Outlook:

Interest rates continue to rise as the Fed sticks to its mandate of full employment and price stability. Employment is nearly maxed out with 96.3% of workers employed and just 3.7% seeking employment. Benign levels of inflation have been the norm for nearly a decade, but now signs of acceleration are showing. The Fed seeks to get out ahead of the expected wage and capital cost pressures, and thus has raised overnight rates from a range of 0.00% – 0.25% to the current 2.00-2.25%, a substantial tightening.

Prospects for another hike before year-end, and possibly three in 2019 have added pressure to businesses and consumers.

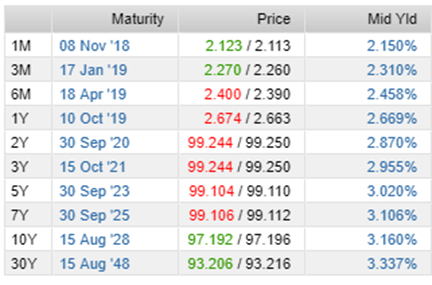

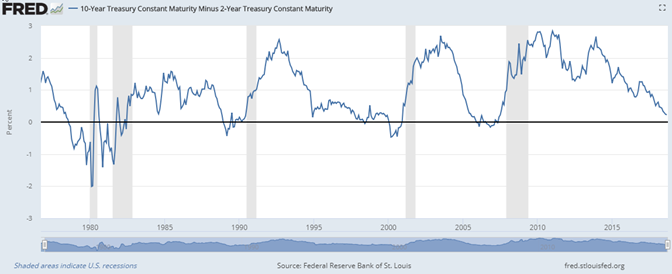

Bond markets are reacting to the rate hikes with trepidation. The 10-Year US treasury yield is now just above the 2-Year. Historically when the yield-curve flattens, economic recession follows.

The table above shows US Treasuries by maturity. Note the 2-year rate is just .30% below the 10-year. Investors are earning a fractional increase when committing another eight years. Recessions typically follow periods when the 10-year rate falls below the 2-year rate as illustrated below. The Fed does have additional fire power on its balance sheet to manage interest rates. They could sell bonds and force 10-Year rates higher to manufacture a steeper yield-curve, however this action could simply create the illusion that all is well. We know the housing market has slowed, auto sales are tapering off, consumer debt is above pre-crisis levels, and US Government debt increased by a trillion over the past year, standing now at $21.51 trillion.

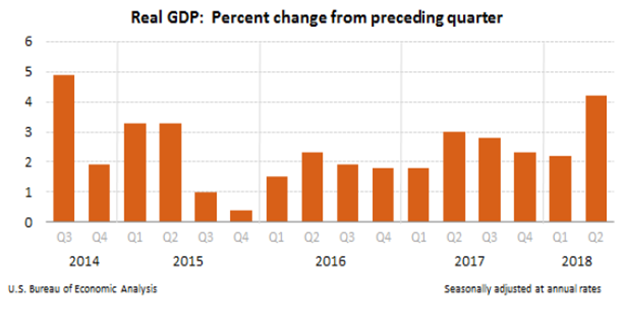

On the other hand, the US economy posted a 4.2% Q2 rate of growth – an amazingly strong rate stimulated through significant tax reform 10 months earlier.

Corporate profits have been strong as well over the past several years. However, as current earnings are being reported there are additional signs of slowing as the economic cycle ages. Capital costs, wages, and raw material costs are all on the rise. Oil is trading near $75 per barrel as of this writing, the highest level since 2014.

Companies have three primary production inputs: labor, raw materials, and capital. The cost of all are on the rise. Profit margins are under pressure. It’s easy to imagine wage inflation ahead with the very low level of slack in the labor market today.

We think this is an ideal market in which to invest. Uncertainty and confusion lead to irrational behavior in the form of rash and impulsive selling. Bargains can best be found during times of disruption.

