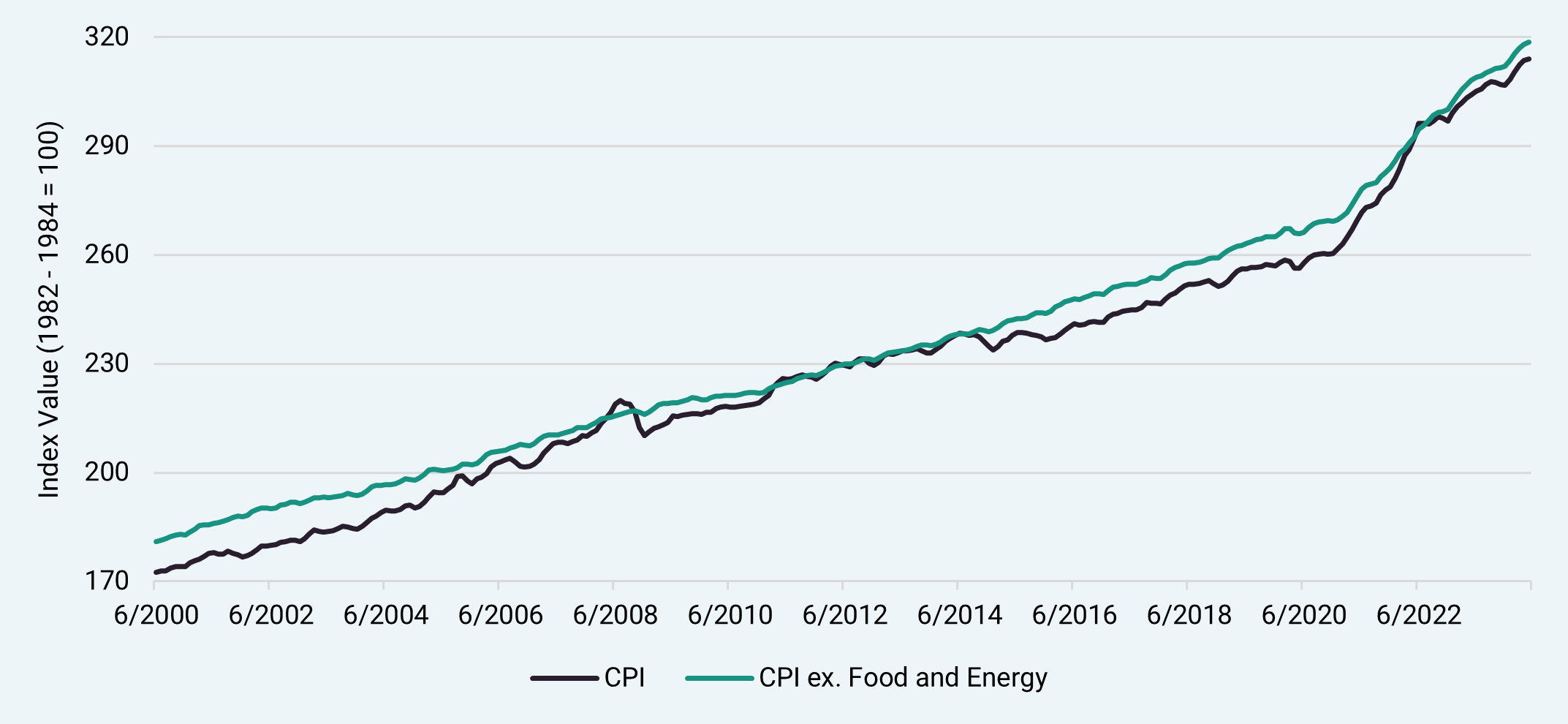

Many economic prognosticators have postulated that the federal funds rate will begin to decrease imminently, although this has been a familiar tune for the better part of the past year. However, much to the chagrin of economic participants ranging from small consumers to large corporations, inflation, as measured by the Consumer Price Index (CPI), has remained persistently high.1 We reference CPI both including and excluding food and energy prices when assessing the impact of inflation on our investment portfolios and the wider economy (each shown in Chart 2, below). On one hand, the notoriously volatile prices of food and energy introduce quite a bit of variability into this monthly measurement; on the other hand, both food and energy are essential and sizable categories of economic spending, over which consumers have little control in terms of the timing of purchase.

