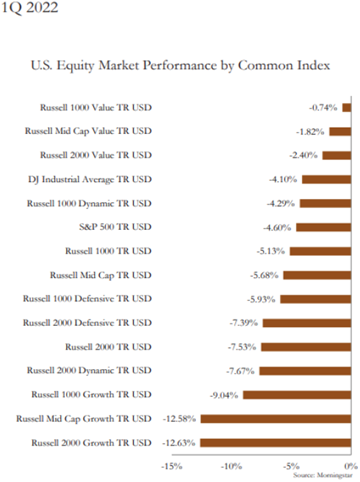

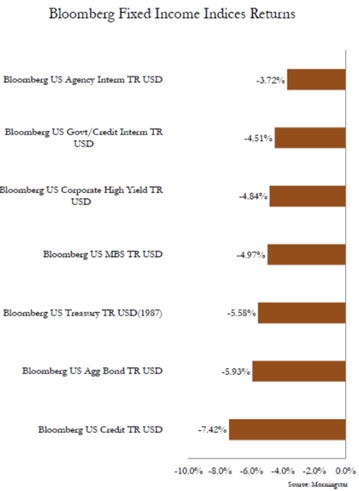

The year is off to a solid start for Global Value Investment Corp. despite chaos in Eastern Europe and an elevated level of inflation in the US and abroad. Every major stock and bond market index is lower year-to-date through March 31. GVIC’s Total Return Value Strategy, Concentrated Equity Strategy and Focused Fixed Income Strategy – are all in positive territory.

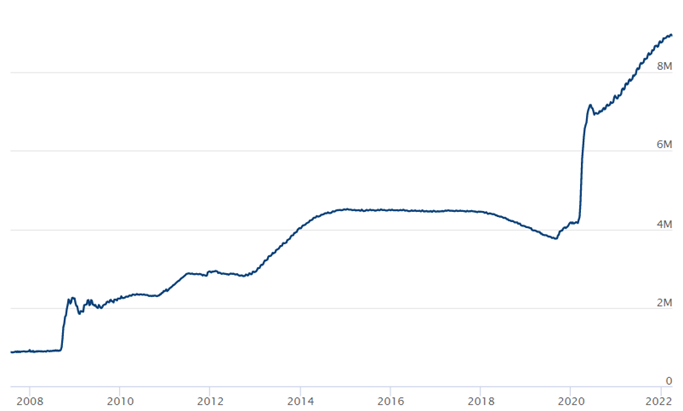

As expected, the Federal Reserve Bank has signaled through its Open Market Committee they will be taking proactive action soon to address an overheated economy and elevated levels of inflation. This will be in the form of increased interest rates (the Overnight Fed Funds rate dictates short-term interest rates) in addition to a reduction in Quantitative Easing (QE), which has been an ongoing policy tool used by the Fed since 2009. This new phase of Fed monetary policy is known as Quantitative Tightening (QT) and will include the rolling off of maturing bonds and the outright sale of longer-dated bonds held on its balance sheet.

The Federal Reserve has balance sheet assets of $9.1 trillion. To put this in perspective, before the first series of QE occurred in 2009, the Fed’s balance sheet was around $800 billion. When the Fed took its first pause from QE in 2018, balance sheet assets had expanded to just below $4.5 trillion. Covid-19-induced resumption of QE policy more than doubled its size to over $9 trillion (see below).

The Fed primarily owns US Treasury Bonds and US mortgage-backed securities (securitized home mortgages). The rationale for the Fed to be a buyer of these debt securities is to allow it control of long-term interest rates. Keep in mind, the Fed’s traditional policy tools only allow it to set overnight rates. All other rates are traditionally determined by market demand. With the Fed becoming an outsized buyer of bonds, it has been able to manage interest rates and borrowing costs. Consequently, money has become available at unusually low rates, which has created additional demand, spending, and investment — “Fed Induced” economic expansion. This policy tool, known as Quantitative Easing, worked beautifully for many years. Now, however, we expect the inverse: as the Fed begins rolling-off and selling bonds, it will cause excess supply. This should cause higher interest rates, which will stymie spending and borrowing and may cause economic contraction. This is Quantitative Tightening.

