Outlook:

2018 has been far more volatile than any year in recent memory. Markets continue to be driven by a very narrow group of large companies, nearly all of which trade at extreme valuations. Below are year-to-date price changes for the Value Line, a broad measure of stock performance, and the S&P 500, an index of large stocks.

The following summarizes a few of the popular market indices and recent results:

| Year-to-Date Return | 12-Month Return | |

|---|---|---|

| DJIA | -1.81% | 13.69% |

| S&P 500 | 1.67% | 12.17% |

| Value Line | 1.30% | 8.98% |

| Barclays US Agg Bond | -1.62% | -0.40% |

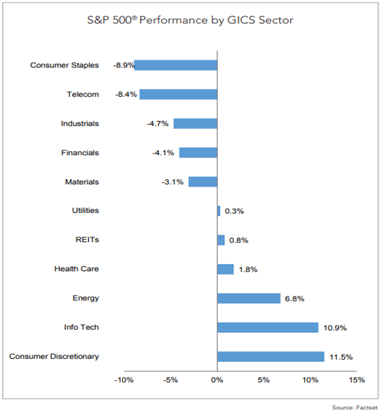

As you can see in the table below, many market participants have honed-in on a small group of large stocks, leaving some sectors of the economy looking attractive due to price declines.

Of note, year-to-date there has been a wide divergence in returns across economic sectors. Since the end of the first quarter we have seen an increase in the number of well-established consumer companies and major telecom companies with sharply lower share prices; for example, year-to-date: Wal-Mart -12%, Campbells -13%, J&J -12%, Kraft-Heinze -17%, Colgate -13%, P&G -14%, AT&T -15%, Comcast -17% to name a few.

This type of divergence is symptomatic of investors scrambling from one group to another, which often leaves a disproportionate number of mispriced companies.

Note in the graph below the variations in results by the economic sectors of S&P 500 stocks. As indicated above, year-to-date the S&P 500 has generated about a net zero return.

The table below highlights a few on the stocks that have been driving the Info Tech and Consumer Discretionary sectors.

The names on the bottom of page one are members of the Consumer Staples and Telecom sectors.

Keep in mind the stock market is a market of stocks and very few companies produce an average return – returns are often well above or well below average.

We remain alert for opportunities.

The following table details six large companies that can account for nearly 100% the S&P 500 returns for the first half of the year. However, each trades for a very, very high valuation compared to the average:

| Company Name | YTD Return | P/E Multiple | P/S Multiple | P/BV Multiple |

|---|---|---|---|---|

| Amazon | 36% | 215x | 4.4x | 26.4x |

| Microsofy | 18% | 56x | 7.6x | 9.8x |

| Apple | 15% | 18x | 3.8x | 7.3x |

| Netflix | 15% | 274x | 14.4x | 44.1x |

| Alphabet | 7% | 49x | 6.9x | 5.0x |

| NVIDIA | 5% | 41x | 14.1x | 19.5x |

| S&P 500 | 17x | 2.1x | 3.2x |

Effectively, the other 494 issues in the S&P 500 together produced a net 0% return for the first half of the year. Note each of those listed above trade at very high valuations, with Amazon and Netflix in particular trading at levels we view as unsustainable.

Market pricing continues to be influenced by the Federal Reserve Bank’s interest rate policy and ongoing political uncertainties related to global trade negotiations. The underlying US economy is performing well, with GDP, inflation, employment and wages all showing stable, positive reports.

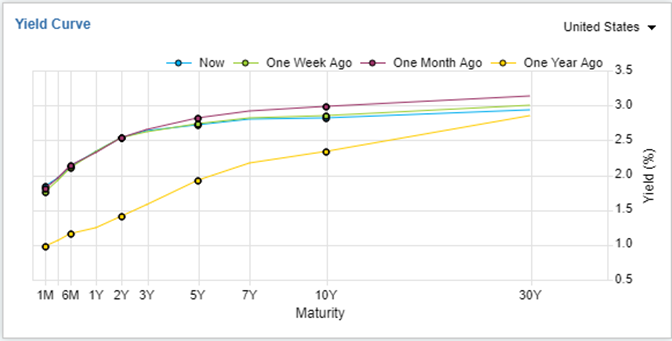

It is noteworthy and disconcerting that the US Treasury Yield Curve has flattened despite strong economic reports. Over the past twelve months, as the Fed has initiated a series of rate hikes (short-term rate increases), ostensibly to cool down a “potentially” overheating economy, long-term rates have remained static, thus causing the shape of the curve to flatten. Normally, the yield curve is positively sloped with about 300 basis points (or 3.00%) from the short-end to the long-end. As you can see now, the spread is just 100 basis points, down from 200 basis points a year ago.