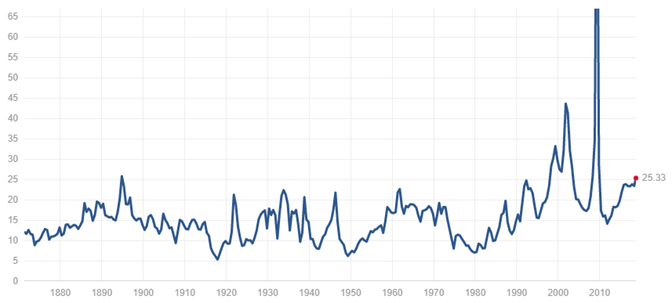

The stock market as measured by the S&P 500 trades at a very high price multiple of 25.3 times, a level that should concern investors. We find the outlook for patient investors to be very favorable because of potential irrational behavior that typically accompanies price volatility.

Behind the scenes:

Philosophy – Global Value Investment Corp. and its divisions, including Milwaukee Private Wealth Management, Milwaukee Institutional Asset Management, and Global Value Research Company are driven to find bargains. We define a bargain as a situation in which a dollar can be purchased for 50 cents – or at what we believe is a sharp discount from its appraised value. Not much appraisal work goes into determining the value of a dollar. On the other hand, an extraordinary amount of time and skill are required to appraise the value of a business.

The firm’s research team identifies companies trading at a discount from our appraisal of its value. Discounts can be caused for many reasons, some transitory, others permanent. We discern between the two and invest only when we believe the discount is significant and temporary in nature. The gap between our appraised value and the lower share price is what we call a Margin-of-Safety. It is that margin which protects our capital and gives us confidence even if the share price moves lower after we invest.

Our goal is to invest when companies can be bought at bargain prices. The best time to find bargains is when other investors are selling despondently, thus our penchant for market uncertainty. Recent market activity, with elevated valuations, has made bargain hunting more difficult. We look forward to more price variability with the expectation of finding more bargain priced issues.

Process – Once we identify a potentially undervalued investment, our research process begins. We analyze the company’s financial statements to thoroughly understand its economic characteristics and its performance in prior economic cycles. This process involves many hours of research and analysis. Once complete, we engage with senior management to evaluate their ability to articulate strategy and direction as well as the reason for the company to exist. We review and compare competitive position, industry trends, economic and political developments, and other factors that may impact share prices. Once complete, we write an investment thesis which is our internal document defining our rational for the investment and expected outcome. The thesis writing is a very important part of our process as it requires a rational and detailed explanation by our research team. The thesis is vetted by all members of the team. Once we have established a rational appraised value, we compare that value to the currently quoted share price, and if the price has remained sharply undervalued, we will invest.

Each new investment begins a continuous process of review and reappraisal. Most companies provide quarterly financial statement updates along with a Management Discussion and Analysis of the company’s performance over the covered period of the report. Once we complete our review of the company’s SEC filed report and participate in a public conference call led by management with other institutional investors, we re-engage with management to clarify any ambiguities in the information they reported or resulting behavior of the share price. To say management gets to know and appreciate our line of questioning over time would be an understatement.

We conclude our process with an internal meeting to update our thinking and recalculate our appraised value in light of current developments with the company. If the price remains undervalued, we continue to hold. If the price has closed in on our appraised value, we contemplate selling. We have been long- term holders as measured by our ten-year turnover ratio of 17%. We have an average holding period of over 5 years and in some instances much longer, so our selling activity is low.

People – None of this happens without committed people. We are very fortunate to have attracted a few smart and dedicated people to help make our vision a reality. We have always had a goal of remaining small and nimble. We believe what matters isn’t the number of people making decisions, rather the quality of the decisions being made by those people.

Most of our manpower is dedicated to investment research and analysis. We have four full-time analysts working together to generate new investment ideas and manage existing holdings. We have a rigorous process that is energetically carried out by our team. I spend roughly three-quarters of my week engaged in research and management interactions as well as spearheading our activist strategies which support our research efforts.