The Federal Reserve Bank has a dual mandate per its charter: 1) maximum sustainable employment, and 2) price stability. Currently, the rate of employment is near record levels, with 96.4% of the labor force employed (or put another way, an unemployment rate of just 3.6%). Thus, the Fed’s first mandate is currently achieved. Until recently, the Fed had kept prices quite stable with inflation floating around 2% for nearly a decade. Recent global events related to the Covid-19 pandemic and global trade flows, in conjunction with governments around the world providing large economic stimulus programs, prompted an upward spike in inflation. The US consumer price index (CPI), a broad gauge of inflation, has recently been running above 7% as shown below — a perilously high rate. With the Fed’s second mandate in mind, the central bank board has begun to take aggressive action to curb inflation, including short-term interest rate increases and Quantitative Tightening.

The implication of this policy has far-reaching effects. At GVIC, we invest in both equity (stocks) and debt (bonds), each of which responds in unique ways to inflationary pressures and rising interest rates. We view the recent elevated inflationary pressure as being transitory in nature. As such, we have taken defensive actions to preserve capital during this period, while remaining alert to investment opportunities that may arise regardless of the duration of the current status quo. We wrote about impending inflationary pressures in our prior quarterly letters to clients. Our concern has proven to be warranted, leaving us well positioned.

At the time of our last writing, the 10-Year US Treasury bond was trading to yield 1.85%. Today, it yields 2.70%. Several Fed Open Market Committee members have made comments suggesting they may raise rates another 2.00% before pausing, leaving the 10-year bond at an estimated 4.00-5.00% level.

It’s difficult to handicap how stock and bond prices will respond to the challenges ahead, but in every economic cycle there are pockets of opportunity. We will remain alert as we navigate one day at a time and seek interesting and compelling situations in which to commit capital.

Portfolio Update

The research team at GVIC constantly seeks new and attractive investments in both the stock and bond markets. They are committed to managing our current holdings, which includes an ongoing, comprehensive analysis of each company’s financial reporting and other news and events.

In past letters, we’ve described our investment process in detail. We begin with a large universe of companies, distill out the best investment opportunities, and then invest. A fully invested stock portfolio will hold roughly 20 securities.

Some of those investments will significantly outperform our expectations, rising to values multiple times over the original cost. Others will provide adequate returns. And alas, a few will disappoint. At the time of purchase, our team has a high level of conviction in each position, or we would not make the investment. Over years of experience, we know, despite our best intentions, we will pick a few dogs from time to time.

This allows for an illustration of the lifecycle of an investment — from the time of purchase until the time of sale. Our average holding period is about five years, and that has been consistent over the past three decades. We tend to have high conviction at the time of investment, and we allow company management time to execute on their business strategy. In our 2021 Q4 letter, we shared our practices related to management interactions and why we feel so strongly about holding regular calls and holding management accountable.

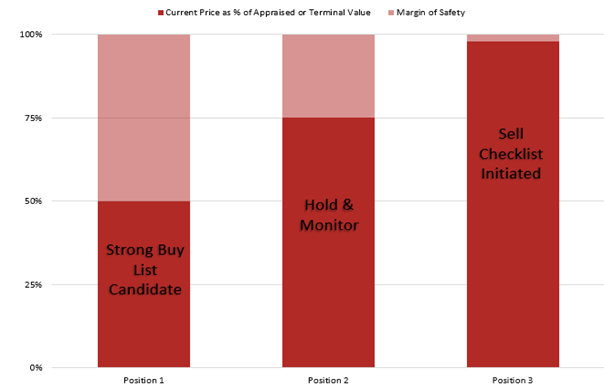

Over time, each position will work out in its own unique way for reasons tied to a) management’s success in executing its business strategy, b) the overall economic environment, and c) other factors that influence earnings. The chart below illustrates the way we expect our holdings to mature — very much like a garden in which different plants mature and bud at different times.

It bears repeating from our prior letters that we are in a perpetual state of review and analysis with each position in our portfolio. Making the initial decision to invest is just the beginning of a long journey in which we update and review each position on a quarterly basis as companies issue earnings reports, other intermittent filings, and press releases.

As a result, as illustrated above, we continuously update and assign an appraised value to each company and compare it to the most recent market price quote. Our appraised value tends to change only gradually over time, and, if management is doing a good job, the value continues to increase. The share price is another matter. Share prices fluctuate far more than appraised values. It is this phenomenon that allows us to invest when the share price is well below our appraised value, and later sell when the price reflects our appraised value (typically a much higher price than we paid at the time of purchase).

While this may sound simple, in practice this requires immense amounts of time, energy, and patience. Our approach is not for the faint of heart. We spend dozens of hours with each security every quarter to ensure we have been thorough in our analysis and understand changes in management’s strategy and economic events that may arise and cause adverse consequences for the company.

