Investment Philosophy

Six core tenets constitute GVIC’s investment philosophy. These principles color our discipline, process, and analytical thinking.

Short-Term Market Inefficiencies Create Opportunity: We believe that short-term marketing pricing can be inefficient. We attribute discrepancies between price and intrinsic value to factors that are transient or misunderstood by market participants, and we expect price to align with intrinsic value in the long-term. We seek to arbitrage these opportunities by identifying securities where there is a severe dislocation between price and intrinsic value.

A Long-Term Horizon is Critical to Consistent Long-Term Performance: Patience is rewarded as price and intrinsic value can take time to align. While we are cognizant of “value traps,” we also realize that value-creating initiatives bear fruit over periods measured in years.

Rigorous Fundamental Analysis Based on Value-Oriented Investment Principles Underpins Our Process: A thorough understanding of a company’s financial statements, achieved through a disciplined approach to quantitative analysis, is a critical foundation upon which the wholistic understanding of an investment’s merits is built.

People Run Businesses: While quantitative analysis provides a framework for valuation, qualitative considerations are equally important. We place great weight on understanding the people in charge of operating the businesses in which we invest, as well as understanding other non-quantitative factors that could impact an issuer’s financial performance.

Capital Should be Concentrated in a Limited Number of High-Conviction Investments: Our superior understanding of the investments included in client portfolios represents a significant information advantage. Therefore, we aspire to construct portfolios consisting of a small number of high-conviction investments that allows us to devote an outsized amount of time to understanding and enabling the determinants of long-term value realization.

Operational Engagement Can Catalyze Value Creation: If the financial performance of an investment falls short of our expectations, we can employ several strategies to catalyze the realization of an investment’s intrinsic value.

Investment Discipline

Our investment discipline is the manifestation of our investment philosophy, and describes how we approach investing in equity and debt securities. Although our analytical processes are similar, each of equity and debt requires unique consideration of an owner’s rights and claims.

Equity

Fractional ownership interest in an operating business; we evaluate as perspective of owners of the entire enterprise

Businesses have value insofar as they generate cash flows or own assets that can be monetized for the benefit of the business’s owners

Analytical process marries qualitative and quantitative considerations, and valuation is based on a methodology consistent with a business’s economic characteristics

Debt

Contractual claims on the cash flows and/or assets of a business

Analytical process focuses on a company’s leverage and interest coverage, with additional consideration paid to the durability of cash flows, the value and marketability of a company’s assets, and management’s approach to controlling leverage

Bond indentures and the rights and recourse available to bondholders are examined

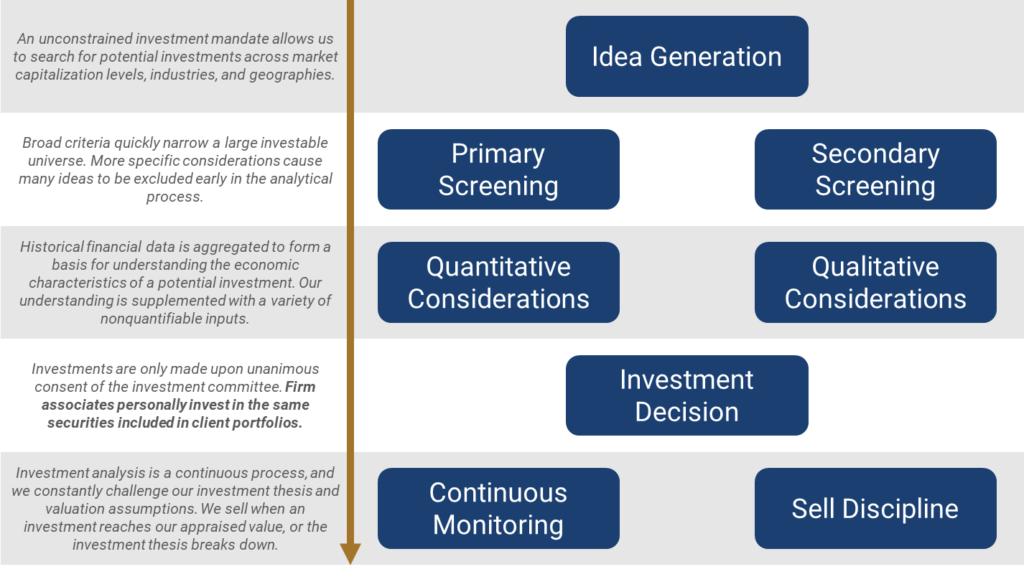

Investment Process

Our investment analysis process represents the implementation of our investment discipline. Investment analysis involves several quantitative and qualitative processes and considerations, and is guided by internally developed checklists that provide a framework for our thinking.

Global Value Investment Corp. claims compliance with the CFA Institute Code of Ethics and Standards of Professional Conduct. This claim has not been verified by CFA Institute.

Global Value Investment Corp. claims compliance with the CFA Institute Asset Manager Code. This claim has not been verified by CFA Institute.