Preparing for Uncertainty After a Year of Market Resilience

2024 Q4

Economic and Market Overview

The closing months of 2024 capped an unusual and complex year. In the United States, perhaps the most atypical political election cycle in recent memory with the election of Donald Trump as the 47th President of the United States on November 5. On the international geopolitical front, conflicts continued in the Middle East and Ukraine, with wide-ranging ramifications on the global stage. Economically, the S&P 500 index finished the year with a return of 23.3% – the second consecutive year in which the index advanced at least 20% (a milestone that had not occurred since 1997-1998). While we believe that a calm, patient, and opportunistic approach to investing can allow one to achieve superior long-term investment returns through market cycles, we are cautious of heightened market risks and global economic divergences.

The 2024 US presidential election was top of mind heading into the final quarter of the year for management teams and investors alike. The outcome of a national election is almost always uncertain; with uncertainty comes risk, and with risk comes price volatility. Accordingly, throughout 2024 we seized opportunities to trim or sell outright investments that approached our appraisal of fair value. The cycle of patiently buying undervalued securities and selling such securities at fair value (or better) aptly summarizes our charge in every market environment, but this year we took a slightly more proactive stance.

While investors’ initial reaction to November’s election results was positive, we will we continue to analyze each portfolio company on a standalone basis, with a keen eye towards effects of the policies of the incoming administration.

