July 2022

Economic Outlook

Recent business news headlines read as follows, and summarize the sentiment in the market and among investors:

Stocks Close Out Brutal June With Losses as S&P Suffers Worst First Half Since 1970

Year-to-date, through June 30th, the S&P 500 stock index declined by 20.6%, the NASDAQ by 29.5%, and our preferred measure of the average investor’s equity portfolio, the Value Line Index, declined by 21.9%.

Global Value Investment Corp (“GVIC”) believes the US economy is well into an economic recession. The broadest gauge of economic growth, gross domestic product, turned negative in Q1 2022, falling by -1.6%. All evidence suggests it remained negative throughout Q2, as inflation reared its head in a material way earlier this year and has spiked to levels not seen since the late 1970s, keeping consumers on edge.

GVIC sees signs of slowing economic growth evidenced by declining aggregate consumer demand, growing business inventories, excess capacity (notably in shipping and truck transportation), declining home sales and softening prices, and of great importance, declining consumer sentiment, which hit an all-time low in June (this index has been tracked since 1952).

The principal inputs to production – raw material, labor, and capital – have all seen upward price adjustments (costs have increased) over the past six to twelve months. We are not at all surprised by the recent and sharp acceleration of inflationary pressures.

The irony of this situation is for the past ten years the US Federal Reserve Bank (the “Fed”) has been jawboning about the need for higher inflation, and now they have it in large amounts. Naturally their response is to employ traditional monetary policy – raising short-term interest rates – in an attempt to slow the economy and thus put downward pressure on prices. They are operating in a way that will likely result in a short-term economic recession.

Regrettably for the Fed, the economy is one step ahead, and before their prescriptive action is completed, we expect the economy will be in full recession. This leaves the Fed in a peculiar spot, still wanting to raise rates but doing so in the face of a recessing economy.

GVIC has expressed concern over the Fed’s ”lower for longer” policy and addressed it repeatedly in past client letters. The real challenge today (and for the past several decades) has been the excessive use of debt spending to boost economic activity, through what has amounted to a massive wealth transfer, while interest rates have been managed lower for too long.

We think these events have been visible and the outcome predictable for many years. The only question was when it would occur, not if it would occur. As investment managers, we have repeatedly invested to protect capital during this prolonged phase of the economic cycle.

Reading recent comments from various Fed presidents and members of the Fed’s Board of Governors, we have deduced the Fed will not raise rates as much as Wall Street projects, despite the recent 75 basis point hike (3/4 of 1%). Some economists have projected eight or more rates hike this year alone. Likewise, we do not expect inflation to persist at recently elevated levels.

There’s an adage in the commodity markets, “The solution for high prices, is high prices.” When prices rise, new entrants appear, creating additional capacity, which in turn creates excess supply and lower prices.

At GVIC, we believe the peak of inflation is occurring now and we’ll see lower – not higher – prices over the short-term. We also believe market participants are too pessimistic in their views on rising interest rates, and the Fed will soften its stance far sooner than most participants anticipate.

Recent business headlines, although accurate, are reporting what has happened, not what’s likely to happen. Excluding the possibility of an escalation or prolongment of the war in Ukraine or some other exogenous event, we believe the worst of the market decline is behind us and we look ahead with an expectation of making timely and opportunistic investments.

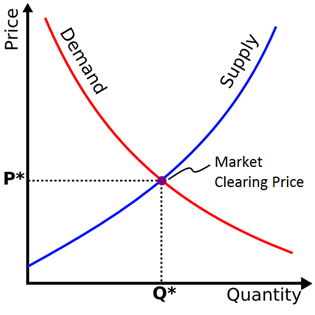

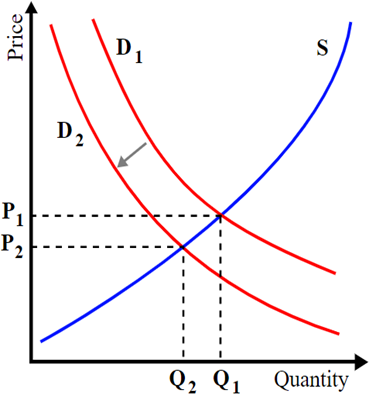

As quickly as prices rise, they can fall. We see evidence of slowing consumer demand across nearly every category and believe this will lead to price declines as supply and demand reach price equilibrium at lower levels. Basic economics suggests as demand wanes, prices adjust. If supply increases at the same time, then the price adjustments will be large and rapid.

As illustrated above, when demand contracts (D1 moving to D2), price adjusts accordingly (illustrated by P1 declining to P2).

Portfolio Update

The last new stock investment in client portfolios occurred in November 2021. Since then, we’ve sold two positions and trimmed a few others as they became overweighted. We’ve found few situations that motivated us to commit additional capital. By and large, stock valuations have not been compelling until recently.