Bond market investors remain less optimistic about the condition of the economy, potentially viewing the December tax reform as an effort too late in the economic expansion to provide additional growth stimulus. At any rate, if the bond market believed better times were ahead, we would expect to see long rates at 4 ½ to 5%, not the current 3%. We make note of this condition and continue to proceed with caution.

Recent Activity:

Global Value Investment Corp’s research analysts remained completely engaged during the second quarter, pressing hard to make sure we had the best possible perspective on our core issues. We remained busy, analyzing existing companies and communicating with senior management. Contrary to our observation of extreme valuations as noted above, GVIC’s equity portfolio holdings are trading at very reasonable valuations. In fact, we continue to hold several issues that are sharply undervalued. We are more frequently identifying prospective investments as a result of heightened price volatility.

During the past quarter we had one or more of our analysts make on site visits to the following companies:

Gulf Island Fabrication (Houston TX) May 30; Bristow Group (Houston, TX) May 30; Wayside Technology (Eatontown, NJ) June 6; Fluent Corp. (NY City) June 7; Liquidity Services (Washington DC) June 12; LSB Industries (El Dorado, AR) June 28.

Overall we’ve had a great deal of one-on-one interaction with company management. There is no substitute for this type of meeting. Watching managers react to probing questions, and observing their body language and nuanced responses, tells us a great deal about the answer that is unspoken. Seeing corporate office and staff interactions is often revealing. We continue to schedule on site visits to gather whatever additional intelligence we can to confirm our belief in the company and reaffirm our investment thesis.

We also held many conference calls with company management – both of companies in which we are invested and others in which we have an interest.

The following are dates of a few of the calls with company management over the past quarter:

April 30 – LSB Industries, Inc. (which lead to our June 28 plant visit); May 4 – SubSea7 S.A.; May 15 – Gulf Island Fabrication, Inc. (which lead to our May 30 visit); May 21 – AutoWeb, Inc.; May 31 – Seaspan Corp.; June 4 – TravelCenters of America, LLC; June 19 – Liquidity Services Inc. (as a follow up to our June 12 meeting); and June 21 – UFP Technologies, Inc.

We also had one analyst attend the East Coast Ideas Conference in Boston for two days to hear a number of companies presenting their business plans and strategies.

We spend time researching and analyzing our current investment holdings as well as new ideas. We are continuously seeking to identify undervalued investment opportunities. Some of our research involves talking with ex-employees and non-financial industry professionals. This quarter we established rapport with the editor of Trade Winds, a shipping industry news source. The editorial staff provided a trove of information not typically available to investors (for a price of course). We continue seeking new and compelling investments to add to portfolios.

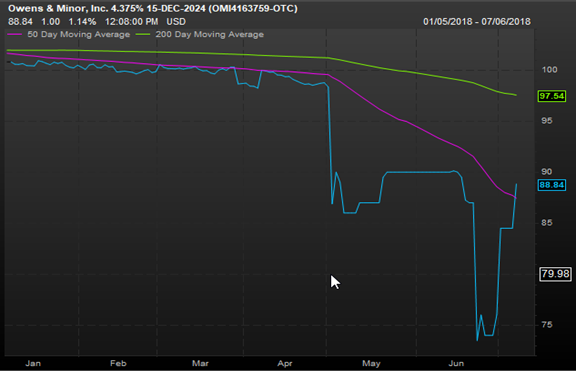

When analyzing a company, we look at both its equity (stock) and debt (bond) securities. Over the past few months we have spent considerable time analyzing numerous candidates for inclusion in portfolios where we hold debt. We are constantly shopping for bargain issues, being price sensitive given the daily price variability as evidenced in the chart below. Just like equities, debt prices can fluctuate wildly – below is an example of one such issue:

One of our core debt holdings, Rent-A-Center, Inc., which has been the target of an activist investor, finally conceded and endorsed a going-private transaction. The debt we hold is now subject to a mandatory call at 101% of its par value ($1,010 for every $1,000 of face value).

We had anticipated this event and are delighted with the result. Clients enjoyed appreciation from their purchase price (see your monthly statement detail for your specific cost basis) as we bought the debt for as little as 77% of par ($770 for every $1,000) over the past 18 months (see chart below).

