January 2021

2020 will be a year to remember for its antithetical extremes. As the year concluded, the world celebrated as several new vaccines were developed to address the misery caused by the COVID-19 pandemic. In addition, the long-awaited Brexit transition was completed, and the US was preparing for a transition of the Presidency. All of these events contributed to extreme volatility in the capital markets during 2020 and impacted our lives very directly.

We are grateful to report we avoided any serious COVID related illness and happy that all of our associates and their family members remain in good health.

By year-end, the economy was vastly improved over its very erratic performance in Q2 and Q3 caused by economic lockdowns and other measures designed to mitigate the impact of COVID. As we exited the year, unemployment rates, although improved, were still elevated. Government debt levels had skyrocketed around the world, setting the stage for potential financial strain in the years ahead. Global commerce had picked up, but remained far below pre-COVID levels. Throughout the year, the ways in which we worked and socialized were altered.

For example, nearly everyone has learned how to conduct a video call (“Zoom” seems to be the favorite brand-turned-household name to have emerged). The virtual space has become a common medium in education and commerce as schools and businesses quickly adapted to this new paradigm. To be sure, we are social creatures and need to interact with others, but during this truly unprecedented period, people rose to the occasion and adjusted to a new normal. Without a doubt, our lives will be forever changed by the events of 2020.

We anticipate the year ahead will be filled with continued uncertainty as we navigate into a post-COVID world with far higher levels of public debt than anyone should be comfortable. During this extended period of low interest rates, our country will have an opportunity to get its finances in order, but this will take time and require strong leadership to bring government spending back in check while reducing debt.

In the short term, we remain alert for investment opportunities in the face of potential future price variability and economic uncertainty. In the long term, we continue to be very constructive as we foresee increased global economic growth and prosperity.

Portfolio Update

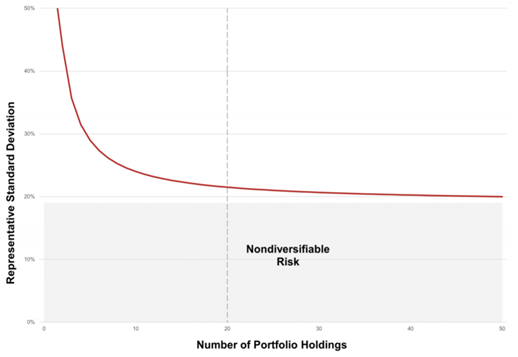

Most of our clients have seen this graph on diversification risk based on the groundbreaking 1977 work by E.J. Elton and M.J. Gruber. A version is referenced below:

The curved red line illustrates the amount of risk (represented on the vertical axis) attributable to diversification or lack thereof (represented on the horizonal access). Some risk can be “diversified away” by adding additional holdings to a portfolio (moving from the upper left with high risk, to the lower right with reduced risk). The grey shaded area represents the amount of risk that is inherent in an investment portfolio; that which cannot be diversified away. As the graph illustrates, at 20 holdings, roughly 95% of risk mitigation through diversification has been achieved, i.e. adding one more holding has a diminishing impact on risk reduction.

Our firm targets 20 equity holdings in fully invested equity portfolios. We believe holding twenty stocks allows us to prudently manage diversification risk without diluting our ability to gain an in-depth understanding of each company we hold. The amount of diversification in debt holdings, due to the nature of bond risk, is even lower. We target 10 debt positions in fully invested fixed income portfolios.

Further to this point, the average stock mutual fund today holds approximately 165 issues. To charge a portfolio manager with knowing 165 issues in great detail is an impossible assignment, even for an investment genius. Some bond funds hold more than a thousand positions from hundreds of issuers. There simply is not enough time in a day, week, or month.

We believe our concentrated holdings constitute a competitive advantage. We are able to dedicate far more time to knowing each of our holdings than those who have “diversified their risk,” giving us an information edge that should translate into superior performance over time.

To wit, when speaking with company management, we are often told “you are among our most informed shareholders.” Virtually every calendar quarter we spend an hour speaking with company management about the quarter’s results, the company’s financial statements, its financial condition, and strategic updates. In so doing, we are continuously able to reconfirm and update our investment thesis while gaining incremental understanding of the company and how management thinks about business strategy and operations.

We cannot emphasize enough the value of our interactions with company management. The qualitative knowledge we gain through these interactions is of immeasurable value. Keep in mind, all investors have access to the raw numeric data which is broadly disseminated by companies to all market participants at nearly the same time, so possessing quantitative information no longer provides a competitive advantage. It is the insights and perspectives garnered during interpersonal communications with management that become our competitive advantage when evaluating an investment opportunity.

By holding a concentrated number of issues, we discipline ourselves to investing only in our very best ideas. At no time do we add a holding because we feel a need to “fill out” a portfolio or add weight to a particular sector or industry group. The only time we invest is when we have identified a company that provides above average investment return potential. Due to our rigorous research and investment selection process, we end up owning companies that constitute our best ideas.

A June 30, 2020 working paper released by Harvard Business School entitled Best Ideas reinforces our long-held belief that investing in a limited number of high-conviction holdings produces above average returns over long time periods.