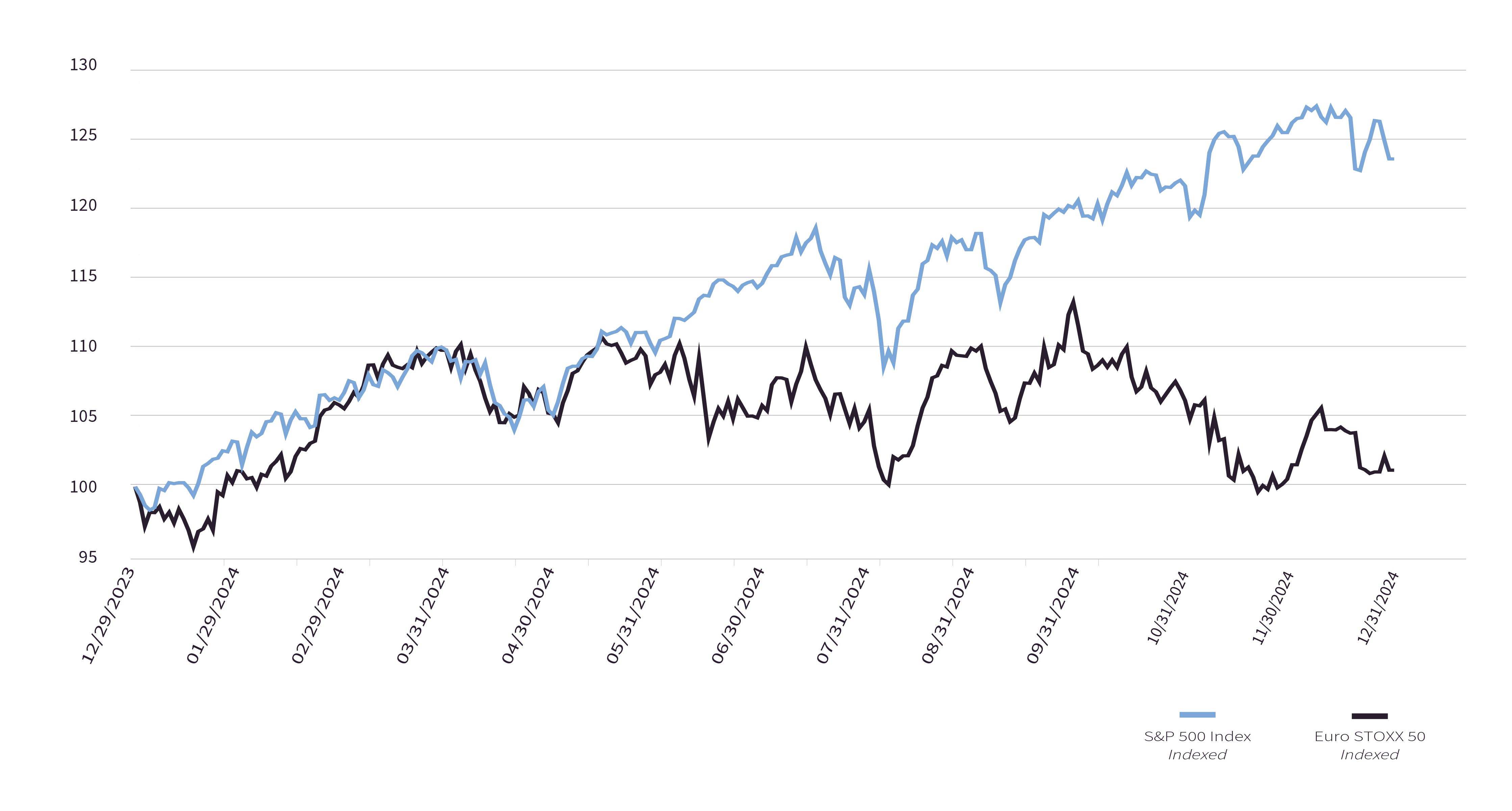

In our third quarter letter, we highlighted diverging global monetary policy by examining the balance sheets of four central banks: the Federal Reserve Bank, European Central Bank, Bank of China, and Bank of Japan. We observed tightening monetary policy through balance sheet asset reductions in the United States and Europe, but loosening monetary policy through balance sheet asset growth in China and Japan. As 2024 draws to a close, we have taken note of further geographical divergence, this time in equity market performance between the United States (as measured by the S&P 500 index) and Europe (as measured by the EURO STOXX 50 index). Interestingly, this is occurring in similar monetary policy environments. Chart 1 (below) shows the performance of each of these indices, indexed to a value of 100 at the close of trading in 2023 (1).

Chart 1: S&P 500 vs. EURO STOXX 50, trailing one year, indexed to 100. Source: FactSet Research Systems