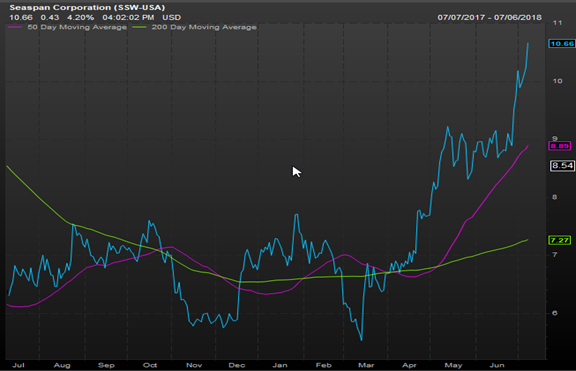

Of note within our core equity holdings is Seaspan Corp., a container ship leasing company. About a year ago the company executed a management shakeup that included changes to the board as well as to the C-Suite. Like many company events, the changes, which were clearly positives from our perspective, took quite a long-time to be factored into the share price. Below is a one-year look back. During this entire period these changes were fully communicated to the marketplace. Modern portfolio theory would suggest all news is immediately reflected in a share’s price. We believe an information advantage can be developed by paying close attention to changes. As you can see, change is not always immediately incorporated into price, thus the need for investor patience.

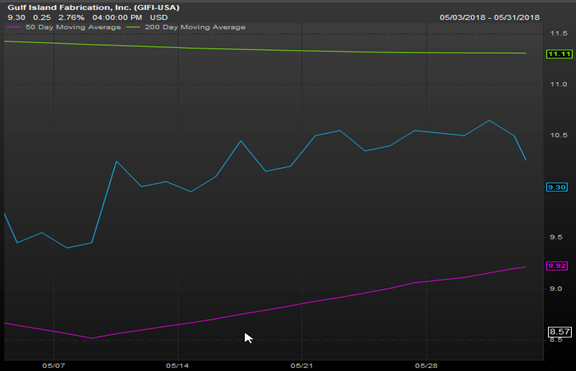

Another example of capitalizing on an information advantage can be seen in the share price of Gulf Island Fabrications, Inc. The company announced a major contract win after hours on May 1st that would have a significant impact on forward earnings, yet the stock sat still for four trading days before market participants recognized this and incorporated it into the share price.

Activist Activity:

We believe the most informed investor can gain an advantage by understanding a company and the industry. We continue to work closely with several companies to influence the future path of the business in ways we think will improve returns to shareholders. We regularly communicate with board members and management to remind them the company is owned by its shareholders. We emphasize that long periods of low return-on-equity are unacceptable. We generally feel free to suggest change in personnel may be required to improve business performance.

We are currently involved in three situations in which we are pressing company board members and management to alter their strategic plans in order to improve shareholder value. These activities necessarily take time and patience. Our experience proves this is a productive way to spend time on a limited number of situations. As we conclude our activist activities we will share the results of our efforts.

From Our Library:

One of our favorite investment reads, originally published in 1949, is The Intelligent Investor by Benjamin Graham.

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. (pg. ix)

A great company is not a great investment if you pay too much for the stock. (pg. 181)

The intelligent investor gets interested in big growth stocks not when they are at their most popular – but when something goes wrong. (pg. 183)

Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. (pg. 205)

The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored. (pg. 206)

The intelligent investor should recognize that market panics can create great prices for good companies and good prices for great companies. (pg. 483)

Firm Updates:

Global Value Investment Corp., the parent of Milwaukee Private Wealth Management, produces investment research through its Global Value Research Company division. We distribute our research through three independent, global market channels (S&P Cap-IQ; FactSet; Thompson Reuters). These reports are available to clients of Milwaukee Private Wealth Management. If you would like to read more about the companies in which you are invested, please let us know and we will be happy to send periodic reports.

On June 1st we added a New Jersey based analyst to our team. Peter Delgado has managed investment portfolios for the past ten years through Threshold Capital. He has been a friend to our firm since its inception, going on eleven years. Peter brings nearly 30 years of investment experience with an impressive financial background. We are glad to have him join our research and analysis team – he already knows several of our core companies. He recently returned from Oklahoma City where he met with LSB Industries and will be joining us to meet with Fluent, Inc. in NY City in early August.

Our India research subsidiary remains active, providing overnight news and information daily to insure their US counterparts hit the ground running. Satendar Singh celebrated his one-year anniversary with us on June 1st. Team India provides extraordinary input and perspective from 9,000 miles away.

Concluding Thoughts:

We are mindful that we are investing other people’s money and as such have a great responsibility to apply rigor with each decision. The firm has a policy that each of its associates will invest in the very same issues we recommend for client portfolios, a policy we think wise and one we would expect if our roles were reversed.

As always, we thank you for the ongoing confidence, trust and the kind words we often hear. Your support means a great deal to us, particularly when stress levels rise due to unanticipated events or increased price volatility. If you’ve had a change in, or would like to update, your investment objectives or portfolio restrictions, please let us know so we can make appropriate adjustments. We recently updated our form ADV with the SEC to reflect changes with the firm. Please let us know if you would like a copy.

We continue to commit to achieving investment excellence over time.

Your Investment Research and Advisory Team

Global Value Investment Corp.