How to Keep a Crisis in Perspective: Know the Facts

If you take the current pandemic news and extrapolate it on a straight-line basis, you could become very worried, very quickly. The current contagion and death rates could spiral out of control, the global economy could shrink to a fraction of itself, and untold human suffering could result.

Regarding the current market meltdown, to say that negative psychology has set in would be a gross understatement. Fortunately, in the rational world, few events move in a linear fashion. We are seeing outright panic in market pricing and individual behaviors.

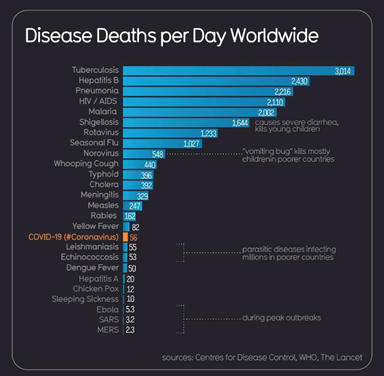

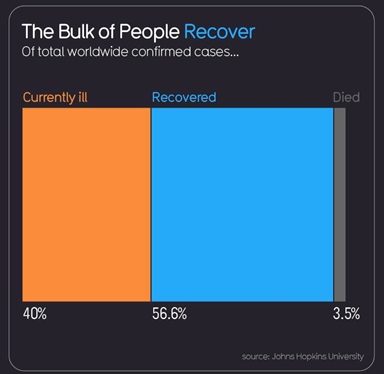

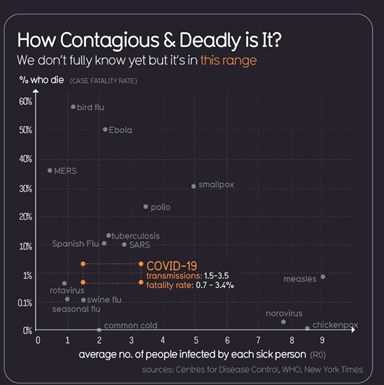

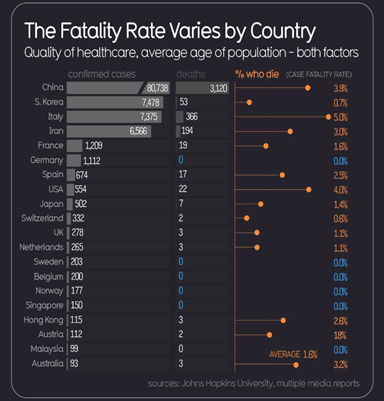

To consider a more measured response to current events, let’s look at the facts:

The final slide, “Mentions in the Media,” reinforces the adage, “fear sells.”

Predicting the future has always been a fool’s errand. Remaining rational while armed with the facts has been the domain of successful and wealthy investors.

The appearance of COVID-19 and the subsequent dramatic negative market reaction is disproportionate to the event. So is betting on a 10-Year US Treasury and locking in a 0.31% return. Yet a large number of investors did just that on Monday. Herd mentality causes people to act in ways that defy reason.

It is wise to take a step back and consider a more rational and measured response to current events. Let’s not create a crisis where one doesn’t exist. Look at this situation for what it really is: the folly of the market, and an excellent opportunity for non-linear thinkers to profit from temporary mispricing.

Everything in the store is on sale at huge discounts, and panicked shoppers are running for the door with empty carts!