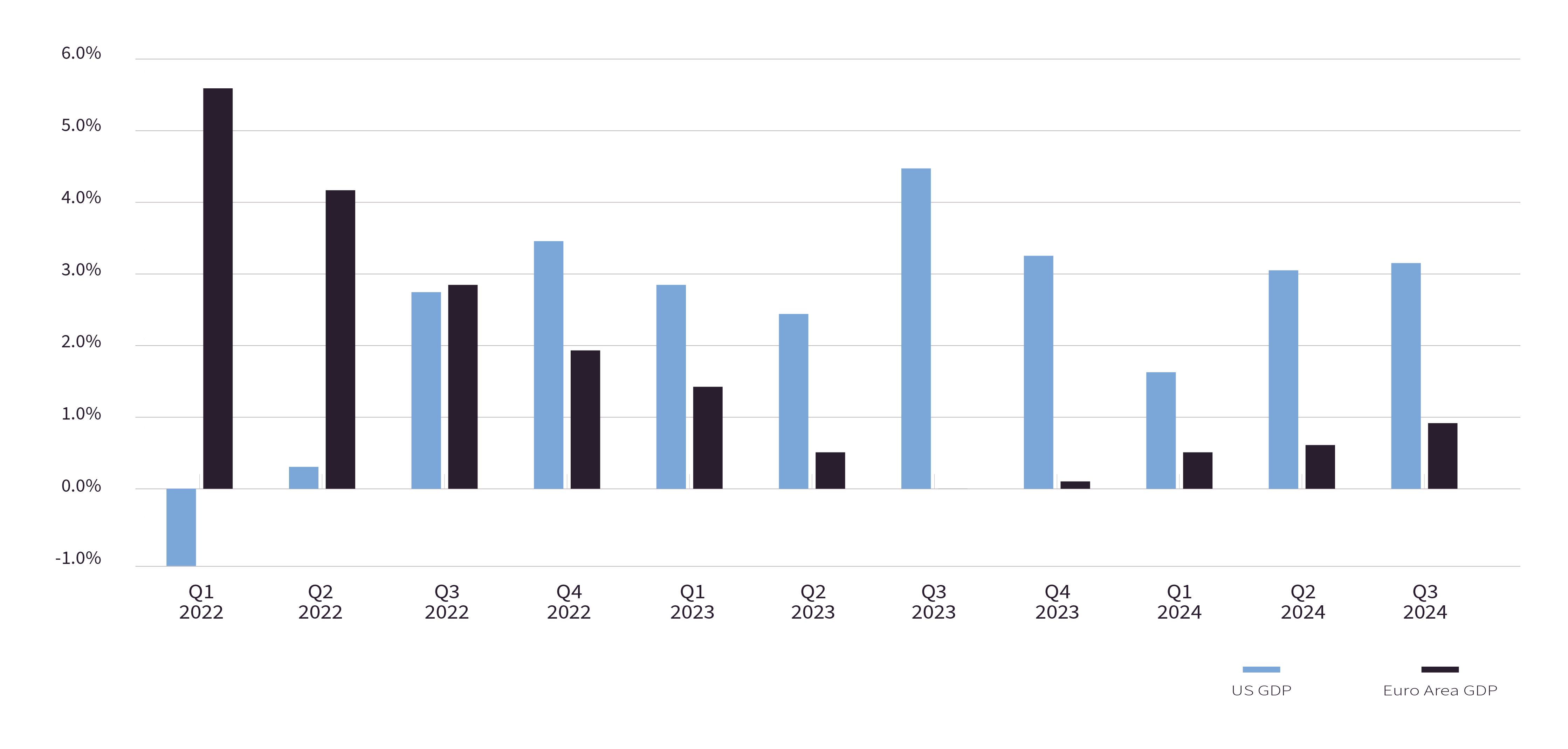

While stock market constituents can disproportionately weigh on index performance, we generally consider such headline indices as rough barometers for actual economic activity and investor sentiment. Turning to gross domestic product in each economy, the growth of which is shown in Chart 2, it becomes apparent that European equity index performance mirrors stagnant economic activity, while economic fortunes in the United Sates have proved surprisingly resilient, as reflected in the performance of the S&P 500 this year.

Chart 2: US GDP and Euro Area GDP, Q1 2022 – Q3 2024. Source: US Bureau of Economic Analysis; Eurostat

