Successful investing requires sound decision making based on judgment, experience, and knowledge. Once an investment decision has been made and capital committed, ongoing monitoring is necessary in order to adjust course as circumstances change, again, requiring sound decision making.

Over many years we’ve learned the single most important investment decision is Price Paid.

Value investing can best be described as ‘investing at a discount from intrinsic value.’ Calculating intrinsic value requires an accurate appraisal of a business. Appraisals come in various forms but are all based on fundamental analysis of business operations and corresponding operating statements. With an accurate appraisal in hand, an investor is in a position to make an intelligent Price Paid decision.

In order to arrive at an accurate appraisal, the appraiser must possess analytical skills to understand company financial statements as well as skills to judge people, motives, and circumstances. Such skills are the differentiator between average and great investors.

Evaluating the financial statements of a business is a straight forward task. There are only three statements to understand and appraise:

1. The Income statement – to be reviewed for consistency and improvement over time

2. The Balance sheet – providing an assessment as to the sustainability of the business through market cycles given specific assets, liabilities, and the requirements for liquidity

3. The Cash-flow statement – to be reviewed in order to reconcile actual cash generation, ongoing capital expenses required to maintain & grow the business, and a judgement of management’s capital allocation decision making track record

The more difficult appraisals are qualitative in nature:

1. The effectiveness of senior management, the board, and corporate governance

2. Customers, competitors & new entrants, sources of supply, and alternative products

3. Industry economics and trends

4. Regulatory and other outside threats

After sound judgements have been made for all of these items, an appraised value can be calculated.

The next steps are simple: divide the appraised value by total shares outstanding; arrive at an appraised value per share; compare the appraised value to the last quoted stock price; only invest when a large discount is available.

Intuitively investors should buy shares at bargain prices. If a business appraised value is $20/share, an investor should want to pay as much below $20 as possible (the discount from intrinsic value).

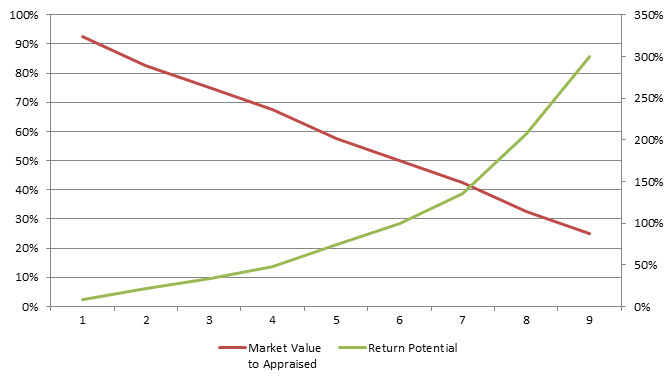

If we assume the share price will eventually return to the appraised value, then the following holds: If purchased at $15.00, a return to appraised value results in a 33% return. If purchased at $10.00, the return is 100%, and at $5.00 it’s 300%.

The wider the discount (left axis), the larger the return (right axis). Price paid is clearly very material to the ultimate investment outcome.

Possessing the ability to correctly appraise the intrinsic value of a business is the starting point for successful investing. Having the intellectual temperament to invest only when the stock is trading sufficiently below that appraisal is the essential emotional characteristic for successful investing.

In Graham & Dodd’s text book, Security Analysis, they describe stock investing as follows:

We all want to buy low and sell high, but first we must develop confidence in the sustainability of a business in order to arrive at a sound judgment about what constitutes “low” and “high.”

Trading on emotions is nearly always the wrong thing to do, especially for those investors who have carefully done their homework.

Certainly a good business can hit a rough patch, but it is not unusual for such a business to regain its footing. Sometimes huge stock declines occur for no apparent reason. But only through careful research can one develop the confidence to take advantage of such a bargain.

This book (Security Analysis) clearly emphasizes the importance of unflinching intellectual honesty on the part of an investor while preparing an analysis.

Over the years we’ve met few investors willing to devote the substantial time and energy required to perform detailed appraisals. This is rigorous work. In our experience, most investors we’ve met tend to perform superficial analysis when determining an appraised value, or alternatively, rely on the thinking of others.

All successful long-term investing begins with a thorough appraisal and disciplined attention to price paid.