Most US equity market indices are again pushing toward record levels, warranting cautious optimism. Astute investors know all too well irrational exuberance often precedes market corrections and is the consequential error of paying top dollar for company shares trading at excessive multiples at the time of purchase.

Successful investing is easy to measure: return earned as a percent of capital, measured over time. Returns can be measured at frequent intervals. Keeping score is simple in this game.

Nearly all seasoned investment professionals can quickly cite their best-ever investment, the one that went up by some multiple of its original value. In many cases the name of that company is lost in the stock tables, typically not being a familiar or popularly traded stock. On the contrary, many of the popular or most widely owned companies of the day are not destined to become great investments.

Here’s the fundamental question every investor must ask each day when arriving at the marketplace:

“Am I interested in owning great companies or making great investments?”

Although the two aren’t mutually exclusive, experience shows most great investment successes are generated by tactical ownership of less popular or out-of-favor companies. Great investments are measured by price increases of a minimum of 10x original cost; those are the investments that make a real difference in an investor’s life and lifestyle.

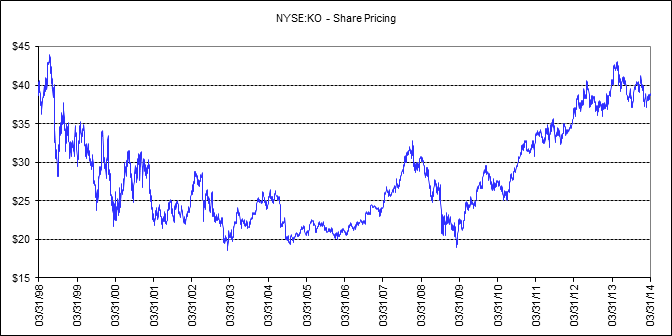

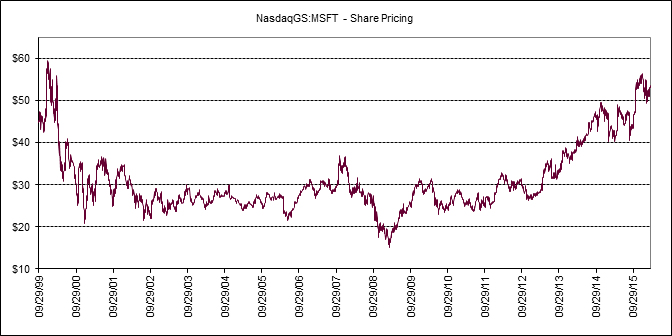

Some of you will recall in the late `90s when Coca-Cola (KO) and Microsoft (MSFT) were the leading and popular stocks. Their valuations were extraordinary, but that didn’t seem to matter. Their stock prices moved higher on a nearly predictable basis. Investors seemed to think those stock would rise without constraint. Until one day when they didn’t. Recall the Y2K scare and the subsequent “Dot-Com” bust, when the market dropped with a resounding thud that echoed for nearly two years?

Coca-Cola peaked in the summer of 1998 just below $45/share. It stayed at that level or lower for over 16 years, until December of 2014. That’s a long time to wait to get back to break-even.

Microsoft is another classic example of a great company that was simply over-owned & overvalued. Its stock peaked in December of 1999 at $59.65. Only now, after 16 years, has the price reached that level again. Granted, the company has paid both regular and special dividends over the years and without question has improved its business and economic fundamentals.

The challenge for investors is to avoid overpaying for these great companies of the day.

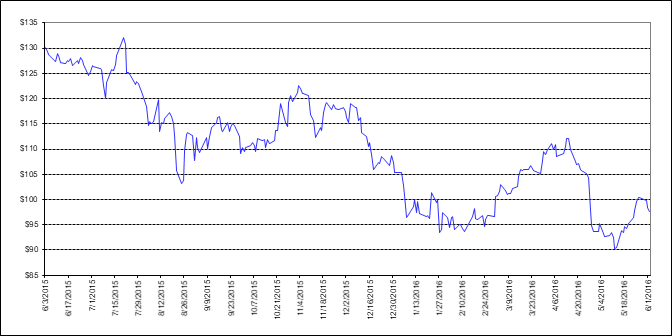

Of course that was in the late 90s, and things have changed, right? For the ‘darling’ stocks of today such as Apple, Facebook, Netflix, and others, things are different… We will only know in retrospect, but Apple has already begun to show signs of stress. Look how its shares traded over the past 12 months compared to the past three years, despite the recent fanfare of Berkshire Hathaway’s stock purchase.

