2023 Q2

Economic Overview

First quarter economic growth, as measured by gross domestic product (GDP), was reported at a solid 2.0% following fourth quarter GDP of 2.6%. The second quarter GDP number will be released at the end of July, and we believe it will show continued positive results. The employment numbers for June were issued recently and showed a resilient 3.6% unemployment rate and a continued trend of strong demand for labor with corresponding wage rate increases over the past twelve months of 4.4%. The number of employed persons increased across nearly every segment of the economy including government, a truly healthy sign. According to the Bureau of Labor Statistics (BLS), currently there are just 6.0 million unemployed persons (that is, those who are not currently employed but are actively seeking employment). The Job Openings & Labor Turnover Survey (JOLTS) for May indicated there were 9.8 million unfilled jobs, or 1.6 openings for each unemployed person – a scenario that does not normally precede a recession.

Many pundits have predicted a modest recession in the second half of 2023. Given the recent economic data, this scenario looks less likely, or at the very least will be pushed off to the first part of 2024. The contra-case for the economy not dipping into recession comes from the large fiscal stimulus packages passed by Congress over the past few years. The total amount of additional money being injected into the economy through these stimulus packages will exceed $5.0 trillion (as compared to the total domestic economy, as measured by GDP, of roughly $20.3 trillion). This stimulus has and will continue to partially offset the monetary tightening efforts of the Federal Open Market Committee (“the Fed”). Recall that the Fed began the current tightening cycle in March 2022 with a 1.0% hike in the overnight funds rate, reversing its quantitative easing policy and kicking off a multiyear effort to curb inflation to its target rate of 2.0%.

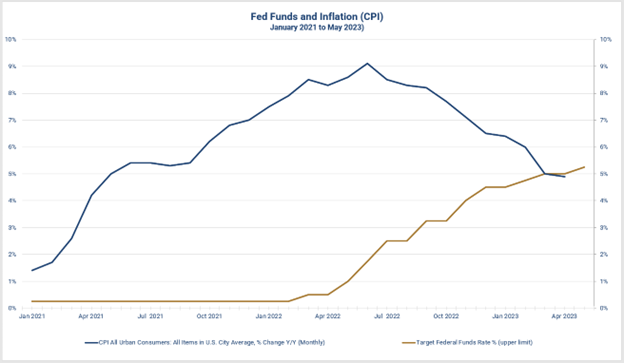

Inflation has in fact slowed sharply from its peak level of 9.1% in June 2022, and was most recently reported at 4.7%. Consistent with the Fed’s messaging, we expect additional monetary tightening until inflation subsides to 2.0%. We take the Fed at face value and have incorporated into our investment perspective at least two more rate hikes, which we believe are largely reflected in market pricing today. Any deviation from this path by the Fed will come as a surprise to markets, although the path of monetary policy can be quickly altered by economic data.

The chart on the following page shows the Fed’s interest rate actions in comparison to the rate of inflation, as measured by the Consumer Price Index (CPI). It is apparent to us that the Fed was well behind the curve when it came to curtailing inflation, with monetary tightening beginning in March 2022 when inflation was already at 8.5%. We suspect the Fed will continue to tighten even after inflation is under control. They may in fact tighten until the economy experiences a quarter or two of negative GDP, if only to attempt to remain credible in the eyes of Wall Street and global capital market participants. It is worth noting that economic activity in other regions of the world has already slowed far faster than the US with Europe notably teetering on recession.

Most of the companies we have spoken with over the past three months indicate their business outlook remains positive and the labor and wage issues experienced over the past eighteen months have subsided. There are few companies that have trimmed their workforce or revised their growth plans down. We believe this is a direct result of the fiscal stimulus plans launched by Congress resulting in a continued high level of employment that has created strong consumer demand.

Our position remains calm, alert and opportunistic. We have continued to find interesting investments in the bond market, but less so in the stock market outside of a special situation that resulted from the March failure of Silicon Valley Bank and several other banks.

We stated in our prior letter that we think some caution is warranted looking ahead. Our research team meets at least weekly to analyze economic data and draw conclusions that inform our view of the world now and into the future. We continue to focus our efforts on making intelligent investments in the equity and debt of a small number of businesses in which we have developed a high level of confidence and where we believe the security is currently mispriced by market participants.

Portfolio Update

Our research team speaks with senior management of companies consistently throughout our holding period, which typically extends beyond five years and in some cases for over a decade. Over the years with repeated management contact, we develop an understanding of how a business responds in different economic environments, as well as how management navigates through industry and economic changes.

We remind ourselves that people run businesses (one of our investment principles), meaning the outcome and return on investment (ROI) will be heavily dependent on the quality of management, the soundness of its strategic plan, and its ability to execute to the plan over time. Good management teams can make an average business turn into a great investment. Often times mediocre businesses trade at discounted valuations until new leadership is installed who have the vision and stamina to affect change that causes the business to perform better and the valuation gap to close creating outsized returns for stockholders.

We spoke with the CEO and CFO of Core Molding Technologies, Inc. (CMT) last week. This is a business in which we first invested in October of 2018 at $6.54 per share. The company was in the process of replacing its CEO who had produced unimpressive results over an extended period. Shortly after our purchase CMT hired Dave Duvall as its new CEO. Our research team visited CMTs’ headquarters in Columbus, OH several months later to meet with management and confirm our investment thesis, which was in part based upon Mr. Duvall’s ability to execute a successful turnaround. Needless to say, nearly five years later with the stock price now over $22.00 per share, the plan developed by management and approved by the board was successfully conceived and executed. Our call last week confirmed that our investment thesis is still intact and management remains focused on future growth and improved profitability. Mr. Duvall has been remarkably consistent from quarter to quarter when we speak with him. His message is clear and has evolved with each passing year and continued improvement in the business, which is ultimately reflected in the stock price.