The Best Ideas working paper states:

We show that under realistic assumptions, investors can gain substantially if managers choose less-diversified portfolios that tilt more towards their best ideas.

Both theory and evidence suggest that investors would benefit from managers holding more concentrated portfolios.

We believe the depth of company-specific knowledge possessed by an investor creates an inherent advantage when it comes to arriving at an accurate appraisal of value. Our research process and portfolio management structure are designed to create an environment enabling us to anticipate a company’s future developments such as acquisitions, key marketing initiatives, product development, senior management change, and a host of other relevant factors that inevitably impact shareholder value creation and stock price. Our research and investment process continues to evolve and adapt to the ever-changing world of finance in which we operate.

From Our Library

Our firm recently finished reading Against the Gods, The Remarkable Story of Risk by Peter Bernstein. We are now reading The General Theory on Employment, Interest and Money by John Maynard Keynes. In contrast, we will follow Keynes with Capitalism and Freedom by Milton Freedman.

Our firm culture embraces continuous learning. One way we ensure this is by filling our minds with new and challenging ideas. Each associate will inevitably be impacted in different ways through his or her impressions and insights from these readings. We gather each week for an hour to review the recent reading assignment, sharing thoughts and ideas about the chapters under review.

Over the past five years, we have read dozens of books on investing and related subjects, always with an eye toward advancing our cultural objective of continuous learning. Ralph Waldo Emerson is credited for having said, “the mind, once stretched by a new idea, never returns to its original dimensions.”

In each of our quarterly client letters we share the title of the book we are reading and an interesting paragraph or two to give you a flavor for the theme and relevant points. We will continue to do so.

From Bernstein’s book, which dealt with the evolution of thinking on the subject of risk and volatility, we leave you with the following thoughts that tie back to this letter’s theme:

Although diversification has never lost its importance, professional investors recognized some time ago that it was both inadequate as a risk-management technique and too primitive for the new environment of volatility and uncertainty.

Volatility fails as a proxy for risk because volatility per se, be it related to weather, portfolio returns, or the timing of one’s morning newspaper delivery, is simply a benign statistical probability factor that tells us nothing about risk until coupled with a consequence.

Volatility represents opportunity rather than risk, at least to the extent that volatile securities [stocks and bonds] tend to provide higher returns than more placid securities.

Firm Update

In order to build a stronger, more enduring organization, at year end the firm added two new executive roles: JP Geygan was promoted to Chief Operating Officer (COO) and Senior Vice-President; Stacy Wilke was promoted to Chief Financial Officer (CFO) and Senior Vice-President. Jeff remains the Chief Executive Officer (CEO) and President. Formally establishing the offices of COO and CFO advances our hundred-year business plan and further solidifies our continuity of transition.

2021 will be our fourteenth year in business. The firm remains strong and in an excellent position. We have been very fortunate to attract highly talented associates to both our US and Indian businesses.

Concluding Thoughts

We continue to work diligently to identify attractive investments. After an extremely profitable year, we are finding fewer interesting investments due to a general rise in asset prices which have advanced in anticipation of a post-COVID economic rebound.

Thank you for trusting us to be prudent stewards of your capital, particularly throughout this challenging period.

Your Investment Research and Advisory Team

Global Value Investment Corp.

This document is published by Milwaukee Institutional Asset Management (MIAM), a division of Global Value Investment Corp. (GVIC). MIAM is the institutional investment advisory division of Global Value Investment Corp., providing investment advisory services to institutional investors including Registered Investment Advisors and Broker-Dealers. All statements or opinions contained herein are solely the responsibility of Milwaukee Institutional Asset Management. The material, information and facts contained in this report were based on publicly available information about the featured company and were obtained from sources believed to be reliable but are in no way guaranteed to be complete or accurate. This report is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. Employees of GVIC may have positions in securities referenced in this report. ‘Intrinsic’ or ‘Appraised’ value refers to MIAM’s quantitative and qualitative assessment of the value of an enterprise. Market capitalization is a measure of the total dollar market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current quoted share price. MIAM’s investment strategies generally invest in a smaller number of securities than some other strategies. The performance of these holdings may increase the variability of a strategy’s return. There is no assurance that dividend-paying stocks will reduce price variability. Value investments are subject to the risk that their intrinsic value may not be reflected in market prices. For purposes of distribution in the United States, this report is prepared for persons who can be defined as “Institutional Investors” under U.S. securities regulations. Any U.S. person receiving this report and wishing to affect a transaction in any security discussed herein must do so through a U.S. registered Broker-Dealer. Neither Global Value Investment Corp. nor Milwaukee Institutional Asset Management is a registered Broker-Dealer.

An investor should consider a strategy’s investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Firm’s SEC form ADV Part II. To obtain a copy of GVIC’s ADV Part II, call 262-478-0640 or visit www.gvi-corp.com. Please read the ADV carefully before investing.

Additional information is available upon request.

No part of this document may be reproduced in any form without the express written consent of GVIC. Copyright 2023. All rights reserved.