Chart 2. CPI for All Urban Consumers (CPI-U) (Unadjusted) and CPI-U/Less Food and Energy (Unadjusted), June 2000 to May 2024. Source: https://data.bls.gov/cgi-bin/surveymost?bls.

Inflation, although tempering, has remained persistently high, forcing the FOMC to maintain the federal funds rate (which serves as a basis for many other short-term lending rates) at current levels. Recent inflationary trends are both complex and perplexing, and we do not purport to entirely understand all the drivers of inflation (although neither do policymakers, otherwise we would hope monetary policy would have more effectively tamed inflation by this point2). We suspect unusually strong consumer demand and a very tight labor market (low labor availability) have contributed significantly to inflationary pressures.

Based on recent CPI readings that show inflation is approaching the FOMC’s target level of 2.00%, the growing consensus among investors is that the FOMC will cut the federal funds rate by twenty-five basis points (0.25%) one time during its four remaining meetings in 2024. Internally, we are of the view that monetary policy has lagged economic data: the FOMC was too slow to increase interest rates as inflation was spiraling out of control, and the FOMC will likely be too slow to decrease interest rates as inflation comes back under control. The implications of this are wide-ranging: overly restrictive monetary policy could lead to recession if the FOMC fails to adjust rates to match economic activity in a timely manner. We may also see a rash of corporate borrowing (or refinancing activity) as lower interest rates make debt financing more attractive, which could also lead to an uptick in corporate mergers and acquisitions. Absent a recession (the FOMC is aiming for a “soft landing,” or a gradual easing of interest rates that avoids causing economic contraction), we would expect equity markets to react favorably to lower interest rates as more corporate cash flows are redirected from interest expenses to other capital allocation alternatives (interest rates also factor into some equity valuation models, with lower rates accruing favorably to target valuations).

In summary, we expect easing inflation to lead to a lower interest rate environment; the timing and implications of this are all but certain. We have taken advantage of recent optimism to raise cash by reducing the size of some investment positions or exiting them altogether. We believe we are well-positioned to capitalize on opportunities that may arise, while remaining appropriately defensive and focusing on capital preservation in an uncertain environment.

Portfolio Update

We sense that most investors expect volatility in the markets for the remainder of this year in deference to the uncertain outcome and impact of political elections in the United States, the United Kingdom, and France, as well as geopolitical upheaval in other parts of the world and uncertainty around the impact of inflation and changes in interest rates in the United States and abroad.

While macroeconomic data and economic trends inform our investment analysis and positioning, the core of our investment discipline rests on fundamental financial statement analysis and our assessment of quantitative and qualitative idiosyncratic considerations regarding issuers of securities, be they debt or equity. However, due to our expectation of continued market volatility, we recently trimmed or exited positions where the price level was in close proximity to our appraised value or an increase in value resulted in the position being overweight in client portfolios. The sales made cash available for potential new investments in opportunities that arise as a result of ongoing economic uncertainty and continued market volatility.

In order to take advantage of opportunities presented when security prices experience increased levels of price volatility, our research team continually screens for new ideas and stays updated on companies that we believe possess compelling fundamental financial characteristics, but in which we have not yet invested because the relationship between price and value does not meet our internal criteria. Often, the window of time when a security’s price is significantly discounted relative to our appraisal of value is fleeting. This means we either need to: (1) perform exhaustive due diligence in a short period of time, or (2) have previously developed familiarity with the issuer of the security and be able to make a purchase decision as soon as the price reaches an attractive level. While our team maintains readiness to execute both approaches, we prefer the latter to the former. The more time we are afforded to fully develop an investment thesis and tease out potential “red flags,” the less prone we are to making investments that will not contribute to the long-term capital appreciation of client portfolios. Accordingly, in addition to reviewing current investments, our research team has been hard at work surfacing new investment opportunities and continues to see many.

Active Engagement

We have long held that “active engagement” is critical in achieving investment excellence. For GVIC, active engagement has taken many forms over the years. In its simplest application, active engagement means studying a business and speaking with senior management in order to establish a dialogue between the company’s owners (shareholders) and its operators (management); we do this for each of the companies in which we invest, and we believe such active engagement allows us to develop an information advantage that translates into superior investment returns over time.