In the illustration above, Position 1 is assumed to be newly purchased and trading at our requisite 50% discount from appraised value, which is our threshold for making an initial capital commitment. Position 2 has matured and is at a point where it is neither “cheap” enough to buy, nor “dear” enough to sell, so we hold and monitor. Position 3 is very close to our appraised value and will be sold when the gap between the price and our appraised value is closed.

We have a well-articulated and repeatable investment process that is embraced by each of our research associates. Our research team continues to evaluate and improve on our process as the world around us continues to change. It is the intellectual rigor and discipline we employ that allow us to invest with confidence even during periods of heightened volatility like the present.

From Our Library

We are currently reading legendary investor Ray Dalio’s book entitled Principles. Dalio, who founded Bridgewater Associates, shares wisdom from his forty years of experience in the capital markets. His perspectives have sparked good discussions during our weekly reading review with the entire team.

There are anxious times in every investor’s career when your expectations of what should be happening aren’t aligned with what is happening and you don’t know if you’re looking at great opportunities or catastrophic mistakes.

All great investors and investment approaches have bad patches; losing faith in them at such times is as common a mistake as getting too enamored of them when they do well. Because most people are more emotional than logical, they tend to overreact to short-term results; they give up and sell low when times are bad and buy too high when times are good.

The key is to fail, learn, and improve quickly. If you’re constantly learning and improving, your evolutionary process will look like the one that’s ascending.

Dalio covers much more than principles on investing he shares his life experiences including successes and failures. It’s a delightful read and one we would highly recommend.

Firm Update

We recently hired a third investment advisory associate, Curtiss Tharp. Curtiss joins us from a Cincinnati-based investment advisory firm where he was responsible for providing client advisory services. He has been in the industry for four years and is a graduate of the University of Cincinnati, where he earned a degree in finance with a minor in economics. He and his fiancée will be moving to Miami, Florida, and plan to be married in September. We are glad to have Curtiss join our team and hope you speak with him soon. He will join Tom and Kevin in providing timely and thoughtful client service.

With the non-stop news flow about cybersecurity, you may be interested to know our third-party technology infrastructure and service provider, B&R Business Solutions, LLC, with whom we hold regular meetings to update our infrastructure and security apparatus, recently shared with us a measure of our overall security level. They told us we have the highest level among all their clients, a tribute to our commitment to ensuring extremely tight security across the firm.

Concluding Thoughts

2022 is off to a solid start for client portfolios and our three investment strategies. We continue to dedicate ourselves each day to achieving long-term investment excellence.

Please let us know if you have any changes in your investment objectives or financial situation that warrant adjustments to your portfolio.

Annually we send a copy of our Privacy Policy, which is enclosed, and an offer to receive our SEC Form ADV, which we can send upon request or direct you to the SEC website to access a digital copy.

Thank you for your ongoing confidence, particularly during this time of elevated uncertainty.

Your Investment Research & Advisory Team

Global Value Investment Corp.

This document is published by Milwaukee Institutional Asset Management (MIAM), a division of Global Value Investment Corp. (GVIC). MIAM is the institutional investment advisory division of Global Value Investment Corp., providing investment advisory services to institutional investors including Registered Investment Advisors and Broker-Dealers. All statements or opinions contained herein are solely the responsibility of Milwaukee Institutional Asset Management. The material, information and facts contained in this report were based on publicly available information about the featured company and were obtained from sources believed to be reliable but are in no way guaranteed to be complete or accurate. This report is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. Employees of GVIC may have positions in securities referenced in this report. ‘Intrinsic’ or ‘Appraised’ value refers to MIAM’s quantitative and qualitative assessment of the value of an enterprise. Market capitalization is a measure of the total dollar market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current quoted share price. MIAM’s investment strategies generally invest in a smaller number of securities than some other strategies. The performance of these holdings may increase the variability of a strategy’s return. There is no assurance that dividend-paying stocks will reduce price variability. Value investments are subject to the risk that their intrinsic value may not be reflected in market prices. For purposes of distribution in the United States, this report is prepared for persons who can be defined as “Institutional Investors” under U.S. securities regulations. Any U.S. person receiving this report and wishing to affect a transaction in any security discussed herein must do so through a U.S. registered Broker-Dealer. Neither Global Value Investment Corp. nor Milwaukee Institutional Asset Management is a registered Broker-Dealer.

An investor should consider a strategy’s investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Firm’s SEC form ADV Part II. To obtain a copy of GVIC’s ADV Part II, call 262-478-0640 or visit www.gvi-corp.com. Please read the ADV carefully before investing.

Additional information is available upon request.

No part of this document may be reproduced in any form without the express written consent of GVIC. Copyright 2023. All rights reserved.