This example illustrates several important points about our investment process. First, we have a long-term investment outlook. As stated earlier, we typically hold our equity investments for five years, sometimes much longer. Workout situations can take time to develop but once they take hold our experience has shown there is tremendous upside return potential. Second, we place a heavy weight on the quality of management and board oversight (as described in many of our prior letters). Having management that develops a well-conceived strategy and then executes it can make the difference between an average and great investment outcome. Third, and related to point two, board oversight and support are critical to us as business owners (also known as stockholders). A board of directors are the elected representatives for all stockholders and have a responsibility to stockholders. A board has two primary roles, 1) hire an executive to manage the day-to-day operations of the business, and 2) approve management’s strategic plan while holding it accountable to achievement.

Our ongoing analysis supports the thesis that Mr. Duvall has the requisite skills to manage this business, has developed an effective strategy, and has the support of the company’s board of directors in executing the plan. Many of our analytical conclusions were derived through conversations with him and his management team and further reinforced by traveling to see the business in operation.

Investing in a company and having a thorough understanding of the business and people managing it is an extraordinary undertaking. When fully invested we hold twenty stocks, which on the face of it may seem like a relatively few issues, but in fact at twenty holdings we can achieve a high level of diversification while allowing adequate time and effort to become fully informed about the business and remain informed over our entire holding period.

Travel

In late April a few members of our research team traveled to New York City to, among other things, meet with one of the founders of Fluent, Inc. (FLNT), a company in which we have been invested for many years. We continue to see how its technology platform creates benefits for its customers and end consumers yet have been puzzled by the failure of the stock price to reflect the continued steady execution of the business strategy. The visit reassured us that our view of Fluent is well positioned and we must exercise patience as Fluent’s plans evolve.

A group of our research team again traveled to New York City for a few days in mid-June to attend a maritime and offshore energy conference sponsored in part by DNB, one of the European investment banks with whom we transact business. We met with several companies in which GVIC has invested as well as a handful of companies in which we have been consistently developing a deeper understanding, which is typical of our long-term investment research and analysis process.

In late June we sent a small group of analysts to meet with senior management of Hooker Furnishings Corporation (HOFT) in Martinsville, Virginia. The meeting lasted the better part of the day and yielded great additional insights into how management is thinking about its business today and into the future. There are many underlying trends currently influencing the furniture marketplace. Hooker’s management has been responsive to these changes which was evidenced when we viewed their “war room” in which they have mock-ups of current and future design concepts. Overall, it was a very productive visit and solidified our research team’s view of the company’s strategic plan and our confidence in management leadership.

Our team is scheduled to travel to Columbus, Ohio to meet with Core Molding Technologies’ (CMT) management mid-August and will share observations in our next quarterly letter.

From Our Library

We recently began reading Financial Shenanigans: How to Detect Accounting Gimmicks and Fraud in Financial Reports by Howard Schilit. We have been impressed by the ongoing need for rigorous board oversight and external auditor inspection. Many of the well-known frauds over the past generation could have or should have been detected by board members exercising their fiduciary duties or the company’s auditing firm in the normal course of business. Schilit cites Enron, Worldcom, Global Crossing and many other frauds perpetrated on stockholders as a result of the failure of those charged with providing oversight. Schilit sums it up by saying there has been repeated failure of regulatory scrutiny of public companies.

Schilit walks his reader through balance sheet, income statement and cash-flow statement analysis and dissects how fraud and misstatement has occurred causing catastrophic loss for stakeholders. We believe having this perspective makes us better prepared and more precise in our questioning and review as we speak with senior management and independent directors.

Firm update

GVIC held its 2023 annual meeting of stockholders in Charleston, South Carolina at the end of April. All of our stockholders were able to attend. During the meeting our board chair, Jeff Geygan, provided an update on the business condition and the outlook for the years ahead. The Firm’s board of directors was expanded this year with the addition of two new directors, including GVIC’s first outside director. We anticipate adding a fifth director who will also be an independent outsider.

During the second quarter of this year, GVIC was recognized in several independent surveys for its leading investment returns over the past one, three and five years, recognition that brings great satisfaction to everyone who has worked so hard to provide above-average long-term results for our clients.

Mac Maclaren, one of our US-based research analysts, will be relocating to San Francisco for 12-18 months where he will continue in his current capacity while also spending time meeting West Coast investment bankers and capital market resources that our Firm generally doesn’t interact with given our predominantly East Coast and Western European focus.

GVIC remains financially healthy and continues to expand its client base and increase its assets under management.

Concluding Thoughts

When we penned our year-end letter, we stated that we still saw significant investment opportunities and encouraged clients to contact us regarding adding capital for investment management. Our equity account (stock), debt account (bonds) and total return account composites all returned well above their respective benchmarks during the first half of this year. We remain alert and opportunistic, seeking attractively priced investments.

For our clients who have accounts with TD Ameritrade, please be aware it will merge with Charles Schwab this fall. You will receive notice from TD Ameritrade this month with more details. We expect the transition to be seamless. Please call us if you have any questions about the transition.

If you’ve had changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can update your objectives to better align with your current circumstances.

Thank you for your ongoing confidence.

Your Investment Research and Advisory Team

Global Value Investment Corp.