But active engagement has taken, and will continue to take, many forms. We recently defined a spectrum of active engagement and wrote about its various forms and benefits in a piece entitled “Bridging the Value Gap – Powering Value Investing through Active Engagement,” which can be found on our website.3 We also held a roundtable discussion moderated by Eric Savitz, Associate Editor of Barron’s, to discuss the topic of active engagement. Panelists included Mark Harris, the chief financial officer of Heidrick & Struggles International, Inc., Doug Schnell, an attorney in the corporate law practice of Wilson Sonsini Goodrich & Rosati, and JP Geygan, the chief executive officer of Global Value Investment Corporation. The roundtable discussion was webcast live and recorded, and is also available on our website.

From Our Library

We recently completed Thinking Fast and Slow by Daniel Kahneman, in which Kahneman challenges assumptions about human behavior and offers insights into decision-making patterns. Near the end of the book, Kahneman makes the following statement, that all investors would do well to heed:

Closely following daily fluctuations is a losing proposition, because the pain of the frequent small losses exceeds the pleasure of the equally frequent small gains. Once a quarter is enough, and may be more than enough for individual investors. In addition to improving the emotional quality of life, the deliberate avoidance of exposure to short-term outcomes improves the quality of both decisions and outcomes.

We understood Kahneman’s point as something like “the more frequently an investor revalues his or her portfolio, the more likely it is he or she will be overly influenced by negative events, even if the investments as a whole are performing well.” It is human nature to linger on the negative consequences one has experienced regardless of how well one’s portfolio does.

Some participants in the investment industry continue to incentivize investors to take action of any sort with regard to their portfolios through the constant use of updates, alerts, and notifications seeking to engage an investor with the unspoken intent of gamifying investing (i.e., incentivizing more frequent trading). Interestingly, there is quite a bit of money to be made by certain firms through this churn. One would be wise to pause and assess the merits of making frequent changes to one’s portfolio, and the motives of anyone suggesting that “more is always better.”

Firm Update

As we previously announced, Jeff Geygan recently took a leave of absence from his position as CEO and president of GVIC to accept the role of interim CEO at Rocky Mountain Chocolate Factory, Inc. (Nasdaq: RMCF), a company in which we have invested in client portfolios. In accordance with GVIC’s business continuity plan, JP Geygan transitioned from his role as COO to interim CEO and president of GVIC. Jeff will remain in his position as GVIC’s board chairman, and will continue to be accessible to clients in this role. We have been deliberate in designing our firm’s structure and memorializing our investment discipline in preparation for such transitions. Our robust contingency and succession planning has been practiced and refined over many years, so that services to our clients are minimally disrupted when such changes occur.

Satendar Singh and JP Geygan both celebrated their seven-year anniversaries with the firm this quarter! Each has played an integral role in helping drive the continuous improvement of our research process. Please join us in congratulating JP and Satendar!

We are excited to continue expanding our client base through a combination of referrals from existing clients and outreach efforts. We recently onboarded several new institutional clients, and we look forward to growing with them for many years to come.

Finally, earlier this year, we began working with an external consultant to solicit client feedback and help us objectively codify our firm’s distinctive approach and founding principles into clear, easy-to-articulate messaging. We are also refining the firm’s logo and graphics to contemporize and standardize how we present ourselves across a variety of media and communications channels. This has been a rewarding introspective exercise, and we look forward to your thoughts and feedback as we publish new content and expand our marketing materials based on this work.

Concluding Thoughts

If you’ve had changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can adjust your portfolio to more appropriately align with your current circumstances.

Thank you for your ongoing confidence.

Your Investment Research and Advisory Team

Global Value Investment Corporation

- CPI, published by the Bureau of Labor Statistics, is our preferred measure of inflation, and that of most market participants. The FOMC gauges inflation using the personal consumption expenditures price index, published by the Bureau of Economic Analysis. For a brief but informative discussion on the differences, see the following article by former President of the Federal Reserve Bank of St. Louis James Bullard: https://www.stlouisfed.org/publications/regional-economist/july-2013/cpi-vs-pce-inflation–choosing-a-standard-measure. ↩︎

- This is well-established; Chair of the Federal Reserve Jerome Powell admits as much as recently as June 12, 2024, in his comments following the conclusion of the FOMC meeting held on June 11 and 12. A transcript of his remarks can be accessed here: https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240612.pdf. ↩︎

- https://gvi-corp.com/bridging-the-value-gap-powering-value-investing-through-active-engagement/ ↩︎