The subject of stocks vs bonds elicits diverse reactions from investment professionals. This article explores the unique opportunity in the bond market that may challenge previous notions.

Investors have three distinct opportunities when choosing to invest in a company, and each have to do with layers of capital structure.

- On the top, and most senior / secured, is debt (bonds)

- In the middle, and junior to the senior debt, is subordinate debt or preferred stock

- On the bottom, and least secure, is equity (stocks)

The expected return on investment at each layer generally increases from most to least secure.

Note a few material differences between bonds (debt) and stocks (equity).

- A bond has a known maturity date –at some point it matures and for better or worse the investment period concludes. As opposed to a stock which is a perpetual security and can be held for any length of time.

- A bond has an established credit rating – most bonds are assigned a credit rating by one of a few agencies such as S&P, Moody’s or Duff & Phelps. These agencies offer an initial rating and regularly review bonds for upgrades or downgrades based upon economic conditions and business performance. Stocks rely on Wall Street research firms to render opinions as to safety of principal and economic outlook.

- Bonds carry a fixed interest rate – most bonds have an established fixed rate or “coupon” at issuance that remains for the life of the bond. There are variations in which rates can adjust based on a change in an underlying index such as inflation/CPI or a broad based interest rate index like LIBOR, but the vast majority of bonds begin and end with a stated rate that the investor can count on for periodic and predictable interest payments. Stocks may pay dividends, which can be increased, decreased or omitted over time, authorized quarterly only by the judgment of the board of directors. Payments may vary over a market cycle.

Bonds, like stocks, bear uncertainties. The real differentiator of a bond is the terminal or maturity date. At some point it reaches its maturity date and makes a final payment of principal and interest.

Although one has the advantage of a finite life and a known and predictable stream of income, it is interesting to note that most bonds are issued at par ($1,000) and mature at the same par value. During its life, however, a bond trades much like a stock with price fluctuation. This means a bond can trade above and below its par between issuance and maturity. An investor may buy or sell the bond at any point between its issuance and maturity.

The following examples provide graphic illustrations of the opportunity. Note the Alcoa 5.125% due October 2024 bonds pictured below, issued in 2014 at $1,000 with a 5.125% stated rate (paying $51.25 per bond annually). On October 1, 2024 the holder will receive $1,000 per bond – backed by the full faith and credit of Alcoa. The bonds traded to 82% of par in mid-2015. At that point the bond had a current yield of 6.25% ($51.25/$820), while also offering 22% appreciation potential assuming a maturity value of $1,000 (par.) Now note by early 2016 the bonds traded above par, again creating a very attractive return over the short term.

Herein lies the opportunity for the enterprising investor. As long as the bond has certainty of maturity, downside risk can be managed through a hold to maturity approach, but the variability in pricing creates short-term opportunity to lock in current yield and capital appreciation.

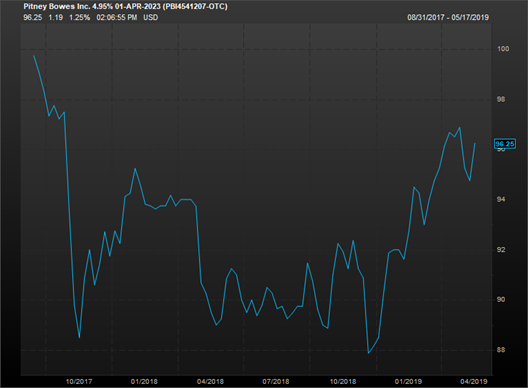

Another example is Pitney Bowes, Inc. 4.95% due April 2023. These bonds bounced around for most of 2018 below 90% of par. In April 2023 they’ll come to maturity.

Trinity Industries, Inc. 4.55% due October 2024 (below) experienced two periods of sharp decline, creating attractive entry points. With $45.50 of certain annual income and a known terminal date, buying these bonds at 85% of par was a very sensible investment in an asset that behaves differently than stock.

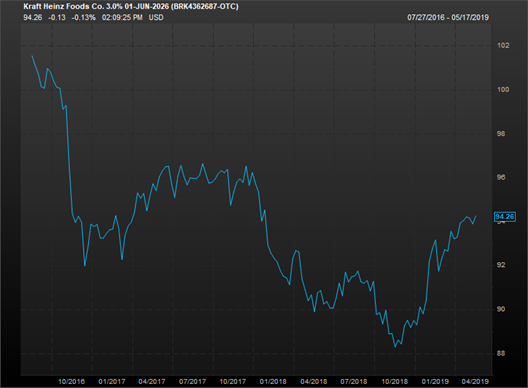

Finally, Kraft Heinze Company 3.0% due June 2026 have been taken out behind the wood shed. What makes these most interesting is the large ownership of legendary investor Warren Buffett and 3G Capital. Between them, they control 48% of the stock. These bonds are senior obligations to Buffett and 3G Capital, meaning in the capital structure the bond holder has a higher level of security than Buffett.

There are many ways to invest in both stocks and bonds. Each has its own set of value drivers as well as uncertainties. The opportunity for attractive total returns can be realized through alert and opportunistic bond market investments.

For additional perspective and strategic analysis on how to position yourself or clients to exploit price variability in the bond market, feel free to call our offices.

This document is published by Milwaukee Institutional Asset Management (MIAM), a division of Global Value Investment Corp. (GVIC). MIAM is the institutional investment advisory division of Global Value Investment Corp., providing investment advisory services to institutional investors including Registered Investment Advisors and Broker-Dealers. All statements or opinions contained herein are solely the responsibility of Milwaukee Institutional Asset Management. The material, information and facts contained in this report were based on publicly available information about the featured company and were obtained from sources believed to be reliable but are in no way guaranteed to be complete or accurate. This report is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. Employees of GVIC may have positions in securities referenced in this report. ‘Intrinsic’ or ‘Appraised’ value refers to MIAM’s quantitative and qualitative assessment of the value of an enterprise. Market capitalization is a measure of the total dollar market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current quoted share price. MIAM’s investment strategies generally invest in a smaller number of securities than some other strategies. The performance of these holdings may increase the variability of a strategy’s return. There is no assurance that dividend-paying stocks will reduce price variability. Value investments are subject to the risk that their intrinsic value may not be reflected in market prices. For purposes of distribution in the United States, this report is prepared for persons who can be defined as “Institutional Investors” under U.S. securities regulations. Any U.S. person receiving this report and wishing to affect a transaction in any security discussed herein must do so through a U.S. registered Broker-Dealer. Neither Global Value Investment Corp. nor Milwaukee Institutional Asset Management is a registered Broker-Dealer.

An investor should consider a strategy’s investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Firm’s SEC form ADV Part II. To obtain a copy of GVIC’s ADV Part II, call 262-478-0640 or visit www.gvi-corp.com. Please read the ADV carefully before investing.

Additional information is available upon request.

No part of this document may be reproduced in any form without the express written consent of GVIC. Copyright 2023. All rights reserved.