Economic Outlook

The US economy contracted during the first and second quarters and is likely to have contracted further during the third quarter. Results will be released on October 27th.

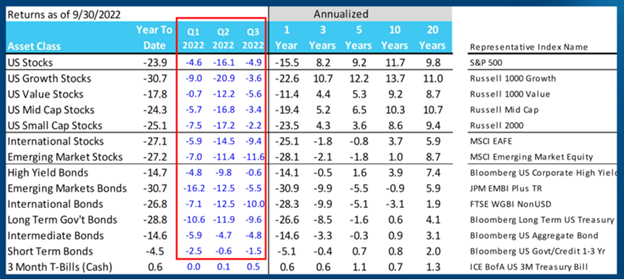

Central banks across the globe, led by the US Federal Reserve Bank (“the Fed”), have raised short-term rates in near unison. The Fed has raised aggressively, with 75 basis point increases (three quarters of one percent) becoming the new norm. Other central banks have followed, but none have matched the Fed’s aggressiveness. As a result, financial markets have contorted and asset prices have dropped, very sharply in many cases. Global stock markets have declined markedly over the course of the year, and bond markets, typically a safe haven for investors, have performed almost as poorly.

Central bankers have been motivated by concerns of hyperinflation. At Global Value Investment Corp., we have been cognizant of the imminent threat of inflation for many years as central bankers were singularly focused on employing expansionary monetary policy that included keeping short-term rates near zero. Notably, Japan and some Northern European countries have kept rates below zero (negative interest rates). In addition, central banks implemented a rarely used tactic of quantitative easing, which involves central banks borrowing money to buy bonds or other securities with the objective of managing interest rates and stabilizing asset prices. Between 2009 and 2022, the Fed borrowed over $8 trillion for quantitative easing.

The Fed was successful in creating confidence and stability by providing underlying support for economic growth, which resulted in an extended period of high levels of employment and stable consumer prices. However, the impact of this policy predictably led to a period of elevated inflation, which occurs when too much money chases too few goods and services. This chase creates an imbalance between supply and demand and results in inflation.

The Fed recognized the need to alter its low interest rate strategy and repay the money it borrowed. Since February of this year, the Fed has increased its base lending rate from 0.25% to 3.25%, an enormous increase when viewed historically and one that has reverberated through financial markets. The Fed has now unambiguously adopted a policy of quantitative tightening, which will further depress economic activity, as it endeavors to repay some of the $8 trillion it has borrowed.

Like every economic cycle of the past, there are winners and losers. On any given day, if the broad stock market falls, there are stocks that rise; and conversely, when markets rise, there are stocks that fall. This type of environment creates opportunity for investors who are adept in stock selection as opposed to buying large baskets of stocks.

GVIC believes that inflationary pressures are beginning to ease, with the peak having occurred in early summer. We think a decline in aggregate demand is well underway, which will naturally cause supply and demand to come into balance. Energy prices, including the prices of oil and natural gas, have fallen dramatically — oil is down 22% since May and natural gas down 28% since August — which will have a reverberating impact on the economy and will provide a pleasant tailwind for businesses and consumers.

To keep up with robust consumer demand, many businesses across the globe raced to increase inventories coming out of the COVID-19-induced economic downturn. The global supply chain entered a period of gridlock that resulted in further inventory shortages. When the gridlock began to ease and supply chain functions normalized, inventories returned to normal levels, but this occurred as central banks implemented policies to slow economic activity. The confluence of these phenomena created excess inventory levels. GVIC thinks this condition may lead to substantial product discounting in the months ahead (another way of saying that we are likely heading into a period marked by disinflation or deflation).

As interest rates have risen, the US dollar has become a relatively more attractive currency, thus attracting foreign investors to US-dollar denominated assets. The US Dollar index now stands at a 20-year high. A strong dollar makes US-exported goods and services more expensive in foreign countries, simultaneously making imports less expensive. This further supports GVIC’s view on impending disinflation or deflation.

In summary, as a result of these global economic trends, GVIC believes that a) inflationary pressures will soon become concerns about disinflation or deflation, and b) central banks will make an abrupt about face slowing the pace of rate hikes and backing away from aggressive quantitative tightening. As interest rates stabilize, we expect central banks to contemplate rate reductions to stimulate economic growth and expansion, perhaps sooner than financial markets anticipate.

GVIC remains well positioned with regard to stock selection and has opportunistically invested in bonds as central bank actions and investor reactions have created attractive entry points for long-term investors. We are constructive and increasingly optimistic as we monitor economic and market data, and continue to expect a short, shallow recession.

Portfolio Update

We recently began publishing bi-weekly communications from our research team for distribution to GVIC’s institutional clients. The following is a note written on August 3, 2022, by one of our research analysts, Mac MacLaren, and embodies our analytical process when researching companies:

In this version of Notes from MIAM Research Desk we turn our attention to data. The Merriam-Webster Dictionary defines data as “factual information (such as measurements or statistics) used as a basis for reasoning, discussion, or calculation.” Although Merriam-Webster doesn’t ask for our approval before defining words, we agree with their definition. We first ensure that our data is factual. Then we use the data for rigorous reasoning, discussions (lots of them), and calculations.

There are three primary ways that our research team interacts with data. First, we gather data. Second, we analyze data. And third, we act on data. Because each way we interact with data is complex, we will focus our current attention on the first step: how and why we gather data.

As a research team we encounter lots of types of data: “Big data,” simple data, colorful data, data in Excel, data in written stories, data from company management (see our notes from June 30 and July 20 for more detail on these interactions), new data, old data, un-translated data, and — worst of all — bad data. However, to say that we “encounter” data is an intentional misnomer because we seek data with intent rather than encounter it by happenstance.