The bond market has presented a variety of attractively priced issues, allowing us to add five new holdings this year, while selling two positions that reached our price target levels. Our most recent purchases have been made with yields over 8% – a level we haven’t seen for some time.

We have written over the years about the importance of showing up in the marketplace as opportunistic buyers shopping for bargains or sellers with a willingness to exit our current holdings if a compelling bid exists.

Despite showing up regularly, we often spend the entire day simply browsing without taking action. The only requirement for admission to the marketplace is having capital. There is no cost to enter or leave, and no obligation to buy or sell.

What makes the market interesting are other participants. Some are financially sophisticated, many not so much. Some have focused investment disciplines (like us) but most show up using arbitrary parameters (that is, they show up with capital, see something that looks interesting, and buy it, then grow weary if it doesn’t quickly appreciate, and sell it).

GVIC’s focus and patience allows us to wait until those times when investor fear is high and sellers become desperate. When that psychology takes over, we are able to get the best bargains, making deals with participants that have neither the psychological nor financial stamina to step back and take inventory of the overall situation.

We are starting to sense an increase in the level of negative sentiment. Year-to-date, the S&P 500 index is down over 20% and the NASDAQ nearly 30% – sizeable declines, to be sure. However, we have yet to detect investor capitulation, in which a seller utters “any price will do, just make me an offer…” We last observed that in early 2020.

We continue to show up, patiently looking for attractive investment entry points, and always alert to the discrepancy between price and value. We are confident in our ability to analyze a business and arrive at an appraised value. When we can buy a business from a desperate seller for roughly half of its appraised value, we will act. Until that point, we’re happy to remain on the sidelines.

Buyers and Sellers

Every trade has two sides: a buyer and a seller. Having an informed view of a business’s value is immensely useful when making an offer to buy or seeking a bid to sell. Surprisingly, we bump into relatively few informed and knowledgeable investors in the marketplace. We also meet many investors with short-term investment horizons, ranging from a few hours to a few weeks. We believe having a psychological disposition oriented toward making long-term investments (often spanning five years or more), in businesses that can be purchased at a fraction of their appraised value, is essential to generating attractive long-term investment returns.

We think our level of knowledge exceeds that of the average investor. Along with our understanding of financial statements and business strategy, our ability to analyze them in a world that has become increasingly complex, gives us an inherent advantage in the marketplace.

As described in many of our prior letters, we think holding relatively few businesses in which we have regular and ongoing engagement with senior management to confirm our investment premise, gives us an information advantage that few investors possess. Our concentrated portfolio allows us to dedicate substantial time and energy to each of our holdings to ensure we have a comprehensive understanding of each business.

Only after developing a thorough understanding of a business can we calculate an appraised value, and then seek a seller when adding a position or a buyer when exiting a position.

From Our Library

Over the years I’ve written about various books our team has read in this section of our letter. I’ve shared passages that illustrate particular points worth considering, but I don’t think I’ve shared what our book club is all about.

On a weekly basis our entire team meets for 30-60 minutes to share thoughts, comments and observations from a chapter or two of a reading assigned the prior week. It is through this exchange and sharing f ideas that we reinforce our firm’s philosophy of continuous learning. I have found amazing ideas coming from other team members as a result of sharing stimulating thoughts from these readings.

GVIC as a firm has developed a Corporate Culture document that describes how we as a group think about the world, our work relationships, and performance expectations. An overriding theme in our culture is continuous learning. The book club is one example of how learning takes place.

We just completed Principles by Ray Dalio. We are next reading Manias, Panics and Crashes: A history of Financial Crisis by Kindleberger and Aliber. I’ll share a few highlights in our next letter.

Firm Update

The firm will celebrate its 15th anniversary in August. It has been a great ride during these informative founding years. We established a 100-year business plan soon after our founding. We are confident in the future and look ahead with great optimism as we make strategic moves to support our current and future clients.

One of our advisory associates, Kevin Sanford, elected to pursue a unique opportunity in the fintech space. He had been with us for nearly two years, contributing to our institutional advisory process. We thank him for his input and wish him great success in his new endeavor.

Concluding Thoughts

We have told many clients that the best opportunities come during periods of the greatest uncertainty. True to that, we are beginning to see many interesting investments in light of the selloff in both the stock and bond markets. Too often investors buy high and sell low. We sense market valuations are closer to a low than a high. Should you have excess capital for investment, this would be a good time for us to have a conversation.

Finally, if you’ve had any changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We would be happy to schedule a call to discuss ways in which we can adjust to better align with your current circumstances.

Thank you for your ongoing confidence, particularly during this time of elevated uncertainty.

Your Investment Research and Advisory Team

Global Value Investment Corp.