A typical prerequisite to being a successful investor is having the strength of charter and intellectual conviction to commit capital to out-of-favor and underappreciated companies. It is those companies trading at sharply lower prices, typically outcasts – companies such as the energy stocks of today and real estate stocks in recent years – that offer great values and can lead to fantastic investment returns. The best price is generally realized at the moment of maximum market pessimism, when most other investors are selling uncontrollably and irrationally.

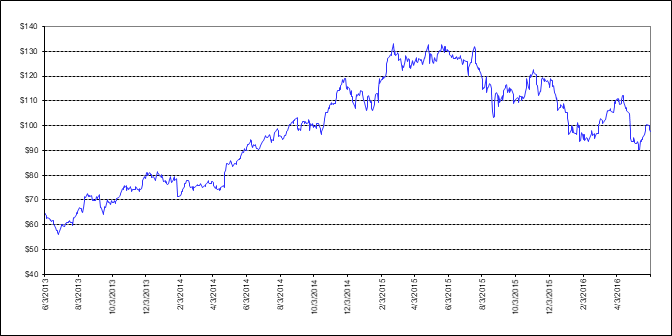

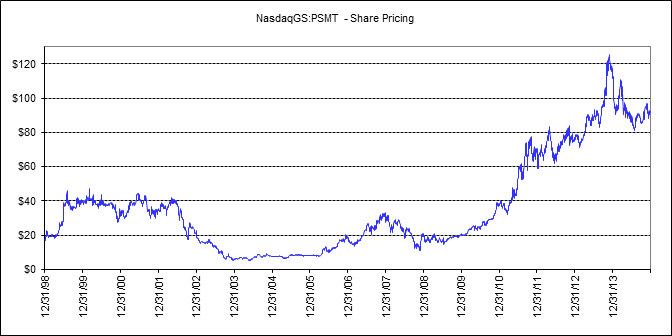

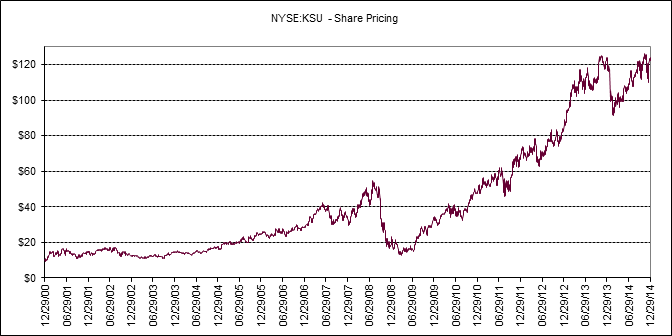

A few companies that are neither household names nor particularly popular but have generated great investment returns include PriceSmart (PSMT), a regional club store, and Kansas City Southern (KSU), one of the remaining North America class one railroads. To be sure, both of these companies fell from grace, but the depth of the fall and the corresponding rebound are quite different than the earlier examples.

PriceSmart peaked in the late 1990s above $40 per share then declined due to temporary internal management issues. Its share price recovered and exceeded $120 per share by the end of 2013. Alert investors had several years to acquire the beaten down shares in the $5.00 – $6.00 range.

Likewise, KSU traded in the mid-teens as a result of the macro-economic fears for an extended period, between 2008–2009, before advancing to over $125 per share.

Neither PSMT nor KSU necessarily qualify as Blue Chip stocks or popular companies, nevermind being characterized as great companies; yet over time both proved to be great investments.

Having the benefit of hindsight of course can make one seem like an expert. Both of these examples will undoubtedly apply to companies of today and tomorrow. The old adage ‘bought right is half sold’ is as true today as it has ever been. Price paid is a critically important element of investment and investor success. Unpopular and out-of-favor stock investing, although not particularly glamorous, can be very profitable.

Share prices often move based on the emotional outlook of the typical market participant. They will respond and react to macro-economic and news events or rumor regardless of their veracity. This creates opportunity for alert investors to step forward and commit capital. The global equity and debt markets both experience periods during which share prices trade inefficiently, creating opportunities for outsized investment returns.

Share price fluctuation and volatility should be welcomed by investors inasmuch as it creates opportunity to enter and exit investments at attractive prices. Alert investors seeking outsized results should watch for and monitor those less than great companies when searching for great investment returns.