Our primary goal when we gather data is to obtain it directly from the best source possible. Ideally, we would conduct our own surveys and observations, but there are practical time and geographic limitations that prevent us from doing that. Instead, we go to the source that is the closest to the subject matter that the data set measurers or describes. We do this so that we can draw our own conclusions on what the data tells us rather than have an intermediary color our analysis. While some media outlets and sources attempt to change little when they report data, even those well-intentioned sources can change the physical layout in which data is reported, add additional graphs, omit some data, or make scrivener’s errors that result in the wrong information being relayed. For these reasons, we go directly to the source to reduce the possibility of bad data to the lowest practicable level.

This philosophy of data gathering results in hyper diligence from each of our team members individually (we each subscribe to and read different sources of information about the world and portfolio companies) and as a team when it comes to “encountering” data. Individually, we all ensure that the apps, websites, broadcast media, and newspapers we read provide us with good data. We are agnostic when it comes to the analysis or opinions of the writers or editors that produce the media. In fact, we encourage different or contrarian viewpoints, especially where they challenge our own thinking, and the geographical differences of where our team members live and work avail them to different sources. However, we have little tolerance for manipulation or obfuscation of facts and will discard any sources that do so.

As a team, we review data only from sources that have proven over time to be accurate and reliable. Macroeconomic and industry data is typically drawn from reliable government and third-party sources like the Bureau of Labor Statistics (unemployment, job openings), the Energy Information Administration (crude reserves, energy trading), Fearnley (maritime shipping rates, vessel sales), or Baker Hughes (oil rig count, new oil field developments). Each week, three of our team members curate a wide-ranging selection of reports on housing, consumer spending, treasury activity, international trade, oil rig counts, and vehicle sales, among many other topics. Our team then meets for a review of the data and a discussion about the conclusions or observations that are drawn.

For data on companies, we almost exclusively review filings with regulatory bodies or press releases directly from the companies. Again, our emphasis is on reading data directly from the source to reduce the imposition of someone else’s analysis or a distortion of the data itself. There is an incredible amount of information contained in a company’s 10-K, 10-Q, 8-K, Form 4, 13D, other public filings, and press releases. While we are quick to question any irregularities or unclear issues on a company’s filing, the application of consistent and fair accounting rules, the oversight of regulatory bodies like the S.E.C., and the ability to use the courts as recourse for incorrectly published information all contribute to a repository of reliable data made up of company filings. Reading each company’s filings thoroughly allows us to exhaust that reliable resource before turning to other, less reliable sources for additional data. Rather than allow a data aggregator to use artificial intelligence to scrub information from the filings or get our information from another analyst who would necessarily impose their own view, each of our team members reads the filings themselves and forms their own analysis of what the data is telling them. We are then able to discuss the data and resulting analyses as a team without non-team members as an intermediary, which allows the purest application of the team’s analytical abilities to the data produced by the company.

With that end goal in mind, the data that we seek shapes our thinking and our entire research process so it must be as reliable as possible, or it risks a shaky foundation for our analysis and decision making. Consequently, our team spends the necessary time and uses the appropriate diligence to gather accurate, reliable data and ensures that investment decisions are made based upon the best possible data in each situation.

From Our Library

We are continuing to read Manias, Panics and Crashes: A History of Financial Crisis by Charles Kindleberger and Robert Aliber. The question of central bank intervention to support asset prices has been debated for years with no obvious conclusions. GVIC has mixed views on the role of central banks, particularly given their increasingly interventionist activities, which we believe distorts prices and normal market function. From Manias:

A major question is whether central bankers should be concerned with asset prices. Most central bankers choose price stability as the main target of monetary policy, whether it be wholesale prices, the consumer price index, or the gross domestic product deflator is not a critical issue. Most recently the policy mantra has been inflation targeting—central banks aim to achieve an inflation rate no higher than 2 percent. If, however, the implosion of a bubble in stocks and/or real estate leads to a significant decline in bank solvency, should the central banker be concerned with asset prices? In one view, asset prices should be incorporated into the general price level because, in a world of efficient markets, they hold a forecast of future prices and consumption. But this view assumes that asset prices are determined by the economic fundamentals and are not affected by herd behavior that leads to a bubble.

Central bankers traditionally have not been reluctant to raise interest rates to prevent an increase in the inflation rate. They are exceedingly reluctant to attempt to deal with asset price bubbles or even to recognize that they exist or could have existed—although they appear to be recognized after the fact.

We tend to see prices more often set by the “herd.” So much for market efficiency.

Concluding Thoughts

We read this recently and thought it a good reminder of market cycles:

Calm plants the seeds of crazy. If markets never crashed they wouldn’t be risky. If they weren’t risky, they would get expensive. When they’re expensive they crash. Same for recessions. When the economy is stable people become optimistic. When they get optimistic they go into debt. When they go into debt the economy becomes unstable. Crazy times aren’t an accident – they’re an inevitability. The same cycle works in reverse, as depressed times create opportunities that plant the seeds of the next boom. One way to summarize it: Nothing too good or too bad lasts indefinitely.

-Blog from Morgan Housel, August 2022 (https://www.collaborativefund.com/blog/big-beliefs/)

If you’ve had any changes in your investment objectives or financial situation that warrant adjustments to your portfolio, please let us know. We are happy to schedule a call to discuss ways in which we can update to better align with your current circumstances.

Your Investment Research and Advisory Team

Global Value Investment Corp.