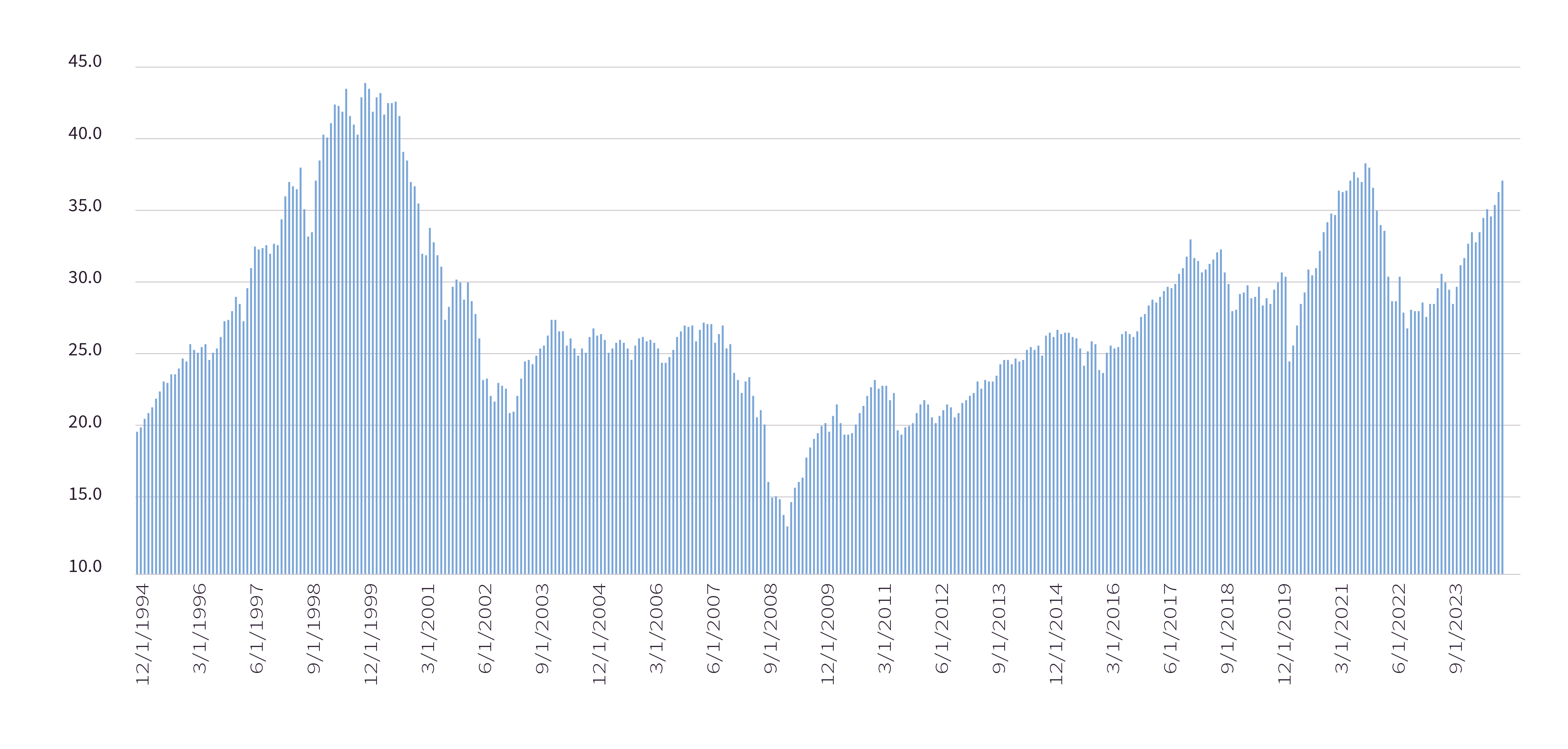

Our analytical assignment becomes significantly more challenging when we pivot from understanding the past to determining how to position investment portfolios for the future. Many attempt to speculate on complex market and economic systems that we believe defy forecasting (indeed, this forms the basis upon which we approach investing: we commit capital to individual businesses that we can analyze and understand, rather than speculating on market momentum or other such ethereal market “factors”). Nevertheless, we monitor numerous macroeconomic indicators and market measurements to inform our understanding of capital market conditions. One such valuation measurement is the cyclically adjusted price-to-earnings ratio (2), often abbreviated as the “CAPE” ratio, and frequently referred to as the “Shiller P/E” after its inventor, economist Robert Shiller (3). The CAPE ratio measures the aggregate price of each of the constituents of the S&P 500 index, divided by sum of the average annual earnings per share over the past 10 years, adjusted for inflation.

We consider the CAPE ratio an indicator of market valuations relative to normalized earnings. Below, we chart the monthly CAPE ratio over the past 30 years (see Chart 3). During the trailing 10-, 20-, and 30-year periods, the CAPE ratio has averaged 30.4, 26.7, and 28.0, respectively. As of November 2024, it was 37.4. While this is not a screaming indicator of overpriced markets, the elevated current measurement relative to historical averages represents heightened risk of a broad market correction, in our opinion.

Chart 3: CAPE ratio, 1994-2024. Source: https://shillerdata.com/

Sir John Templeton famously said, “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” The determination of where we are in this bull market cycle can only be made retrospectively, and current uncertainty highlights the importance of astute and active management of investment assets. We are comfortable with the return potential of each investment held in client portfolios, and the risk we assume in order to gain exposure to such return potential; we will continue to be judicious in managing this relationship.

Portfolio Update

In our last quarterly letter, we highlighted that management teams were generally cautious about the closing months of 2024, with most pointing to the pending US presidential election. Although that election has come and gone, caution is dissipating at a slower pace, particularly regarding large capital projects and guidance for future financial performance. We believe this reveals a persistent underlying uncertainty regarding fundamental business developments that had little to nothing to do with the election.

While we would be foolish not to consider the impact that a change in federal policy could have on a company, we prefer to invest in companies that are “masters of their own destiny.” We look for companies with strong balance sheets, attractive fundamental financial characteristics, and nimble management teams that can assess and appropriately react to changing business conditions. Thus, our conversations with companies continue to center around capital allocation, the quality of management’s decision making, and sound corporate governance practices. In any market environment, these considerations are cornerstones of our investment theses and important drivers of long-term value creation.

We recently invested in the equity of SpartanNash Company (SPTN), which embodies these principles. SPTN owns and operates retail grocery stores, and distributes grocery products to wholesale customers. As of October 5, 2024, the company owned 147 retail stores in the Midwest, primarily under the banners Family Fare, Martin’s Super Markets, and D&W Fresh Market. SPTN’s distributed products include produce, nationally branded goods, and the company’s private label brand, Our Family. We first considered an investment in the company in June 2024 and took the balance of the year to rigorously evaluate the company’s fundamentals and speak to its management team on multiple occasions. After we were satisfied with our findings and discussions, we had the necessary conviction to make an investment in the company. We look forward to future engagement with management and monitoring the company’s progress against its strategic plan.