Each week we hold an economic review session during which both the research and advisory teams come together to discuss current economic news, including monetary and fiscal policy developments. Together we commit over 250-man hours weekly to our research process.

Research Meetings & Conferences:

During the quarter we continued to focus on identifying attractive investments as well as managing current portfolio holdings.

Our analysts attended a research conference in San Francisco, meeting with WSTG and AUTO, two of our current portfolio companies.

We had analysts attend a New York City research conference where they met with LXU and a few other companies we have been reviewing as potential investments.

During the month of September, in addition to the normal workload of our analysts, our research team spent over 120 hours reviewing 25 companies for potential investment. We are constantly on the lookout for attractively priced companies in which to invest.

We feel as though we made a great deal of progress in positioning client capital over the quarter. In addition, even though we are finding relatively few attractively priced companies to buy, we remain confident in those companies we own. When we last wrote, the market had risen as a result of a small number of stocks we believe are sharply overvalued (Amazon, Netflix, Apple, Facebook and Google). Several of these have experienced recent weakness which has influenced market indexes and investor sentiment. Our observations indicate that while many companies’ share prices have declined, they are not yet at levels that make them attractive enough to own. We remain patient and disciplined.

Reviewing July, August, and September, our research team, which operates in our Global Value Research Company division (GVRC), was quite active with our existing holdings. We reviewed and spoke with company management 28 times. We also had in-person meetings with four currently owned companies and another dozen informal meetings while attending conferences.

Today our core portfolio holdings as a group trade at roughly 55% of appraised value, or at a 45% discount. We believe we hold attractively valued companies.

Activist Activity:

As stated above, we continue to meet with management teams and stress ways in which we believe shareholder value can be created. This includes the use of common stock dividends, share buybacks, debt repayment, and/or strategic acquisitions. Under more challenging circumstances, we press for board member changes or management replacement. Companies are typically resistant to the voice of a single shareholder, but more receptive when a coalition develops. We remain focused on doing what is best for shareholders through regular communication with board members and management.

From Our Library:

We have been reding Good to Great, by Jim Collins, a 2002 text on the characteristics of companies that have transcended from a large group of good companies to an elite group of great companies. He describes the best managers as Level 5 Leaders:

Level 5 leaders channel their ego needs away from themselves and into the larger goal of building a great company. It’s not that level 5 leaders have no ego or self-interest. Indeed, they are incredibly ambitious – but their ambition is first and foremost for the institution, not themselves.

We assign a premium to good managers because we have seen the impact poor managers can have on an otherwise good business.

Firm Updates:

Global Value Investment Corp. produces investment research through its Global Value Research Company division. We distribute our research through three independent global market channels (S&P Cap-IQ; FactSet; Thompson Reuters). These reports are available to all firm clients. If you would like to read more about the companies in which we invest, please let us know.

One of our senior research analysts, JP, was married this month. We wish him and his wife, Erin, many years of happiness together. In addition, our senior advisor, Tom, and his wife, Paula, are expecting their first child in December. Our firm family continues to grow!

New to the team is Stacy Wilke who has been working with us part-time for over a year. She continues to manage internal operations including finance, legal, and compliance. Stacy lives in Cedarburg, WI with her husband Steve and their two teenage daughters. We are happy to see her in the office more frequently. She is also a graduate of the University of Wisconsin – Madison.

Concluding Thoughts:

We are mindful that we manage money for others and as such bear a responsibility to apply rigor with every investment decision. We have a policy that each associate will invest in the same issues we recommend.

As always, we thank you for the ongoing confidence.

If you’ve had a change in, or would like to update, your investment objectives or portfolio restrictions, please let us know so we can adjust.

We remain committed to achieving investment excellence.

Your Investment Research and Advisory Team

Global Value Investment Corp.