Finally, members of our research team habitually engage in casual, but stimulating, conversations with clients, management teams, family, and fellow investors alike about a myriad of topics. However, it is with increasing frequency that members of our team get to share their more serious thoughts on a global stage, as was the case in October when portfolio manager JP Geygan participated in the investors’ perspective panel at the 16th annual Capital Link Maritime Forum in New York City. This is the second consecutive year that JP has been invited and participated in the investors’ perspective panel. We encourage you to watch the conversation to gain insight into our firm’s thoughts on the shipping landscape and how our position compares to that of other investors. The video can be found here.

From Our Library

In November, we completed our reading of Competition Demystified by Bruce Greenwald. In the closing chapters of the book, we were struck by the following statement:

Even though investment decisions are generally strategies by anyone’s definition of them, the financial analysis employed to support these decisions generally ignores strategic issues…Given these difficulties (in assessing input values for different variables), it is not surprising that strategic insights are rarely integrated effectively into the investment decision process. Yet omitting an examination of the competitive environment simply because it cannot be neatly incorporated into a financial model ignores crucial information and impairs the quality of the analysis.

Greenwald’s words serve as a valuable reminder for all investors to avoid the trap of relying solely on quantitative analysis. We are firm believers that a company’s financial statements, while serving as the bedrock upon which our analytical process rests, only tell part of the story. By diligently evaluating strategic considerations, often garnered through our conversations with management teams, we believe we can make more informed decisions, enhance our understanding of a company’s intrinsic value, and improve our chances of achieving long-term investment success.

Firm Update

Please join us in welcoming Be Emesal and Kristin Mastantuono, the newest employees of GVIC, who both joined the firm in early November.

Be joins our team as an investment research analyst, bringing impressive experience in investigative journalism, military public affairs, corporate communications, and SaaS marketing. She and her family reside in western Colorado.

Kristin joins us as the firm’s marketing director, having ten years of previous experience in various marketing specialist and director roles at other companies in the past. In addition to her comprehensive knowledge of marketing, she is trained as an audio engineer. Kristin recently completed the relaunch of GVIC’s website, which we encourage you to explore.

We have begun updating the process by which we develop and update client investment objectives, so that we may be more responsive to your evolving financial needs. We will be reaching out over the course of this year to confirm our understanding of your financial situation and adjust your investment objective if necessary.

Finally, we continue to expand our client base through a combination of referrals from existing clients and ongoing outreach efforts. Thank you for many introductions to some truly wonderful people over the past year!

Concluding Thoughts

If you’ve had changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can adjust your portfolio to more appropriately align with your current circumstances.

We pride ourselves on always being accessible to our clients. Should you have questions about specific investments, our market outlook, or anything else regarding your accounts or financial circumstances, we welcome the opportunity to chat. We will continue to be prudent and patient in deploying capital, always remembering that the assets we are entrusted to manage often represent a lifetime of hard work. We are thankful for your ongoing confidence in GVIC.

Your Investment Research and Advisory Team

Global Value Investment Corporation

- The relative underperformance of European equities has compelled us to concentrate more analytical efforts on potential European investments. While we expect the majority of client portfolios to be invested in domestic securities (that is, securities issued by corporate entities domiciled in the United States), we pride ourselves on our ability to invest globally (true to our name, Global Value Investment Corporation). Investing internationally demands additional due diligence, including developing an appreciation of local corporate culture, evaluating the regulation and oversight of issuers and markets, examining corporate governance rules and practices, understanding accounting and auditing standards, and conducting site visits where appropriate.

- We generally avoid use of a price-to-earnings ratio, or “P/E,” in our analytical processes, as in its simplest (and most commonly employed) form, it largely ignores the effects of capitalization on valuation. We prefer measuring enterprise value, or the implied valuation of a company by combining the net book value of its interest-bearing liabilities, the public market value of its equity securities, and other (often-minor) adjustments.

- Dr. Shiller is a professor of economics at Yale University and the author of Irrational Exuberance, a respected work on economic bubbles. Dr. Shiller maintains a list of relevant publications, as well as links to his other work, on his self-curated Yale University website, http://www.econ.yale.edu/~shiller/online.htm